Category: Inequality

-

The Dynamics of Global Development, South and North

The Development of Development In its beginnings, unmovable numeric rankings permeated the always slippery and bumpy development racetrack. Stuck in first place were a selected group of countries labeled as developed, even though many were still rebuilding their economies after the bloody World War II that killed 3 percent of the world’s total population. Led…

-

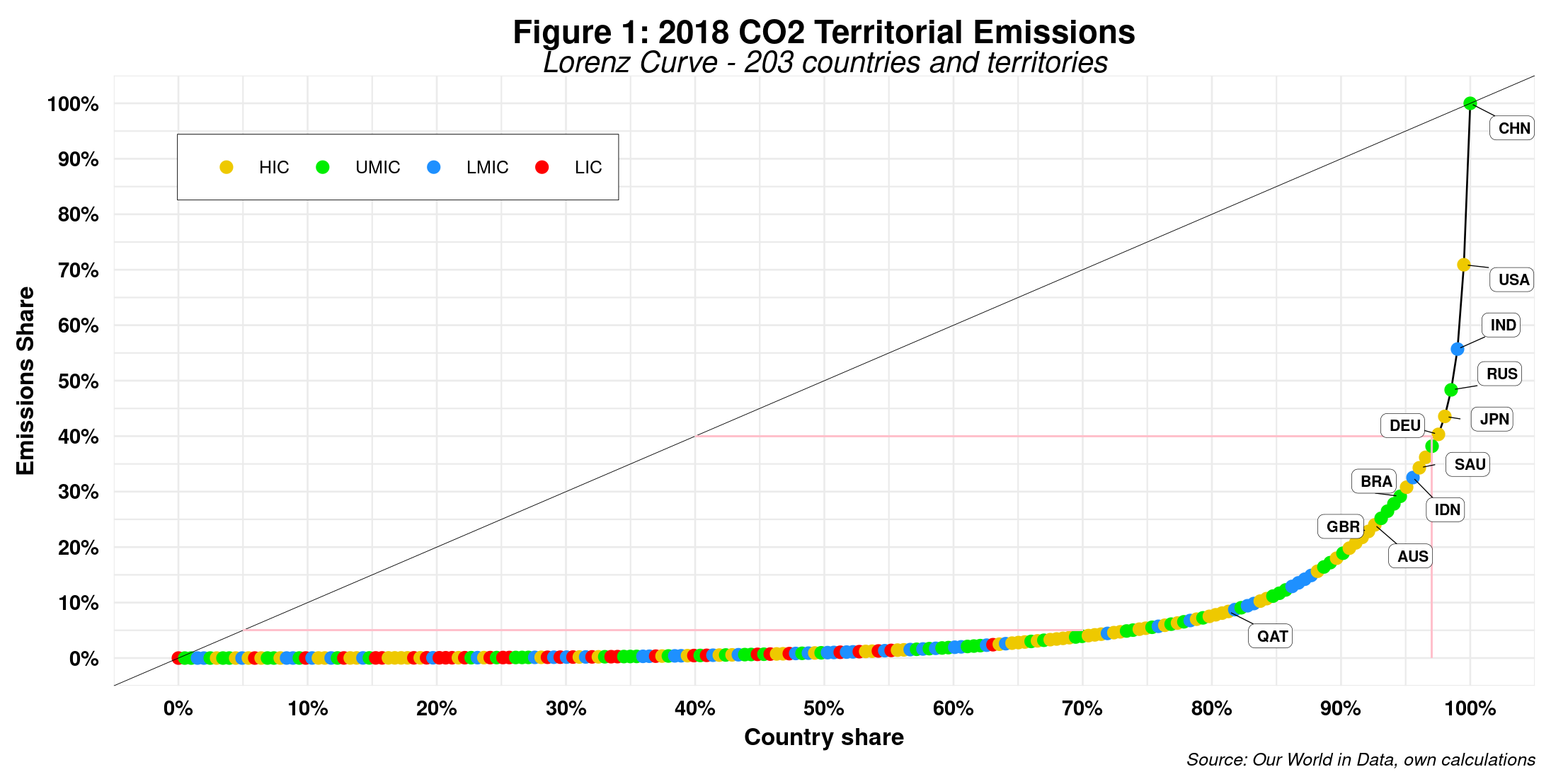

More Carbon Inequality

IPCC reports usually include an annex containing a climate glossary where key terms are succinctly defined. The latest report is no exception, providing an extensive dictionary consuming over 30 pages of text – yet less than 1% of the report’s length. Bringing into the fray four key terms will suffice for our purposes. They are…

