Category: Economics

-

Sizing up Big Tech – V

Connecting to the Internet in 1994, the year Amazon was founded, was certainly not a walk in the park. For starters, the number of access providers could be easily counted. Accessing the emerging network of networks from home required a computer, a modem, an RS-232 compatible cable, supporting software, and an additional phone line, depending…

-

Sizing up Big Tech – IV

Out of the five usual suspects frequently fingered as Big Tech gang members, Microsoft (MS) takes the top spot, time-wise. Indeed, the company turned 50 last April, beating Apple by almost one full year. Many will associate such advanced age with dinosaurs, especially if we use Internet time as a benchmark. However, MS shows no…

-

Sizing up Big Tech – III

In the early 1980s, when Apple was still an underdog facing stiff competition from larger and well-established tech companies, it masterfully used mass advertising to challenge their dominance. TV and paper news media were the only options available at the time. Perhaps Apple’s most famous ad was 1984, launched in 1983, announcing the upcoming Macintosh…

-

Sizing up Big Tech – II

As the EU Digital Markets Act (DMA) has acknowledged, Google operates in many markets, including operating systems, devices, email, browsers, broadcasting, cloud, mobile apps, advertising, and search. In some of these, like search engines and mobile operating systems provided for “free,” the company has disproportionate world market shares (90 and 73 percent, respectively), thus attracting…

-

Sizing up Big Tech

Have you ever bought something from Google? Many will probably answer positively—maybe a tablet or a phone, or perhaps pay for a YouTube or Google One subscription. Back in the early 2000s, most would have responded negatively, though. At the time, the company was a synonym for powerful and mostly accurate web searches, and no…

