Category: Innovation

-

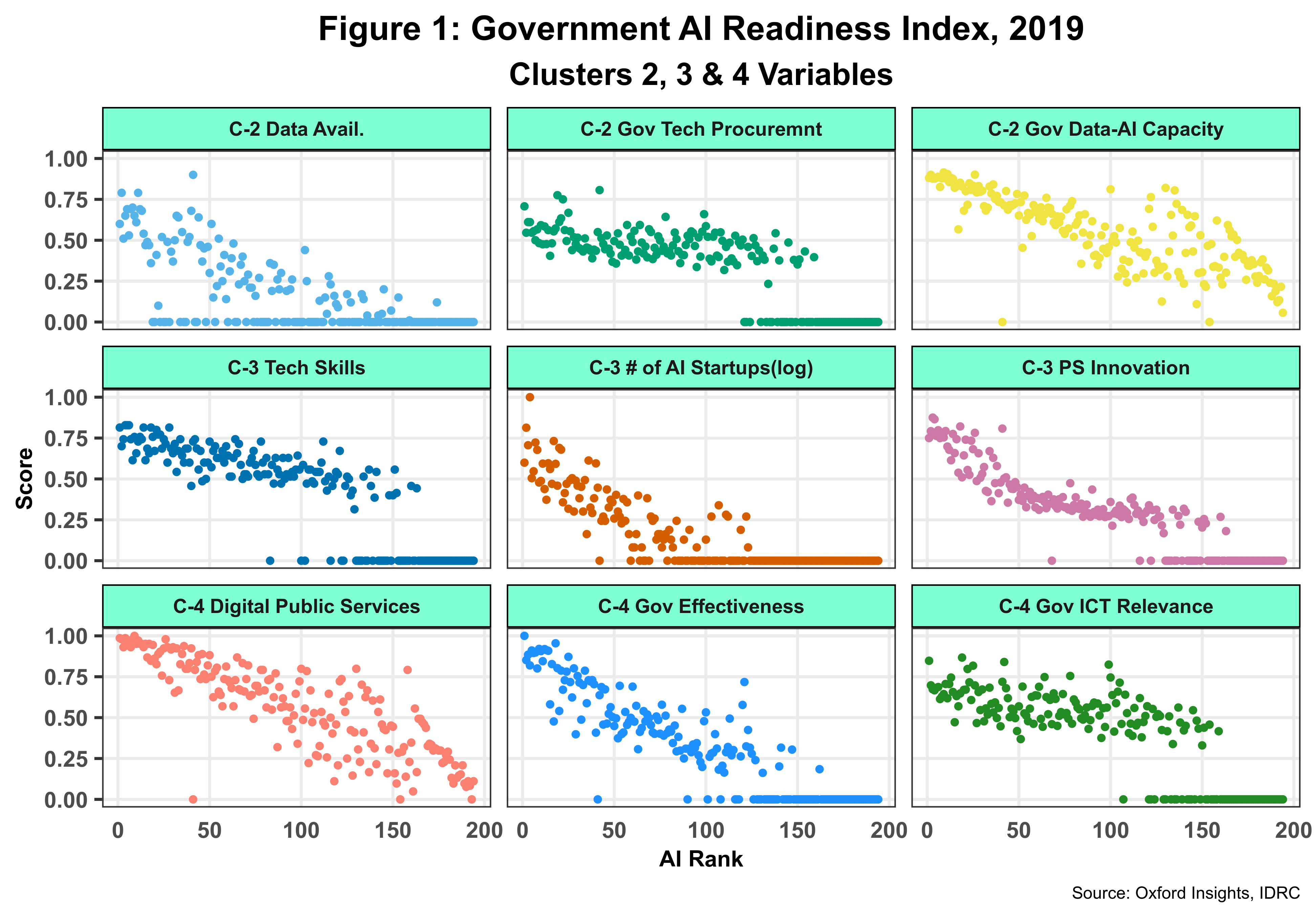

Measuring Artificial Intelligence Development

In the last decade, Artificial Intelligence (AI), including siblings machine learning and deep learning, has been growing by leaps and bounds. More importantly, the technology has been deployed effectively in a wide range of traditional sectors bringing real transformational change while raising fundamental socio-economic (joblessness, more inequality, etc.) and ethical (bias, discrimination, etc.) issues along…

