Category: Blockchain

-

RegTech is Here!

Modern FinTech saw the light of day with the launching of ATM machines in the late 60s. A few years later, NASDAQ was born, credit cards exploded and banks started to deploy mainframes and minicomputer computers to support their operations. The 1990s brought both the Internet and the consolidation of global financialization that accelerated Fintech’s…

-

More Light on Financial Inclusion

In a couple of recent posts, I briefly traced the history of financial inclusion and its links to the emergence and diffusion of digital technologies. A recently published book by Nick Bernards tackles the same issue more comprehensively while taking a more critical perspective. His departing point, however, is not financial inclusion but rather poverty…

-

Financial Inclusion and Democratizing Finance – III

Show me the money The impact of initiatives such as Grameen Bank (Village phone included) and M-Pesa is still under discussion. From a poverty reduction perspective, the effect has been much more limited. Many countries in the Global South have managed until recently to reduce the number of people living in extreme poverty. Take Bangladesh.…

-

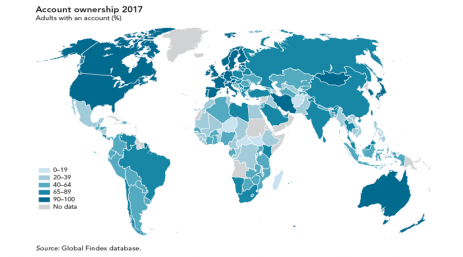

Financial Inclusion and Democratizing Finance – II

Where are the banks? It seems paradoxical that the mainstream history of micro-finance/financial inclusion does not consider banks. After all, banks are supposed to “bank the unbanked.” So banks are not only missing from such a narrative. They are also missing in action on the ground. In principle, banks are the institutions that should cater…