-

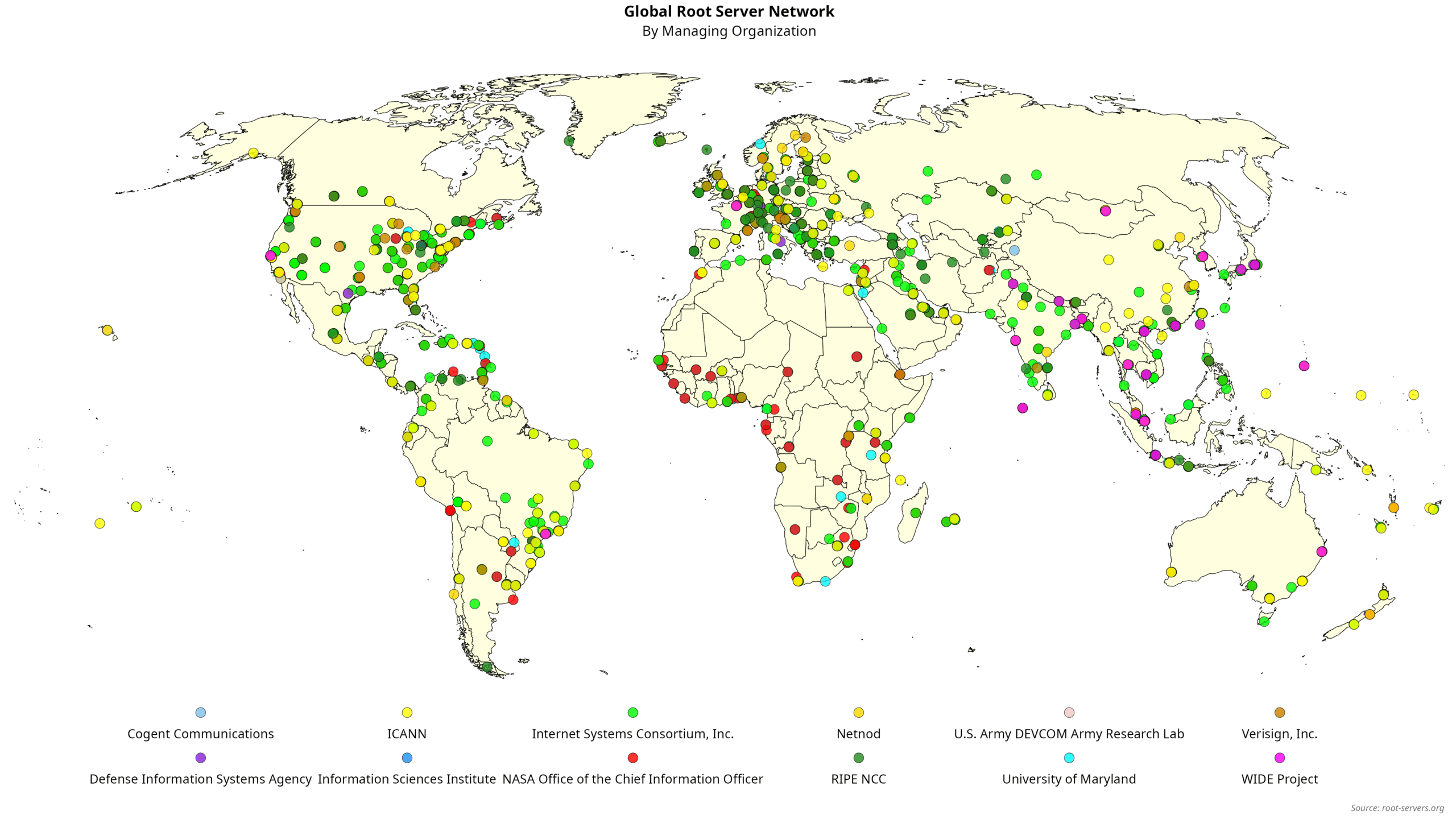

Internet Roots

An Intergalactic Computer Network (ICN). That was the first Internet Imaginary in the early 1960s, used to depict the endless possibilities of the then-emerging network of networks. The ICN Imaginary was thus born several years before the first four academic computer networks were interconnected in 1969, thanks to the pioneering groundwork of IPTO and the…