-

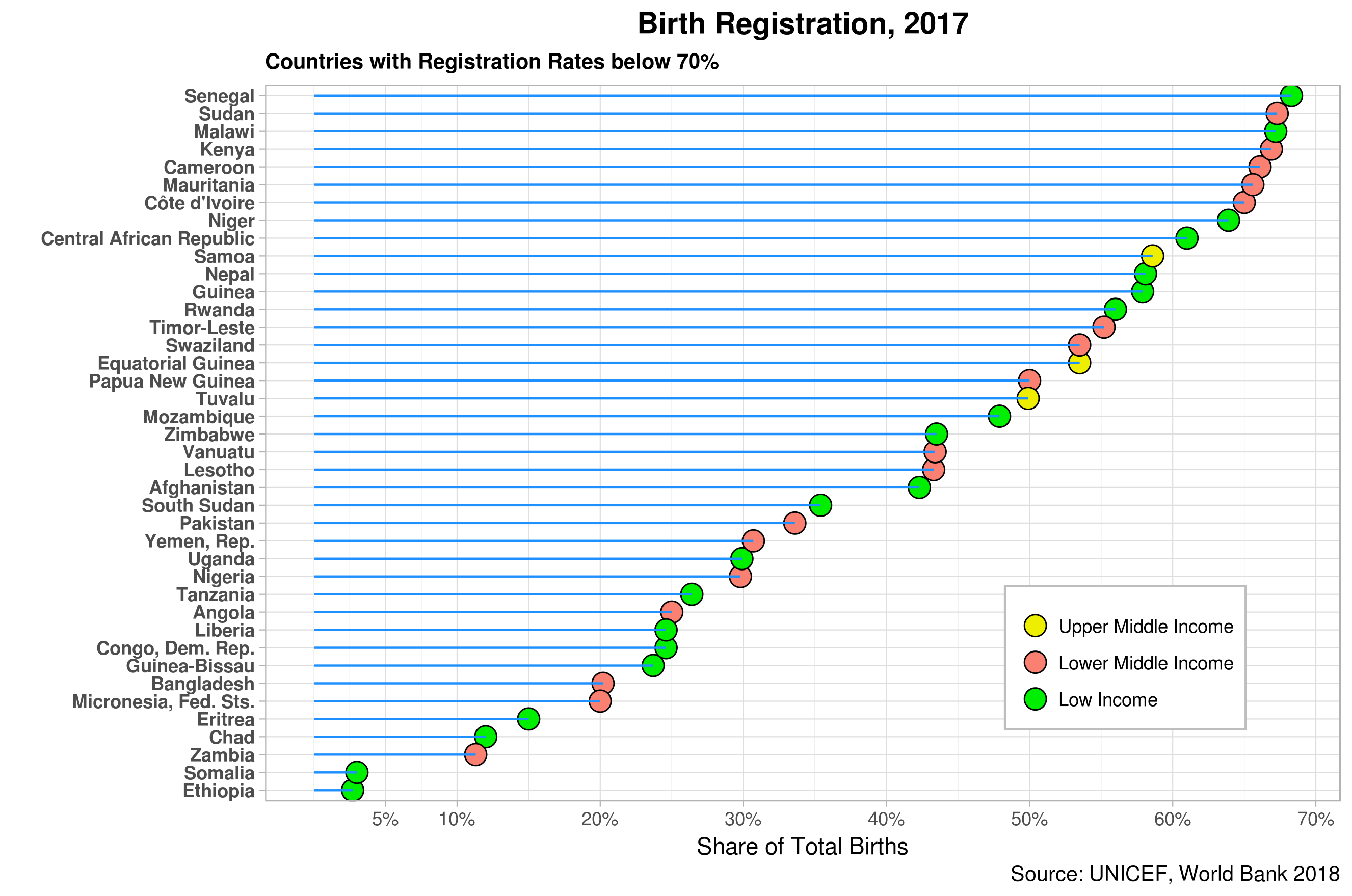

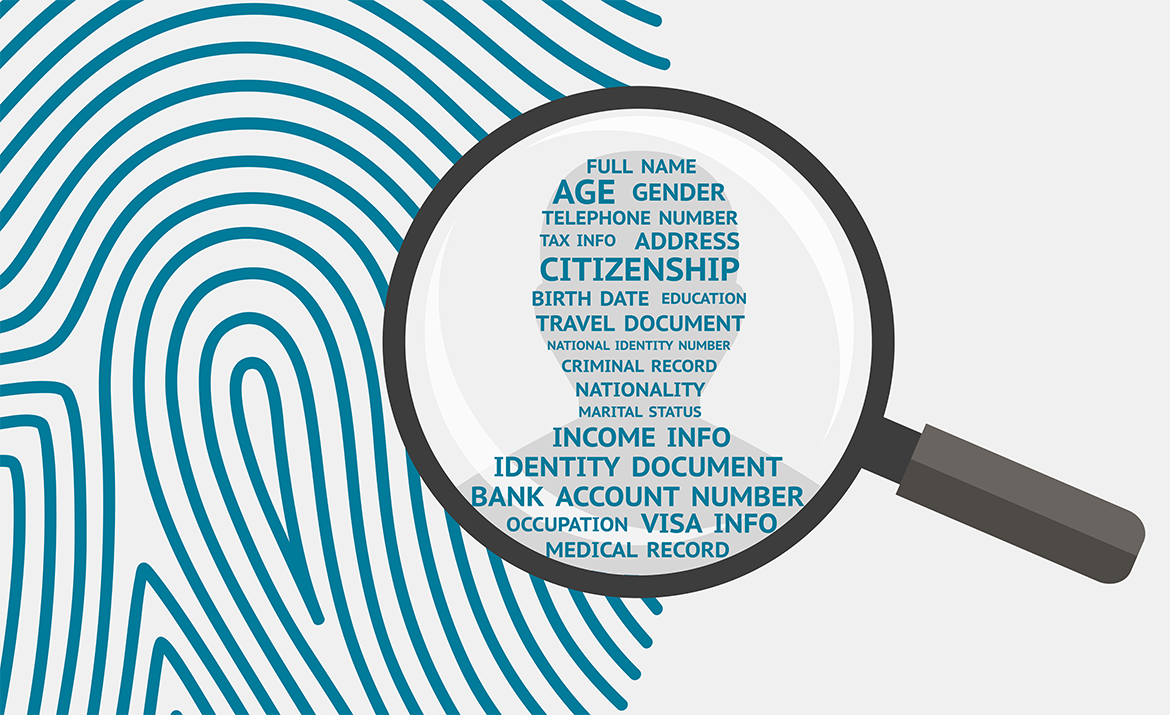

Blockchains and Digital ID, II

The Evolution of Digital identity The emergence of digital technologies provided the ground to shift from traditional systems based on physical identity. In the past, both foundational and functional identity mechanisms were centralized, with individuals getting a physical document containing relevant personal attributes required by the issuing entity. Document management was totally in the hands…

-

Blockchains and Digital ID, I

Overview Like previous technologies, such as the Internet, blockchains have been driven by a high degree of techno-optimism not yet backed up by on the ground impact or reliable evidence. Undoubtedly, the technology, which is still rapidly evolving, has enormous potential in many sectors and could promote human development if harnessed strategically. One of the…

