According to the latest estimates, global Internet penetration was close to 54 percent by the end of 2017. That is roughly 4 billion people.  Figures for the number of unique cell phone users show that 5 billion people have access to the technology.1 BTW, this means that 1 billion people have a cell phone but are not connected to the Internet. But that is another story.

Figures for the number of unique cell phone users show that 5 billion people have access to the technology.1 BTW, this means that 1 billion people have a cell phone but are not connected to the Internet. But that is another story.

Armed with these numbers, I asked a business acquaintance who is a blockchain enthusiast and practitioner if the most popular blockchain platforms could effectively cater to all those users. Answer: “Not at this moment. But do not worry, we are working on it.”

The reason for this stems from the scalability constraints the most reputed blockchain platforms face. As I see, the scalability issue is related to three factors: 1. Speed of transactions; 2. Latency; and 3. Operational costs. The first one is perhaps the most well-known and comparisons with traditional credit card vendors abound on the Internet.

However, two things need to be considered here. First, there is no such thing as single transaction processing in a blockchain. Before being actually processed, a set of transactions is grouped together and linked to a new block. Second, transactions in the block are handled by third parties, or miners, who must first solve the proof of work puzzle. Once this is done, the solution is independently verified by other network members before the new block is finally added at the end of the chain.

From the above, it is clear that block size and the time miners take to solve the puzzle place a cap on speed and increase latency (how long do I have to wait to see my transaction approved.)

But the latter can also be affected by the fee structure that exists in traditional blockchains platforms. Every transaction must pay a processing fee that can vary according to the size of the transaction: the more significant the trade value, the higher the revenue for the miner. Miners, who are looking to maximize profit, can identify such transactions and prioritize them. This means that small deals might get pushed down the list until a miner decides to pick it up for processing sometime later.

Finally, by design, the difficulty for solving the proof of work puzzle increases over time. So miners must acquire more sophisticated hardware (to remain competitive) that consumes more energy, thus augmenting their operational expenses. This puts extra pressure on miners to seek the best path to maximize profits. And so on and so forth.

As we can see, the three factors limiting blockchain scalability are closely interrelated.

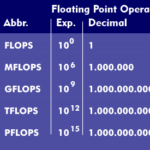

Let us now look at some real data for both Bitcoin and Ethereum2 Data obtained from blockchain.info and etherchain.org. to calculate speed and latency. Looking at the maximum value for daily transaction throughout their history, we obtain the following table:

| Maximum number of transactions per day recorded | Number of blocks per day for maximum daily transactions | Transactions per second | Latency | |

|---|---|---|---|---|

| Blockchain | 490,644 | 185 | 5.68 | 7.47 minutes |

| Ethereum | 1,351,307 | 5,459 | 15.64 | 15.79 seconds |

While Ethereum shows much better latency (and uses a less expensive proof of work algorithm), both platforms fall short when it comes to transaction speeds. And we are using best case scenario numbers derived from real data. Using average or median values to recalculate the above number will reduce speeds by more than 50 percent and increase latency.

Reportedly, at its peak, Amazon makes over 600 sales per second with almost zero latency. If it were to adopt blockchains to process transactions, it would have to scale back its sales volumes. Note also that buyers are not asked to pay fees for every transaction. Sure, credit cards charge fees, but these are usually paid by vendors and stores – and not passed on to the customers.

How about electoral processes? India has over 800 million voters. If India were to use Ethereum, it would take over 20 months to tally all the votes. This could, in fact, be a threat to democracy in the country. I am sure India will pass for the time being.

What about the financial sector? In the book New Dark Age, the author provides a detailed description of how high-frequency trading demands high-speed electronic communications. Financial entities engaged in this type of trading heavily invest in such networks to minimize communications speeds. Having a one millisecond advantage over the competition can bring an additional 100 million dollars a year. Latency reduction thus translates into big money. I am sure these guys are not even thinking about blockchains.

Nevertheless, I still think my acquaintance is right on the money: blockchain innovators are doing their best to overcome these limitations. There are two ways of doing this. The first is to try to change the current platforms. Here we find Bitcoin Cash (segregated witness), the Lightning Network, Plasma, and Sharding. The second is to create brand new platforms that use different technologies to handle blockchain technology’s various features. EOS looks promising, while IOTA, which is not precisely a blockchain, deals with the issue in a radically different way.

If I had to place a bet here, I would probably go for the latter option. But I would not bet the house, not a chance.

Cheers, Raúl

Endnotes

| ⇧1 | BTW, this means that 1 billion people have a cell phone but are not connected to the Internet. But that is another story. |

|---|---|

| ⇧2 | Data obtained from blockchain.info and etherchain.org. |

Comments

One response to “The Scale of the Blockchain Scalability Constraints”