-

Measuring AI, Responsibly – V

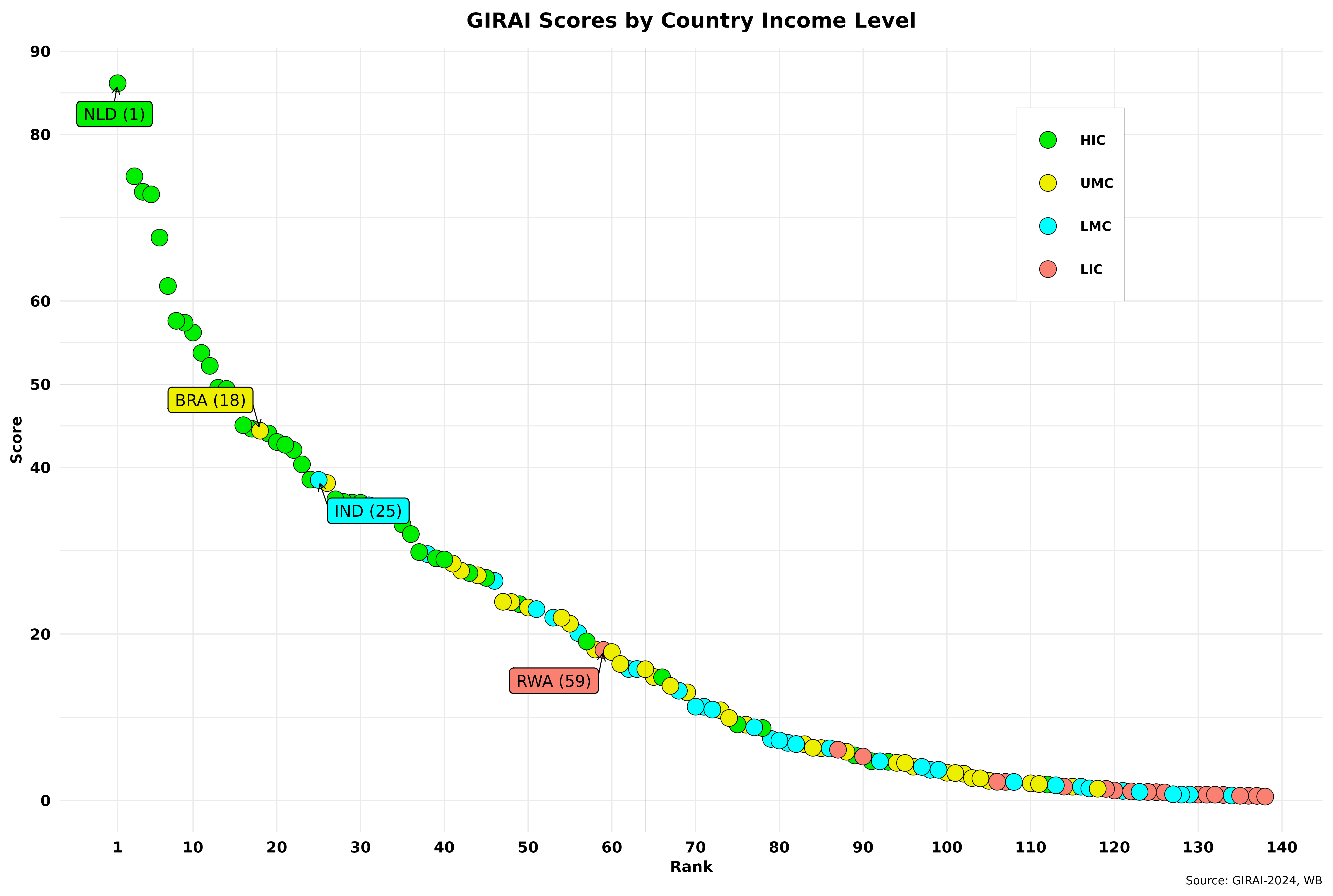

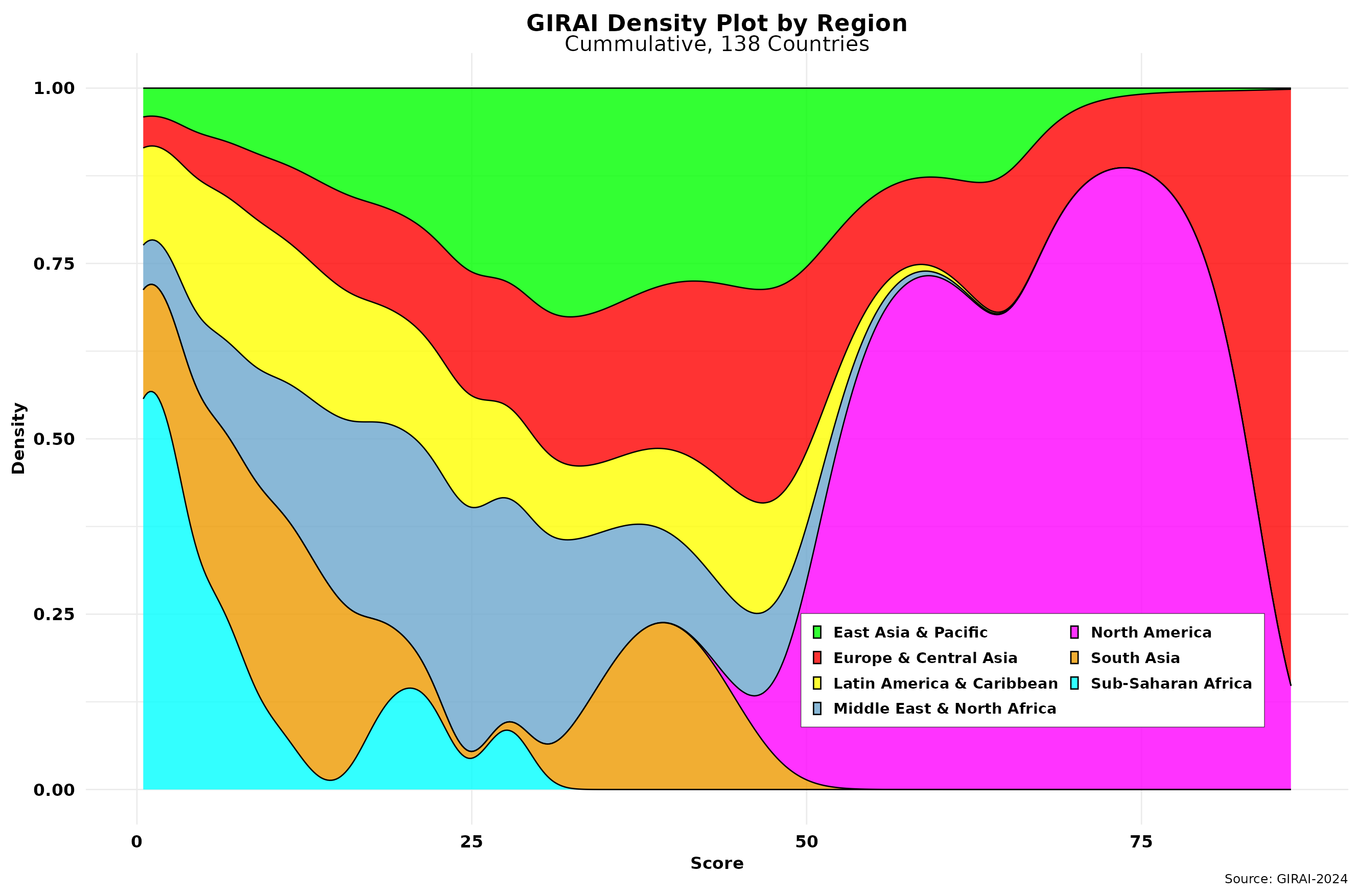

In the previous post of this series, I was surprised to uncover the lack of a positive correlation between GIRAI and regime types—as defined by The Economist Democracy Index (EDI). I expected the opposite since GIRAI’s design is driven by a human rights agenda. That is, countries with democratic regimes should achieve higher GIRAI scores.…