-

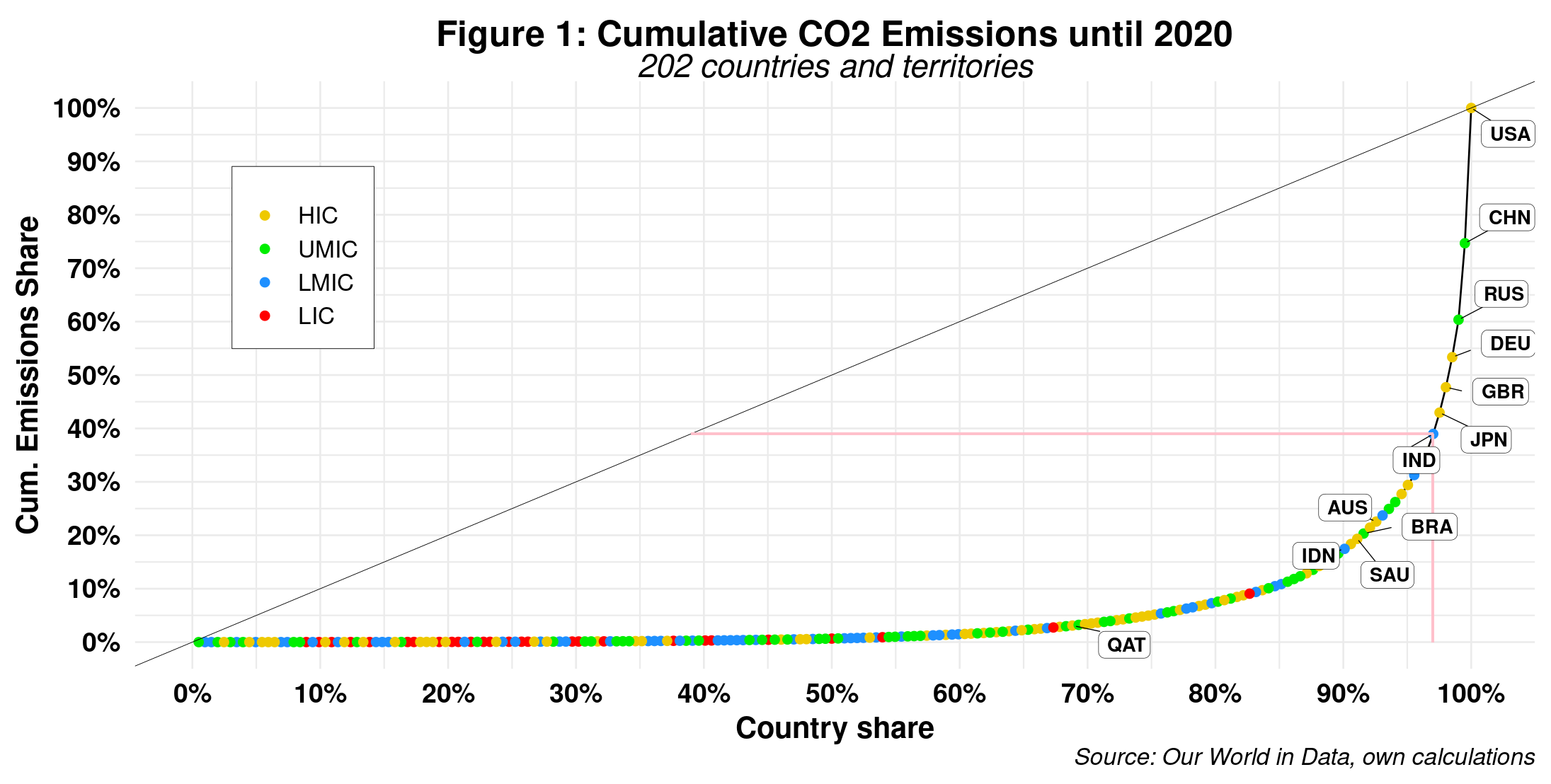

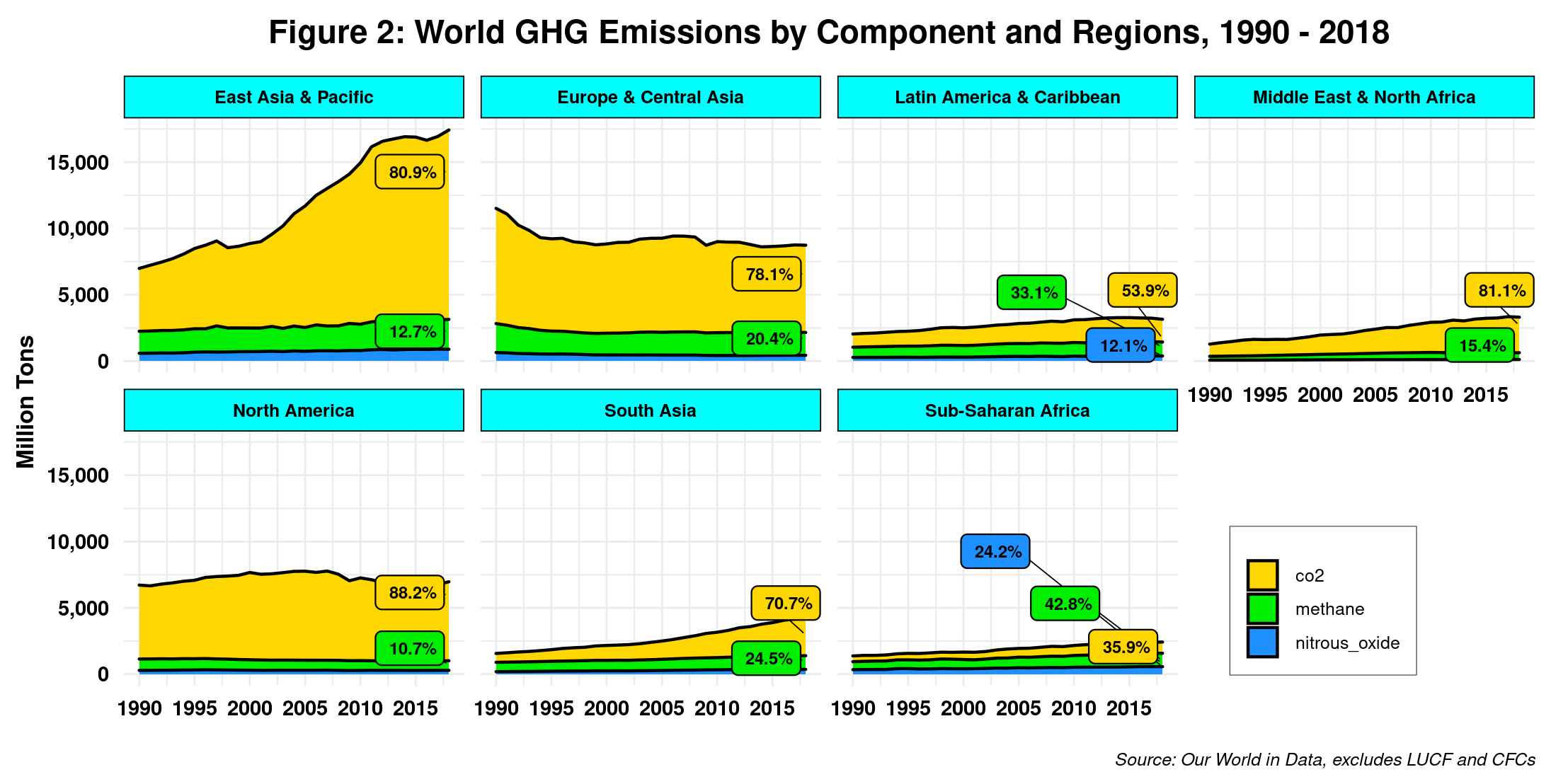

Carbon Inequality

My previous post highlighted a gap between the Glasgow CoP26 mitigation targets and GHG emissions data. The best example here is the selection of methane as a priority while the big elephant in the room, CO2, mentioned in passing, escaped almost unscathed. Indeed one could argue that such global meetings must make choices, some of…