-

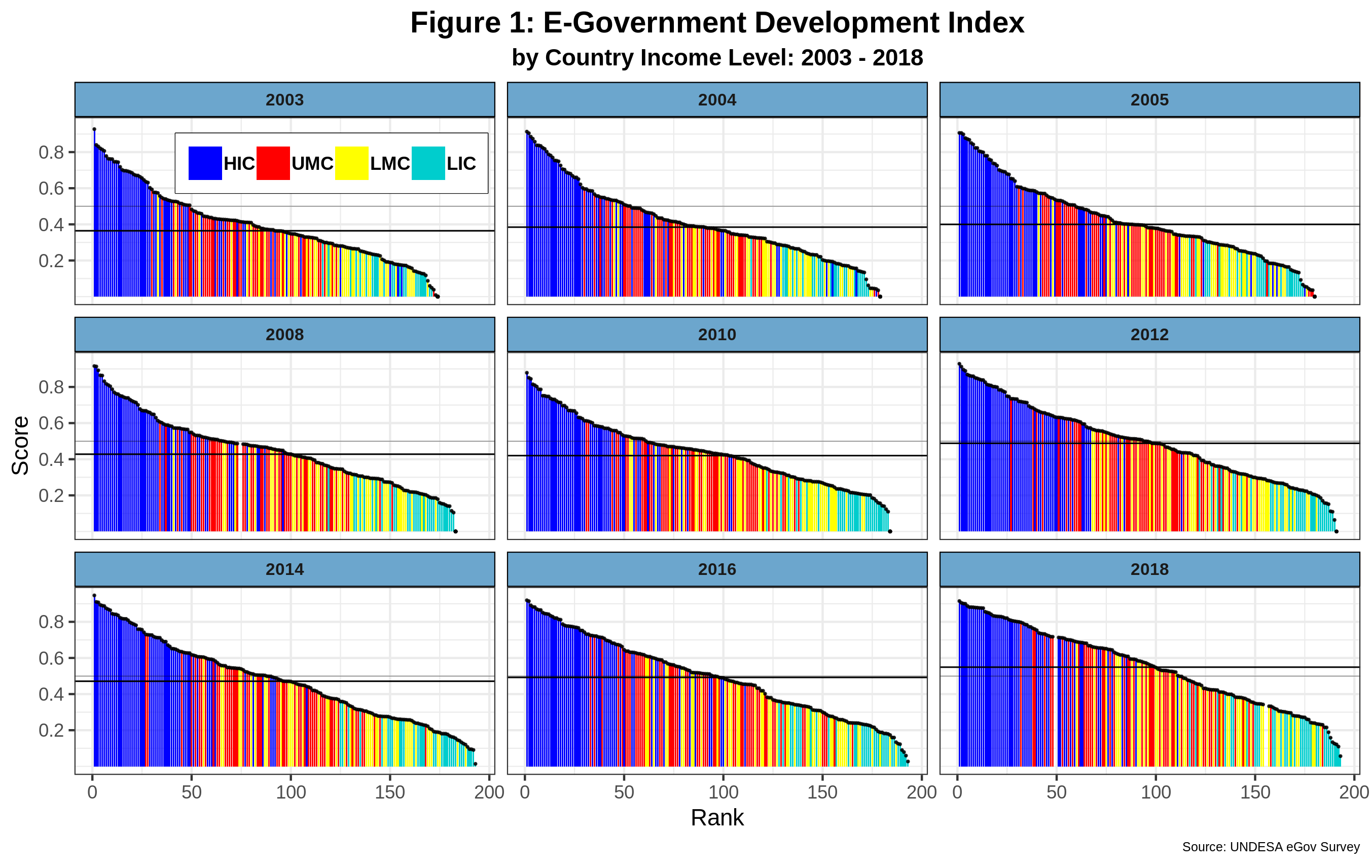

E-government Development I

Birth Running on the coattails of the now infamous dot-com bubble, e-government first saw the light of day before the end of the last Millennium. At that time, where hype overtook the tech scene yet again, adding ‘e’ (as in electronic) to almost any theme became quite fashionable. First in the scene was e-commerce (and…

-

Biased Artificial Intelligence

A recent piece in MIT’s Technology Review nicely summarizes the issue of bias in AI/ML (AI) algorithms used in production to make decisions or predictions. The usual suspects make a cameo appearance, including data, design and implicit fairness assumptions. But the article falls a bit short as it does not distinguish between bias in general…

-

Smart contracts are not that smart

Smart contracts are perhaps one of the most touted features of blockchain technology. While the idea itself dates from the end of the last century, blockchains provided the platform for actual implementation in the Internet era. Undoubtedly, Ethereum was the real disruptive innovator by enhancing the original but limited Bitcoin architecture with a plethora of…

-

ICOs: Endangered Species

As expected, ICOs are finally cooling down. There are several reasons for this. First, ICO oversight by regulators in many countries has substantially increased. Regulators are poking not so much into new ICOs. Instead, they are doing deep dives into those that have already been completed and going after those who look fraudulent. Second, the…

-

Uncertainty and Artificial Intelligence

In a world where perfect information supposedly rules across the board, uncertainty certainly challenges mainstream economists. While some of the tenets of such assumption have already been addressed – via the theory of information asymmetries and the development of the rational expectations school, for example, uncertainty still poses critical questions. For starters, uncertainty should not…

-

Visa on Arrival

My passport seems to profess a deep love for visa stamps. Every time the possibility of travel to another country arises, I can hear its excitement of filling yet another passport page with a brand new and (maybe) shiny visa stamp. The more, the merrier – although blank pages to host additional stamps are becoming…

-

Learning about Machine Learning

A few months ago, as I was finishing a paper on blockchain technology, I received an unexpected comment on Artificial Intelligence (AI from here on in) from one of the peer reviewers. While addressing the overall topic of innovation in the 21st Century, I mentioned in passing the revival of both AI and Machine Learning…