-

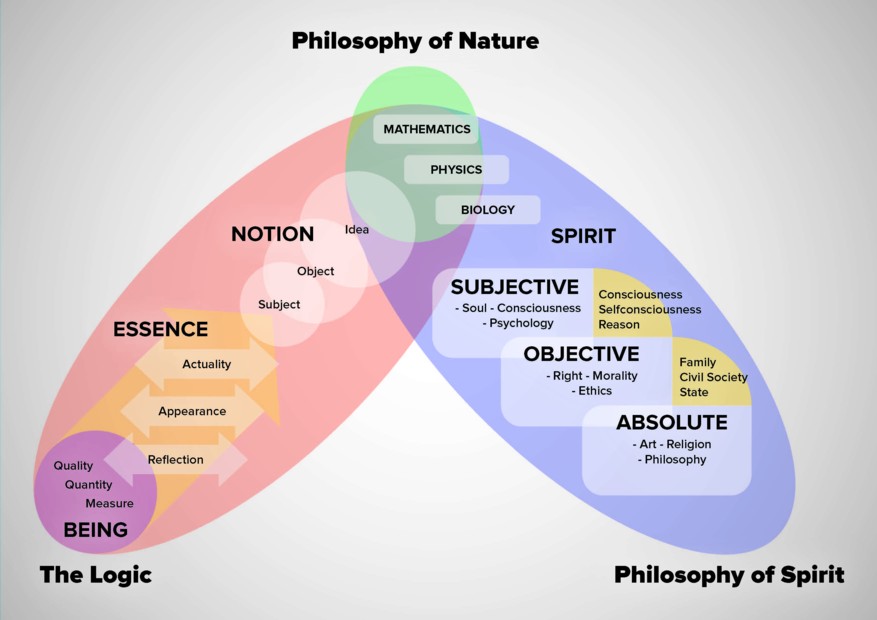

A Decolonial Hegel

The road that took me to Hegel was long and winding — to almost paraphrase the Beatles’ last album song. I first spent two-plus years studying engineering, trying to tame incommensurable and difficult-to-digest content thriving under the headings of calculus, advanced mathematics, statistics, and physics. Sleeping was a luxury while staying alive was the goal,…

