Spring finally arrived but today feels more like summer. Not sure it will last but in I know New York Springs usually tend to be relatively short. Summer seems to always be extremely eager to enter the scene.

In any event, the arrival of Spring is always associated with the US deadlines for submitting taxes, the so-called Tax Day. The usual date is 15 April which works as long as it does not fall on a Friday or over the weekend. This time around it falls on a Saturday so the official deadline for filing 2016 income is Tuesday 18 April.

Filing taxes have also benefited from the rapid development of new technologies, the Internet included. Now it is possible to use one of the many online tax platforms to file one’s taxes. Some of them are free but most will charge between 30 and 50 USD for the service. Filing online does simplify the process as, for example, one does not need to directly fill the required forms. The online platforms will do that for you asking plenty of questions to ensure the right information is captured and placed in the right place. However, one still needs to know what forms are required and check everything before submitting electronically to the IRS. Needless to say, one must have all the relevant documents, forms, data, etc. handy to expedite the process. In terms of time, the process still demands quite a few hours.

My expectations at this point time are that, within a couple of years, machine learning algorithms will also be deployed here and make the process even easier for the end user, while providing the IRS with formidable tools to rapidly detect those intending to evade taxes or getting away with tax fraud. Needless to say, tax audits could also become much easier and be finalized in a relatively short period of time.

A couple of weeks ago, I did my filing using one of the many online platforms available. Once I was done and had actually clicked on the submit button, the platform asked me if I wanted to see what my taxes were financing. I went for it.

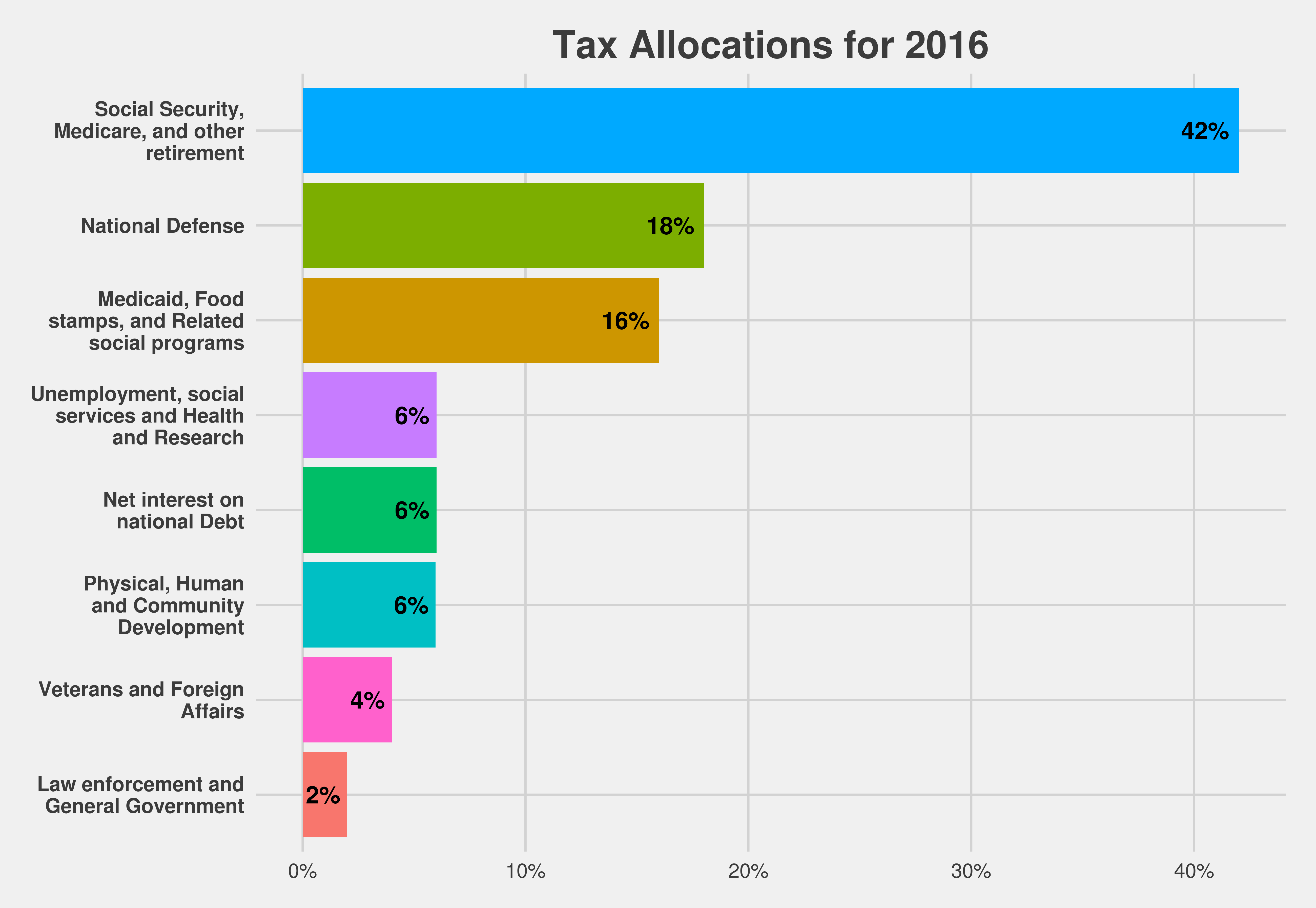

The graph below shows the allocations of my taxes.

So now I know. Over 80% of my taxes finance social benefits and national defense. However, I was not aware I was also financing interest accrued by the existing US national debt which nowadays is almost 20 trillion dollars or close to sixty-two thousand dollars per person.

Cheers, Raúl