Category: Economics

-

AI’s Seemingly Elusive Infrastructure – I

ChatGTP’s sudden and arguably premature success has yet again exposed the usually overlooked link between so-called “virtual” digital technologies and very tangible infrastructure. Indeed, early adopters of the latest incarnation of GTP-3-based bots directly experienced repeated network and login failures. That happened a few times in December when I started playing with the newly launched…

-

ChatGPT’s New Version

Yesterday, OpenAI released a new iteration of ChatGPT, version 3.5. To quickly check, I decided to ask some of the same questions I did back in December. The table below compares the results. ChatGPT November 2022 v3.0 January 30 2023, v3.5 1. Can you perceive any gaps in your training? As a computational agent, I…

-

Chatting with ChatGPT

OpenAI’s new shiny chatbot, with the not-so-brilliant name of ChatGPT, has taken the world by storm, surprising most, company staff included. Evidence of the latter stems from the fact that whenever one tries to access the platform, a message announcing imponderable delays quickly pops up on the screen. Clearly, the current demand is way above…

-

ICTs and Emissions – V

Walking Around the Main Gallery Unlike its basement, the abode’s main gallery is noisy, crowded and chaotic, offering a maze-like layout we need to navigate safely. Indeed, one can easily get lost, and while checking in is pretty simple, finding one of the exit doors is undoubtedly far more elaborate. Thus, we must stand on…

-

Digital Technologies and Sustainable Development: The Missing Link

Context Nowadays, digital technologies occupy most of the interstices of society. While the global pandemic exposed glaring gaps, especially in developing countries, avoiding their mantra seems torturous. Undoubtedly, their rapid diffusion in the last 30 years is historical (Comin & Mestieri, 2018). However, once touted as unstoppable drivers for social change, many now perceive modern…

-

ICTs and Emissions – IV

Environmental Footprints As previously mentioned, data centers (DCs) depend not only on energy consumption but also require plenty of water for survival, just like humans. We thus have increasing competition for a critical resource, significantly when droughts and wildfires are increasing. Not surprisingly, the availability of adequate and nearby water resources is one of the…

-

ICTs and Emissions – III

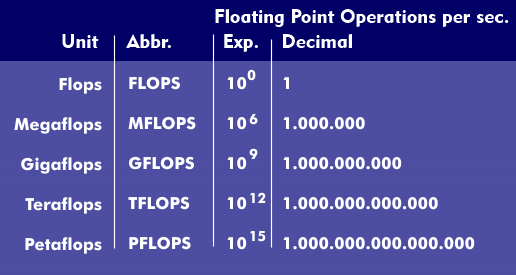

The Abode is a Humongous Shopping Mall As some pundits have observed, data centers (DCs) are the backbone of the digital realm—hiding in plain sight, I would add. However, DCs do not live alone in their noisy, albeit warm homes. They cannot afford to for existential, not financial, reasons. DCs depend on several other beings…