-

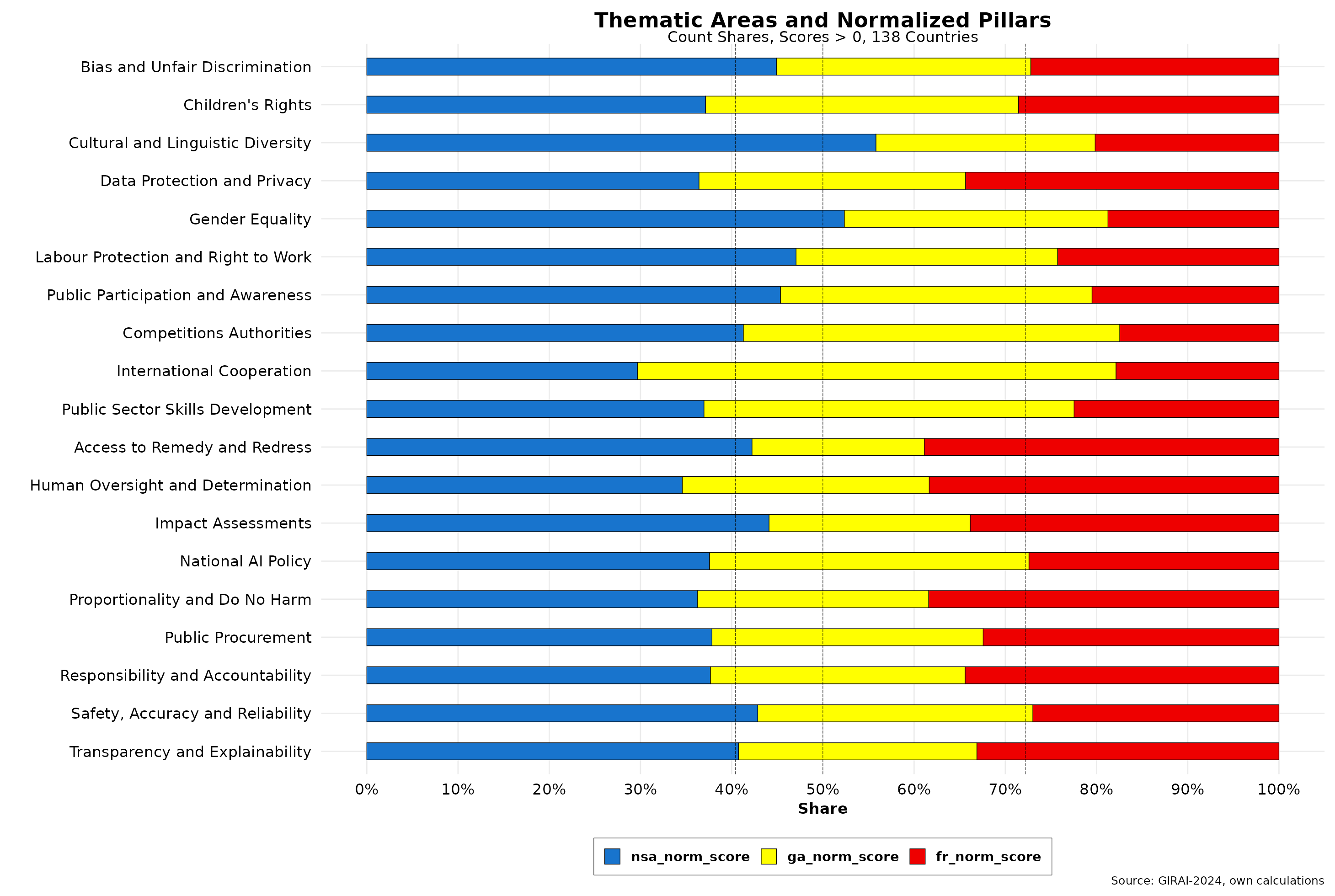

Measuring AI, Responsibly – IV

The complexity of measuring RAI in over one hundred countries covering all regions should not be underestimated. GIRAI’s undertaking should thereby be acknowledged and openly praised. In a previous life, I had the opportunity to manage a global ICT for development program covering over 50 countries in all regions. While sleep time suffered quite a…