-

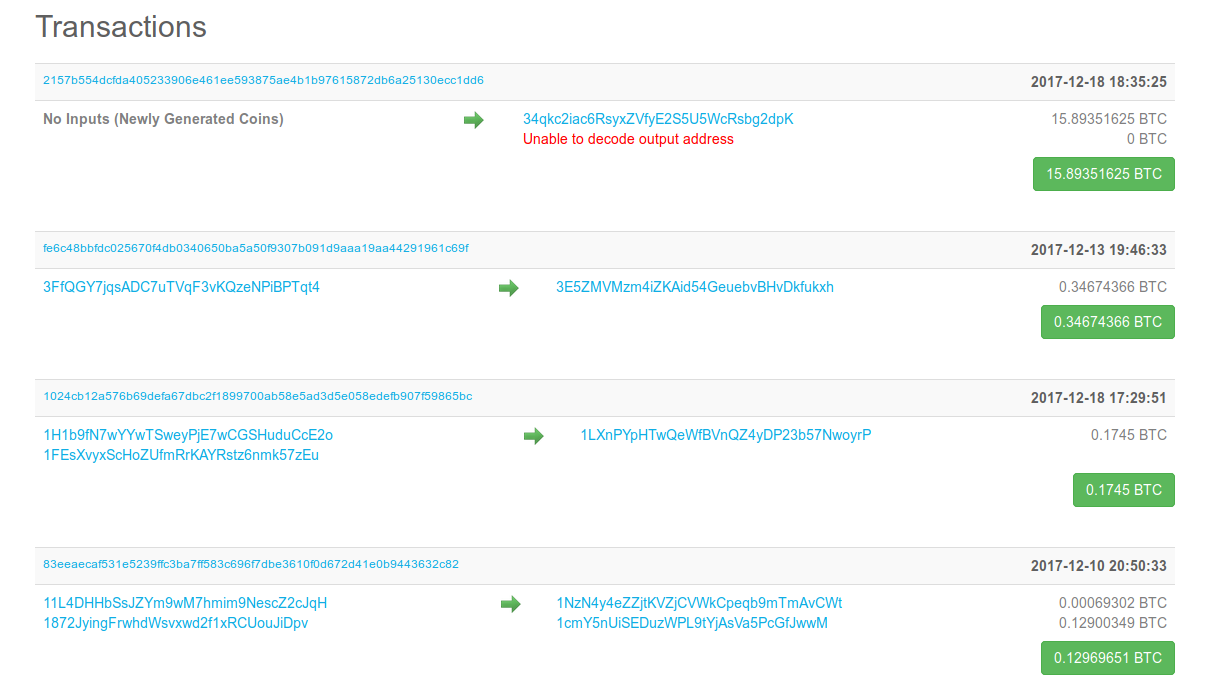

Have You Ever Seen a Blockchain?

A silent but intense competition seems to be taking place when it comes to defining blockchain technology. A Google search for the question “What is blockchain” yields over 120 million possible results. This number includes thousands of guides, videos, FAQs and other “educational” material on the subject. A shining example is a video depicting a…