-

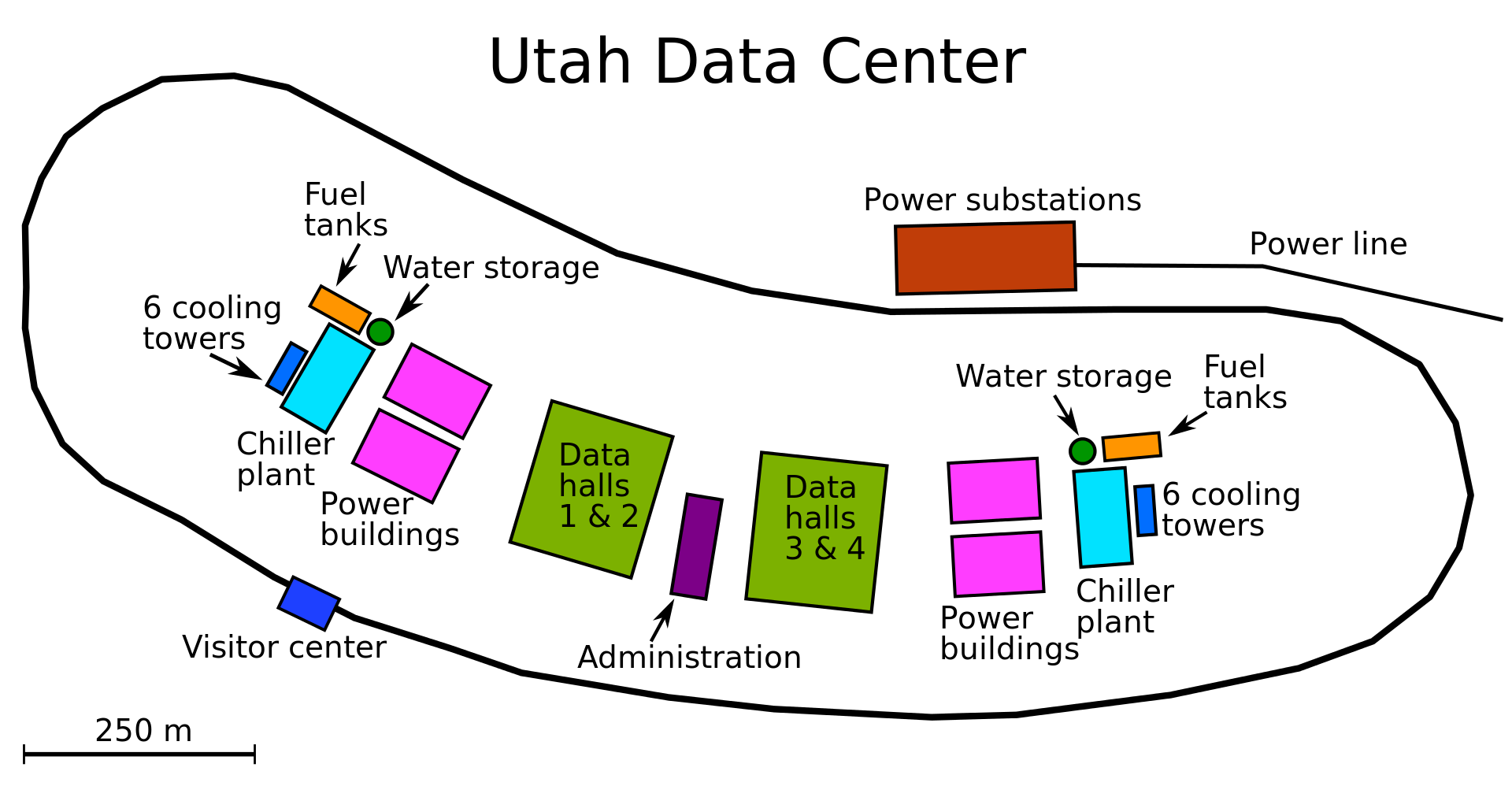

ICTs and Emissions – II

Cyberspace Mansions In 2009, amid the Global Financial Crisis, the U.S. National Security Agency (NSA) announced plans to create a 1.2 billion dollar data center (DC) in Utah. Indeed, surveillance once again proved it is immune to economic disasters, regardless of magnitude. In any case, actual construction began only in 2011, after government approval. The…

-

ICTs and Emissions – I

Digital technologies’ social ubiquitousness is indisputable. Indeed, escaping their mantra seems unreal, almost dystopic, regardless of location or connectivity. The TINA (there is no alternative) principle appears to be entirely at work here. It is thereby paradoxical that new ICTs are conspicuously absent from big-ticket global climate change policy documents such as the 1997 Kyoto…

-

RegTech is Here!