-

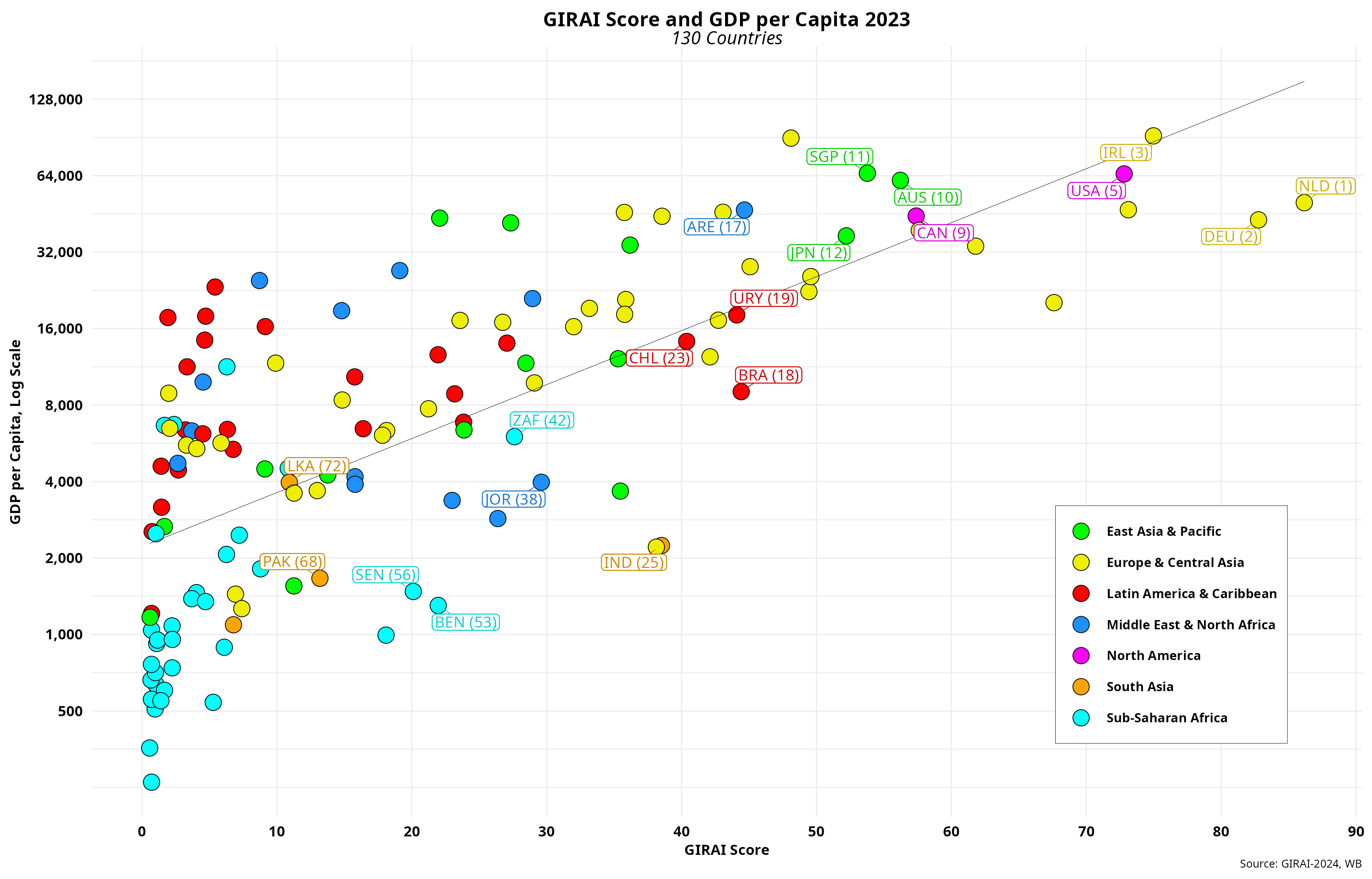

Measuring AI, Responsibly – III

Although not unchallenged, GDP remains the indicator’s champion — I am sure Kuznets must still be delighted about this. Most nations work very hard to make it grow at all costs, as, in principle, the gains translate into higher living standards and human development, which are very laudable goals indeed. The flip side is its…

-

Measuring AI, Responsibly – I

First published in 2017, Stanford’s AI Index Report provides extensive AI information covering a wide range of topics. Take no prisoners seems to be its implicit motto. The latest 2024 version is the most voluminous yet, with over 450 pages. Areas such as the economy, health, policy and governance, and diversity are part of the…

-

Cabbies in Mexico City and Beyond – II

Locals loudly complain about traffic in Mexico City, especially during peak hours. That is also less than ideal for app-driven cabbies. However, I usually tell both cohorts that, comparatively speaking, traffic in the City is not that bad. The situation in other large cities in the Global South I have visited is much worse. In…

-

Cabbies in Mexico City and Beyond

Almost two decades ago, an army of green VW Beetles operating as taxis swarmed Mexico City like an ant colony in permanent search of the next meal—except cab drivers were not working in teams but competing intensively to get the next customer. Estimates suggest that half of the almost 100k taxis endlessly circulating the City…

-

AI Typology

While researching the deployment of artificial intelligence within the public sector, I encountered a limited number of precious case studies that poked a bit deeper into the benefits and risks of such a move . For the most part, that set of studies focused on public service provision, while a few explored AI’s institutional impact…

-

Generative AI (GenAI) in the Public Sector

It was a last-minute decision. The annual New York Film Festival was underway, and I had carefully studied its lineup. My list had four options: 1. Must see. 2. Should see. 3. See some time later on. And 4. Not really interested. The film playing that day was part of the second set. Sixty minutes…