-

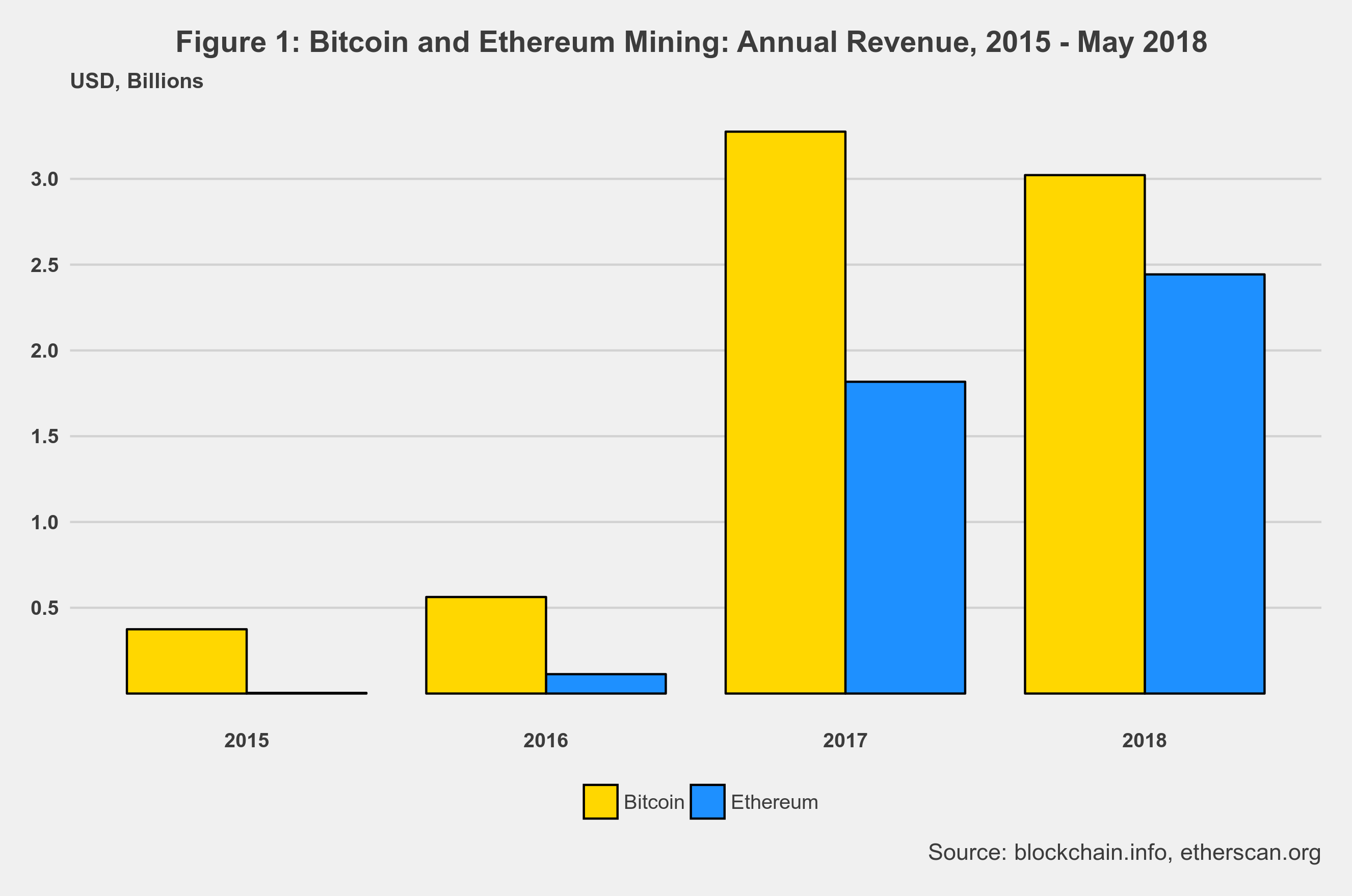

Blockchain Mining Costs and Revenues

In a previous post, I pushed the idea that mining is part of the blockchain economy’s real sector. Unlike financial speculation, mining requires investment in hardware, electricity, space, human resources, etc. This also applies to small miners who will undoubtedly have to defray a lower investment amount but can join a mining pool to share…