-

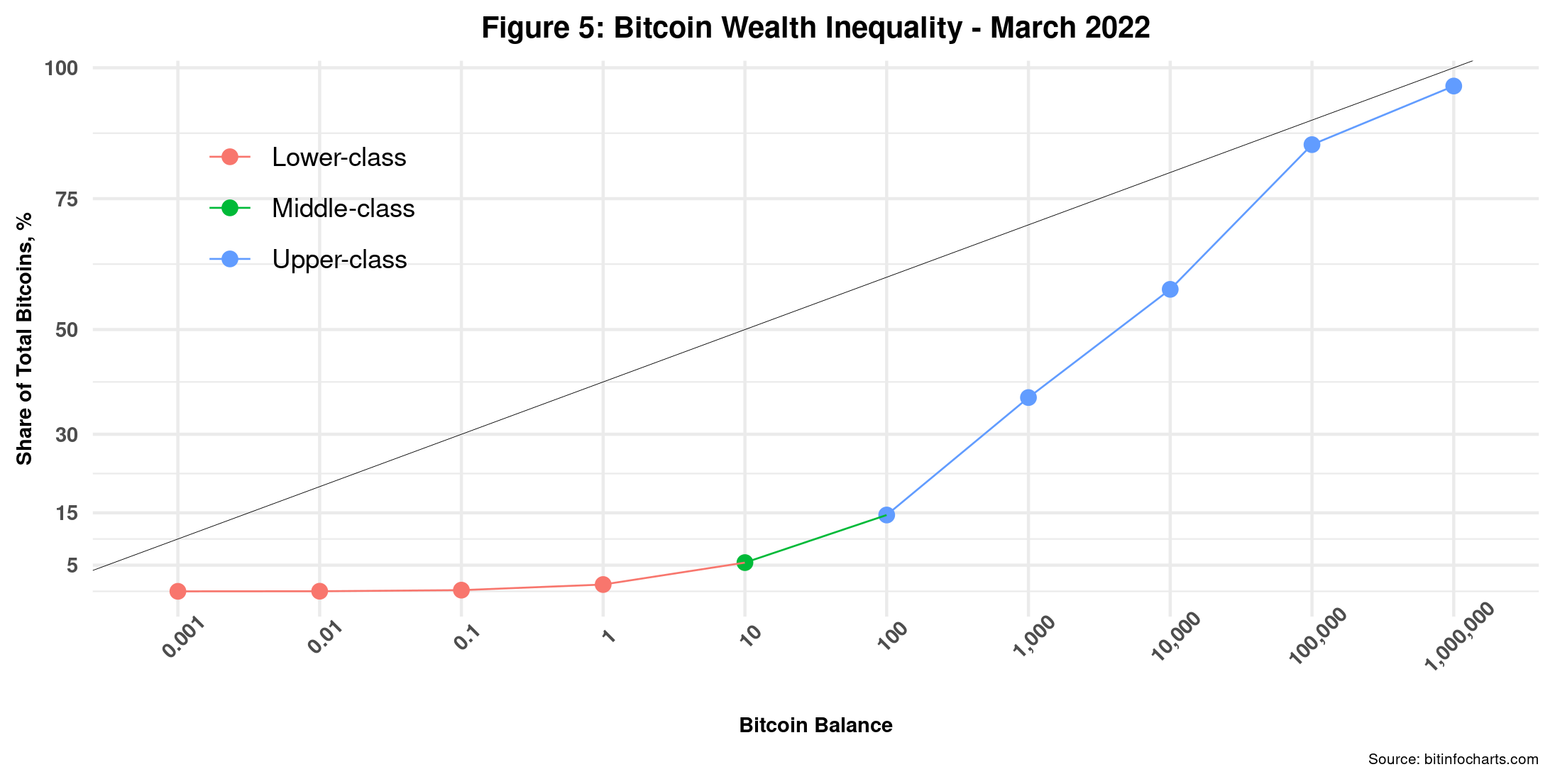

More Bitcoin Inequality

While still prone to seemingly unpredictable dynamics, Bitcoin’s price seems to have found a new center of gravity in the last year. Since February 2021, the Cryptocurrency has oscillated around 4ok per unit, give or take. It peaked at 67.5k last November and then went down to 35k just a couple of months ago. At…

-

Blockchain Adoption in the Public Sector – II

Regulatory frameworks are usually perceived as counter-productive and even nefarious by innovators, pundits and followers. Together they will go out of their way to stop them, arguing that their impact on innovation is lethal, as discussed in a previous post. One could say that such a view finds more ground on ideology than on actual…

-

Blockchain Adoption in the Public Sector – I

Over ten years after its creation, the hype on Blockchain Technology (BCT) continues to dominate the scene compared to actual implementation. However, that does not necessarily imply it has remained immune to change. At the very onset, Cryptocurrencies, led by Bitcoin, were the main attention magnets. Not surprisingly as, after all, the goal of its…

-

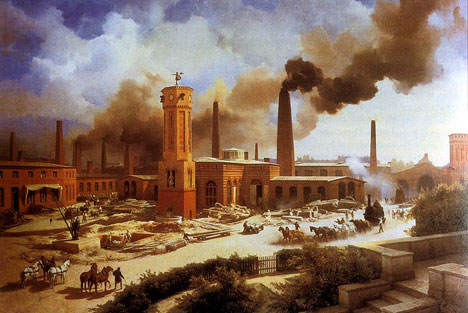

Waiting for yet another Industrial Revolution

The PC revolution. The Internet revolution. The mobile revolution. The social media revolution. The blockchain revolution. And the AI re-revolution. We seem to be living in times of Permanent Revolution. Also reminds me of the Age of Revolution that thrived a couple of centuries ago. Back then, social uprising calling for regime change was the…

-

Better “AI for Good”

While the dystopian camp perceives digital technologies as a formidable, perhaps even unsurmountable threat to society, those on the other, much more optimistic side do not seem to get tired of repeating its almost countless benefits. The latter camp apparently has the upper hand, at least for now, as its message captures most daily media…

-

Blockchains and Food Safety

Trade is one of the main trademarks of the globalization process. Nowadays, most countries exchange products and services regularly and use local comparative advantages to specialize in specific trade sectors and/or commodities. Food and agricultural products are important components of this process. Within countries, rapid urbanization has increased the demand for food. Simultaneously, the number…