-

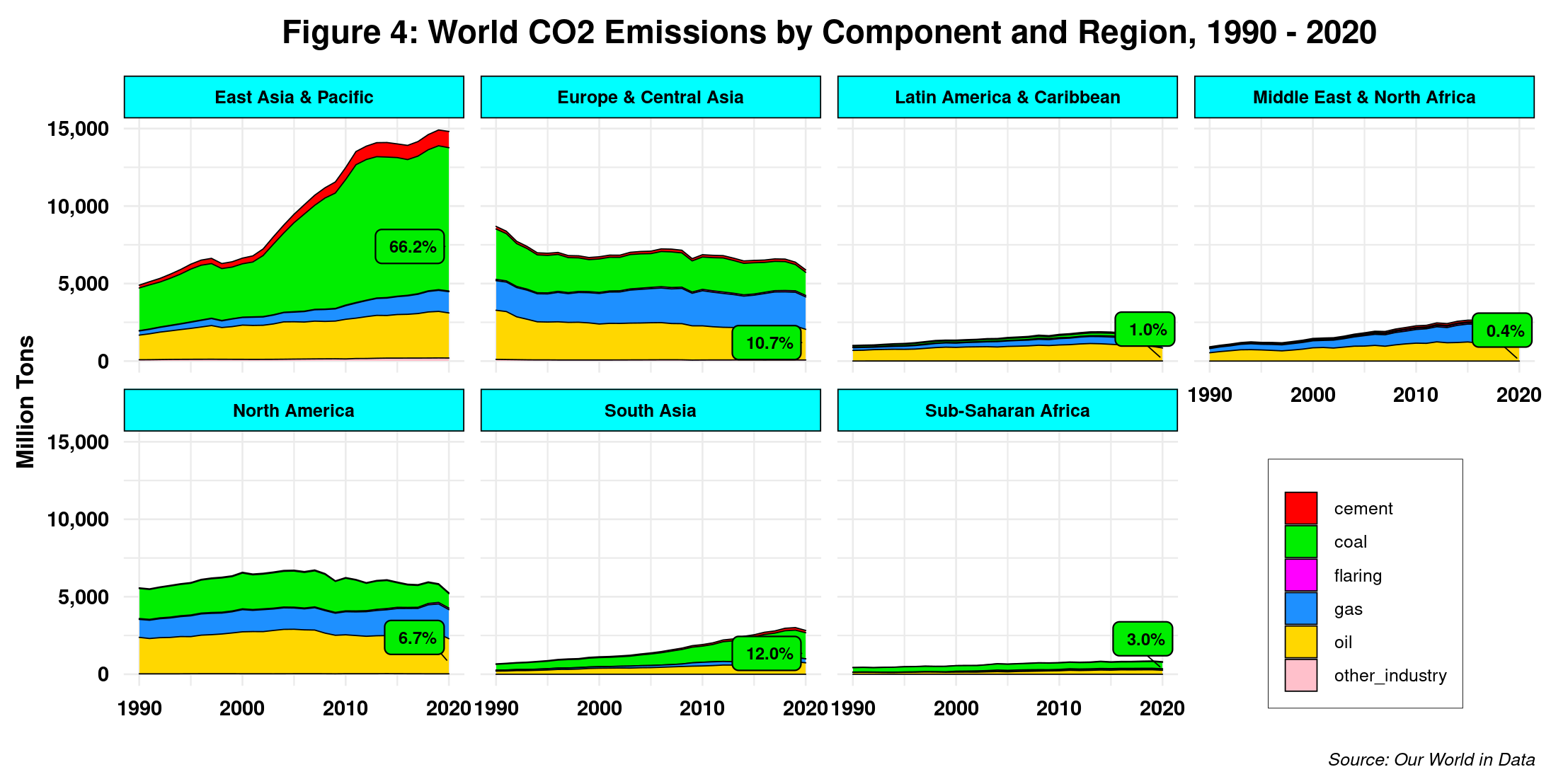

Net-zero Emissions and Developing Countries – II

As discussed in the previous post, low-income and most low-middle-income countries play almost no role in methane emissions. Therefore, embarking on related targets and projects will not make a dent on a global scale. Instead, it might end up increasing foreign debt and diverting from other perhaps more pressing developing gaps, local climate change issues…

-

Net-zero Emissions and Developing Countries – I

If Climate Change rings to many of us as an almost insurmountable global challenge, then net-zero has recently emerged as its apparent universal solution. The coin has finally been imprinted with two clearly defined sides, in constant and inseparable opposition. Many would argue that we can sleep well again; the apocalypse has been postponed indefinitely.…

-

The Environment and “Socialist” States

Thirty-six years after it first broke the news for the wrong reasons, Chernobyl is back in the headlines thanks to the horrible and absurd Russian invasion. Sixteen months before the well-known Soviet nuclear meltdown of 1986, a plant located in Bhopal, India, owned and run by a private U.S corporation, released a lethal gas into…

