Although the root causes of the current financial and economic crisis are still being debated (and will continue until the next large crisis hits), one issue that stems out of of the current discussions is the softening in the last 20 or so years of government regulations in the financial markets. Starting with the Reagan administration and later complemented by the Clinton presidency, laws that were designed to “regulate” financial markets were eliminated in the US. This, combined with a push for innovation in the global financial markets, where new technologies were a key factor, and a “risky” monetary policy (continuous lowering of interest rates in the last 10 or so years), indicate that “governance” issues played a critical role in its onsetting.

In the last 40 years or so we have seen a shift away from Keynesian (where the state plays a key role) to “free market” policies inspired by the theories of Milton Friedman. In this latter paradigm, the ideal state for an economy to grow and have full employment and no inflation is one where the State does not play any role in this process. The market knows best and the State is just an obstacle. The only role the State is to regulate, if at all, markets and other areas. But as seen in the US economy at least, the State was no even doing this. Instead it was “deregulating” more and more and doing less “governance” (some similar happen in the US with say privacy policies which BTW exist in Europe. When asked why isn’t there regulations on privacy the answer is: the market will take care of it). The current crisis could bring back a change in the paradigm by bringing back renewed Keynesian policies as reflected by the current shift from monetary policies to fiscal policies and the State investing productively in the economy to foster effective demand and create jobs.

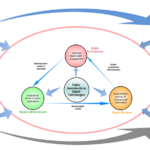

It is also obvious that the current crisis is not the result of “misbehavior” of developing countries or BRICS, an argument made by some in the Asian crisis of 1997. But since the global economy is now a

tight network, shocks in any of the network nodes can have large repercussions in all other countries. Thus, developing countries will be deeply affected (and in fact are affected) by the crisis and will in turn need to respond to it.

Some observers have pointed out that the current crisis could have a devastating impact in many developing countries. For example, the number or poor people living under 2 USD/day is expected to increase by 100 million while global unemployment will rise by at least 20 million people. The WB estimates that 40 million people will fall back into poverty. Also, inequality within countries will grow at a faster pace (as it was growing before the crisis hit) as will inequality between the richest and the poorest countries. Note that those countries with the weakest links to the global network economy will be affected in a lesser way, specially those living in rural areas, etc. It is thus not surprising that sales of Marx’s books has skyrocketed in the last few months. The BBC is also reporting that the number of people visiting Marx’s tomb in North London is also increasing dramatically…

Economists agree that the crisis will affect developing countries in at least three ways: 1) financially, as local financial institutions will suffer and credit to locals will not be available; 2) in terms of trade, as exports from developing countries will decline considerably; and 3) in terms of capital flows to developing countries including ODA, FDI and remittances. This last point is important for us at DG and could provide a key entry point to us.

To the above we can add the collapse of the manufacturing sector (the “real” sector of the economy as opposed to the financial one) which will have a larger impact in developing countries as their economies are based on them (the financial sector is usually handled by industrialized countries), etc.. Many economists today believe that the financial sector is in command and should be the focus of most policy interventions by the State. The “real” sector will just react to it (this is the debate we heard here in the US between Wall Street and Main Street.) The jury is still out though (and in the case of developing countries where the “real sector” is the targets this does necessarily has to hold..)

Developing countries will be affected by the global crisis in different degrees. Most probably, network nodes tightly linked to the the global economy will suffer the most. But in any case, there is not just ONE response to the crisis. This is key for our understanding of what to vis-a-vis DG.

Economist are obviously focusing on the economic issues and several MICs have responded with their own bailout packages. There seems to be an emerging consensus that developing countries need to develop/strengthen sound national financial systems and then start calling for reform at the international level. By sound it is meant that institutions that regulate the financial sector are needed and/or need to be strengthened.

In terms of DG and our potential response, it seems evident that if ODA and other financial flows will indeed decline then national governments will need to prioritize their public investments and they will be under a lot of external pressure to dedicate resources to the financial systems and institutions. The danger is that countries reduce support or stop altogether public investments in existing DG areas of work as the economic priorities will become dominant and job creation and restarting economic growth need immediate attention.

Donors who are planning in reducing ODA should be reminded that there is plenty of evidence that ODA does foster GDP growth particularly in the so-called fragile states and the LDCs. So the current crisis is indeed an opportunity to accelerate it resolution by increasing ODA. Also note that ODA is relatively very small when compared to the trillions of USDs being put into bailout plans, etc..

Being that as it may, some specific entry points for DG could include:

– Advise governments not to abandon the DG portfolio by showing then the links between DG and poverty alleviation and proving them with examples and tools to continue support

– Play a larger role in the regulation of economic and financial institutions by making the governance component a critical issue for success (here both accountability and transparency are essential)

– Foster increase citizen/stakeholder participation in identifying public investment priorities that response to both local needs and development target and plans

– Encourage governments to invest in pro-poor or inclusive delivery of public services (and information) to directly tackle existing gaps -and working in sync with the local private sector, in particular SMEs, to create jobs and have sustainable solutions

– Promote the use of the new technologies to do the above to reduce unit costs and increase coverage -as as as to disseminate information. The Obama Web 2.0 initiative here is an interesting example to consider

– other…

Comments

One response to “Comments on the Economic Crisis”

Post Edited: Comments on the Economic Crisis https://t.co/C3iseolcxA