-

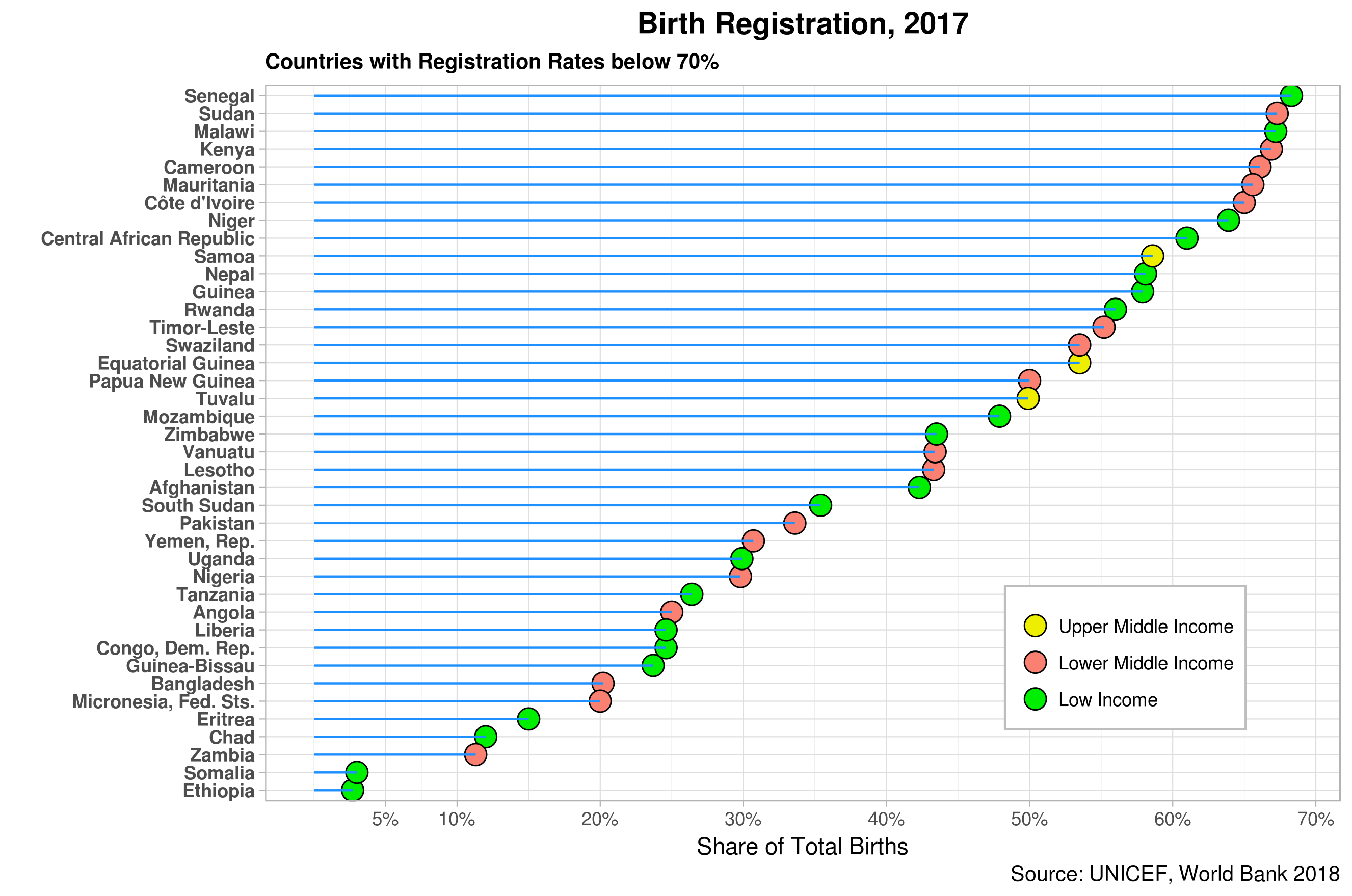

Blockchains and Digital ID, II

The Evolution of Digital identity The emergence of digital technologies provided the ground to shift from traditional systems based on physical identity. In the past, both foundational and functional identity mechanisms were centralized, with individuals getting a physical document containing relevant personal attributes required by the issuing entity. Document management was totally in the hands…

-

Blockchains and Digital ID, I

Overview Like previous technologies, such as the Internet, blockchains have been driven by a high degree of techno-optimism not yet backed up by on the ground impact or reliable evidence. Undoubtedly, the technology, which is still rapidly evolving, has enormous potential in many sectors and could promote human development if harnessed strategically. One of the…

-

On Blockchains Research

Blockchain technology development has been accompanied by a substantial increase in related research. The latter usually trails new technology innovations, but it does tend to catch up in the short-term. Ten years after the emergence of blockchains, there is plenty of ongoing academic and other research. Keeping track of its volume requires some sort of…

-

Algorithms and Algocracy – II

In the previous post, I provided a simple definition of an algorithm to explore its use in the digital world. While algorithms live from the inputs they feed, digital programs such as mobile apps and web platforms comprise a series of algorithms that, working in sync, deliver the desired output(s). Algorithms sit between a given…