-

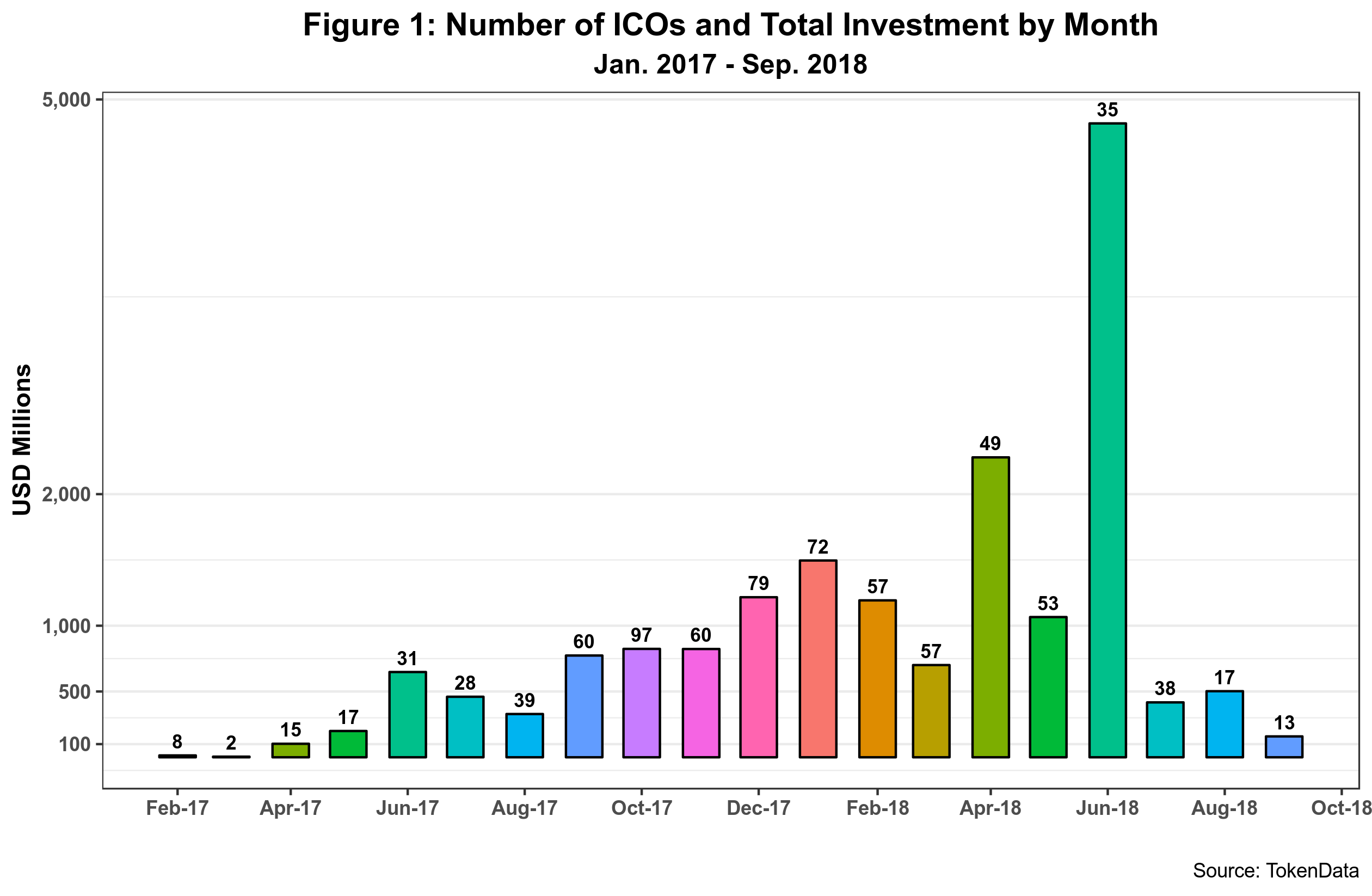

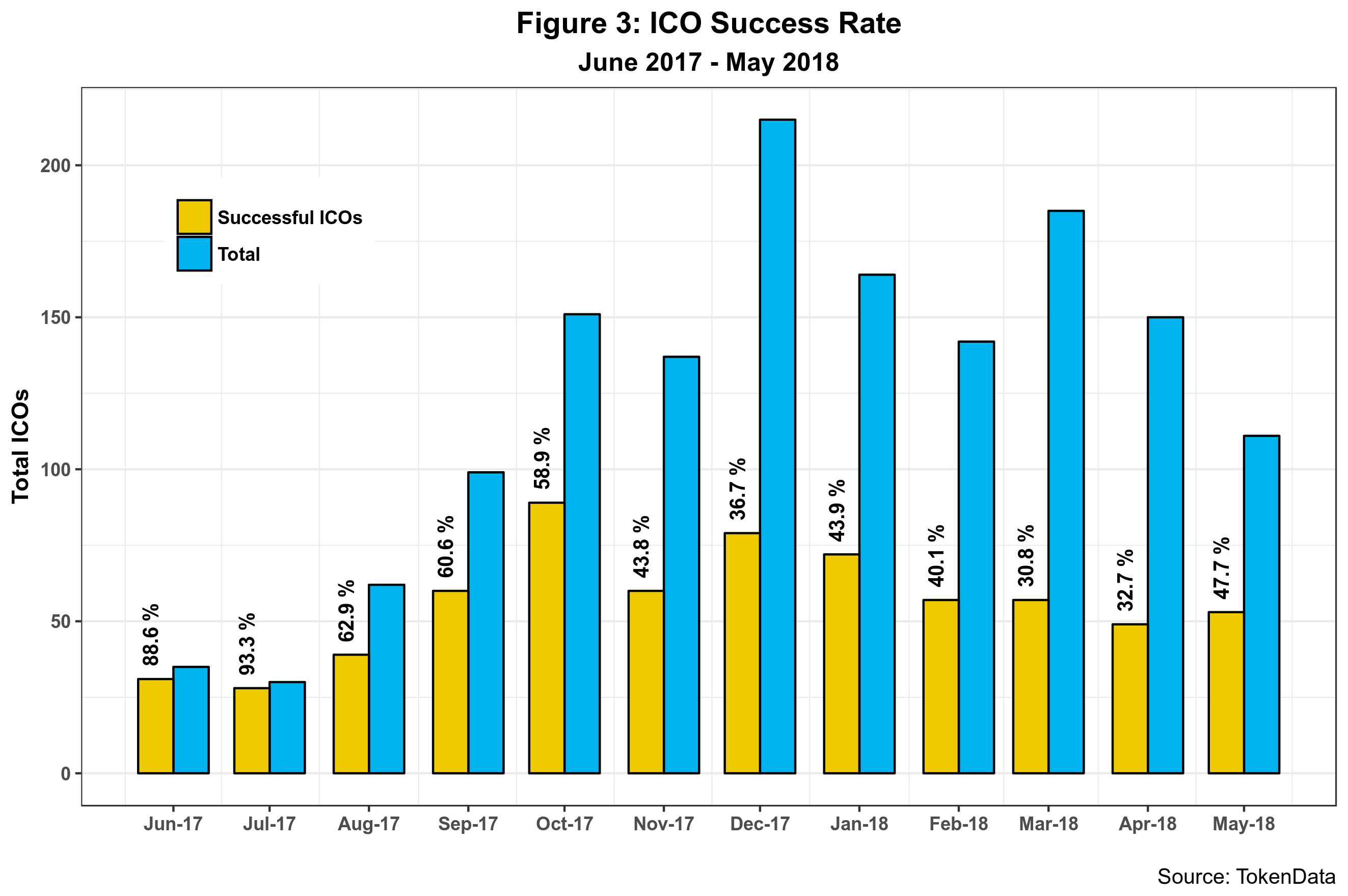

Checking ICOs, Again

It has already been three months since I last checked the ICO scene. At the time, I suggested ICOs were probably slowing down. New data seems to confirm this but all points to other trends not detected before. Figure 1 presents the latest data ending on 31 May. 159 ICOs were successfully completed between March…

-

Algorithmic Inequality

Disruptive. One of the attributes that most use to describe in minimalistic terms the potential impact of new and emerging information and communication technologies (ICTs) in