-

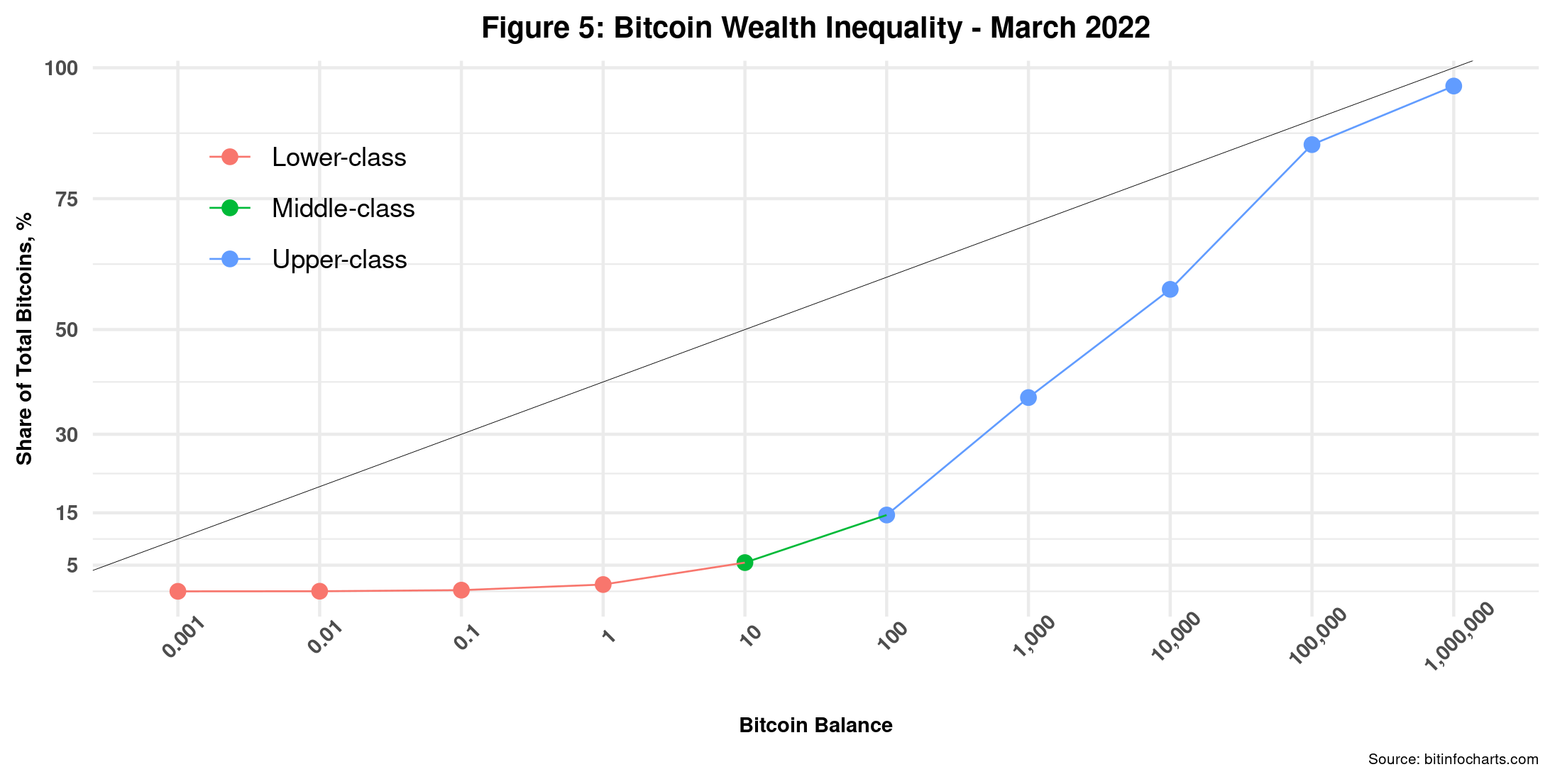

More Bitcoin Inequality

While still prone to seemingly unpredictable dynamics, Bitcoin’s price seems to have found a new center of gravity in the last year. Since February 2021, the Cryptocurrency has oscillated around 4ok per unit, give or take. It peaked at 67.5k last November and then went down to 35k just a couple of months ago. At…