Modern FinTech saw the light of day with the launch of ATMs in the late 60s. A few years later, NASDAQ was born, credit cards exploded, and banks started to deploy mainframes and minicomputers to support their operations. The 1990s brought both the Internet and the consolidation of global financialization that accelerated Fintech’s development, while…

-

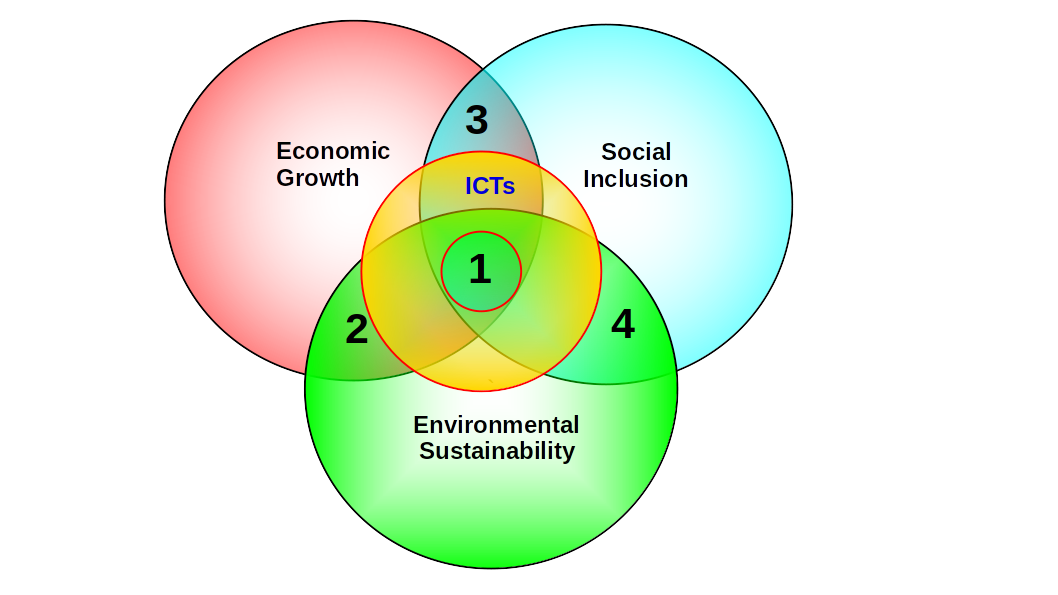

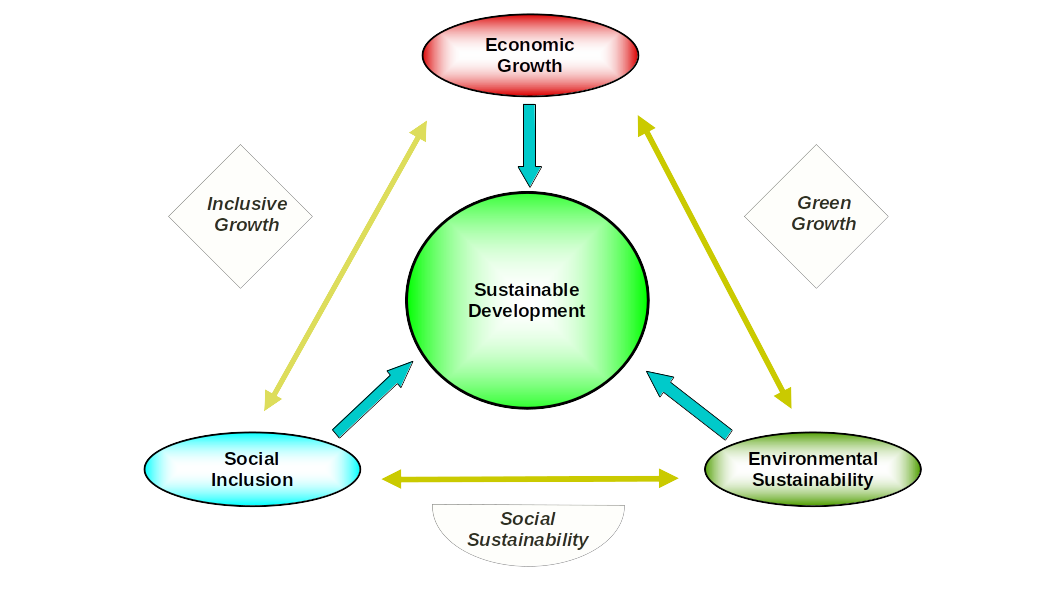

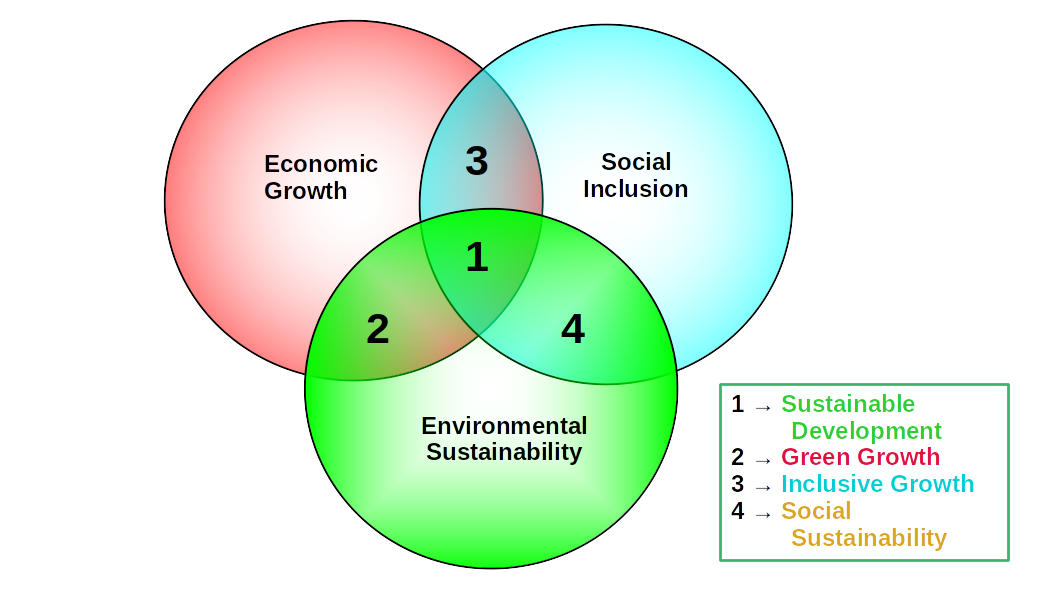

Economic Growth and Sustainable Development

In a previous entry, I explored the connections between digital technologies, economic growth and the environment, using the concept of Sustainable Development (SD) as analytical reference. The figure below depicts yet another way to see the three development outcomes that must interact to trigger SD. Three other outcomes are also possible if the interaction…

-

More Light on Financial Inclusion

In a couple of recent posts, I briefly traced the history of financial inclusion and its links to the emergence and diffusion of digital technologies. A recently published book by Nick Bernards tackles the same issue more comprehensively while taking a more critical perspective. His departing point, however, is not financial inclusion but rather poverty…

-

Digital Technologies and Sustainable Development

1. Overall context Much water has already gone under the bridge on this topic. Yet the flow shows no signs of coming to a halt soon. In the early days of the so-called “Internet revolution,” only a few were connecting the two. At the 1992 UN Earth Summit in Rio de Janeiro, which I had…

-

Financial Inclusion and Democratizing Finance – III

Show me the money The impact of initiatives such as Grameen Bank (Village phone included) and M-Pesa is still under discussion. From a poverty reduction perspective, the effect has been much more limited. Many countries in the Global South have managed until recently to reduce the number of people living in extreme poverty. Take Bangladesh.…

-

Financial Inclusion and Democratizing Finance – II

Where are the banks? It seems paradoxical that the mainstream history of micro-finance/financial inclusion does not consider banks. After all, banks are supposed to “bank the unbanked.” So banks are not only missing from such a narrative. They are also missing in action on the ground. In principle, banks are the institutions that should cater…