society. While its actual meaning can vary from one person to another, disruption is usually linked to dramatic short-term change where old and obsolete technologies, processes and institutions -not…

-

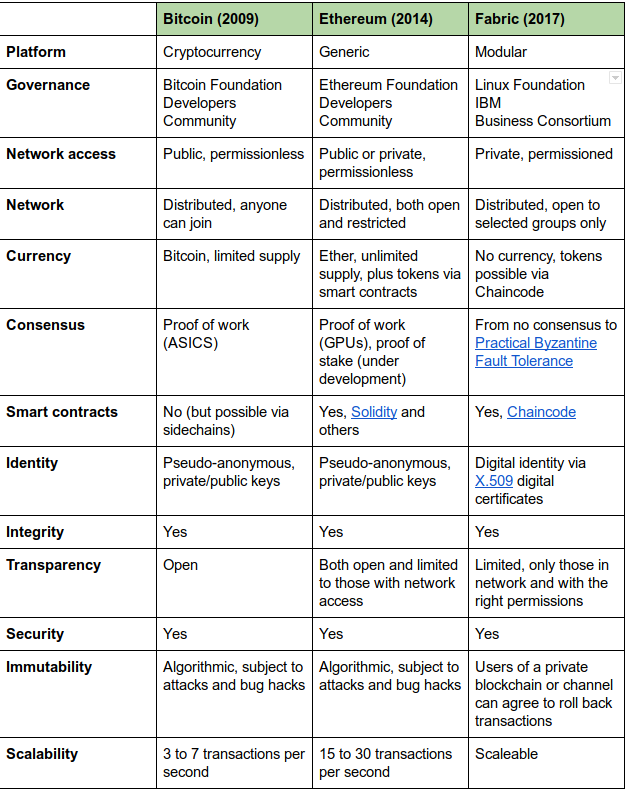

Blockchain Technology is not a Monolith

Many observers seem to assume blockchain technology is an immovable monolith. While such assumption does help when trying to explain how the technology works to the general public, this is not the case when describing the actual status of the technology. Rapid and agile innovation is one of the core traits of blockchains, backed by…