-

Greater “AI for Good”

The proliferation of top, best, fails and prediction posts on almost any topic is now a staple of the annual transition from one year to the next. As the new year starts seeing the light of day, we seem compelled to take stock of the previous 365.25 days and poke more in-depth into the short…

-

Evolving COVID-19

Over six months after its official birth, the COVID-19 pandemic continues to expand globally, as expected. Long-term lockdowns and other complementary measures have impacted, especially in industrialized countries that, back in June, were leading in cases and deaths. Not that the virus has been tamed, not at all. Rather, it now seems to be more…

-

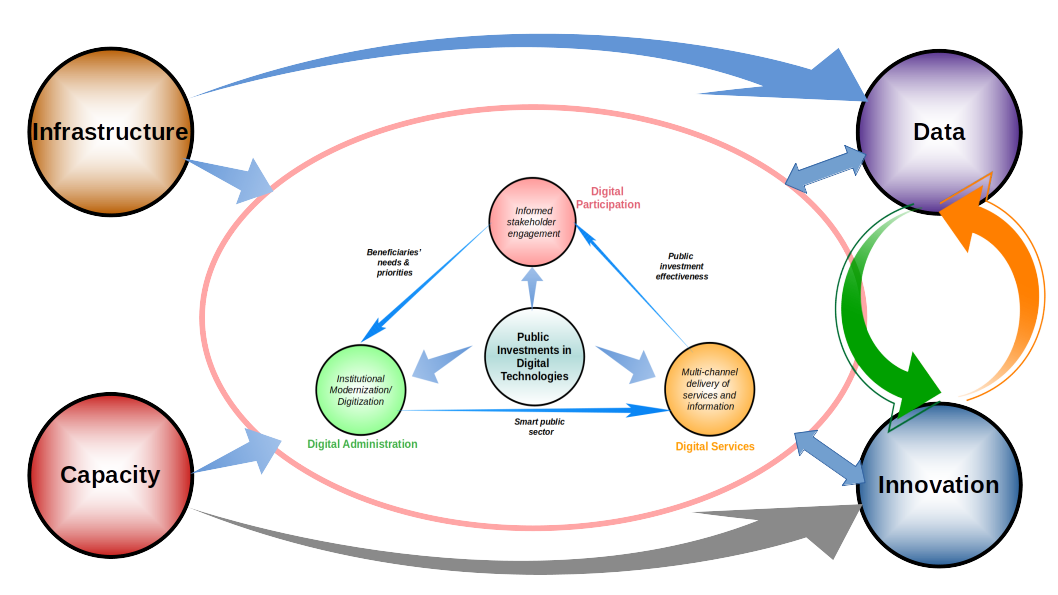

Digital Government Revisited – II

Since the early 1980s, Governments have taken a bad rap. Menacing fingerpointing from most quarters ended up on a consensus that loudly declared them personas non-gratas. The 2009 Global Financial Crisis started to turn the tide. At the time, governments once again came to the rescue of capitalism, unveiling gigantic financial packages to prevent critical…

-

Contentious Politics in the AI Age

Initially touted as revolutionary and progressive in the 1990s, the lightening evolution of digital technologies, running on the coattails of continuous innovation, has been accompanied by the rise of both extreme socio-economic inequalities and loud and widespread populism, nationalism and overt racism. Many countries are undergoing de-democratization processes undergirded by very resilient neoliberalism, while claim-making…

-

Technology and Earth Hacking

Hacking the Sky Low, angry gray clouds, seemingly non-stop light rain and damp breathing air were hometown weather traits that most bothered me when I was growing up. Like most other children, I had a fascination with airplanes and could spend hours watching them. Going to the airport was one of the coolest things –…

-

The Global Centralization of (Dis)Intermediation

Merchants are perhaps the most famous image of an intermediary, the not-so-loved “middleman” that buys cheap, sells dear, and becomes rich doing little work. Even in the supposedly dark Middle Ages, merchants could openly operate creating Merchant Guilds that promoted regional trade while protecting members from potential abuses by powerful landlords and countervailing the staunch opposition…

-

Uncertainty and Artificial Intelligence

In a world where perfect information supposedly rules across the board, uncertainty certainly challenges mainstream economists. While some of the tenets of such assumption have already been addressed – via the theory of information asymmetries and the development of the rational expectations school, for example, uncertainty still poses critical questions. For starters, uncertainty should not…