“One-CPU-one-vote.” 1 CPU stands for Central Processing Unit, nowadays also known as a microprocessor. From a governance perspective, this is perhaps one of the most interesting phrases included in the original Bitcoin paper penned by a still anonymous author. Could we then say the goal is to build a democracy of devices, a CPU-democracy where each node has the same “power,” so to speak?

The phrase is part of the paper’s discussion of the so-called proof-of-work (PoW) algorithm.2 Needless to say, PoW is not the only algorithm used to add records to a blockchain. Others such as proof-of-stake and proof-of-value, for example, have been developed. As a decentralized peer-to-peer network, blockchain allows any CPU to run PoW. In principle, any network node could be a blockchain miner. Attaching a new block of transactions to the existing blockchain to win the financial rewards built into the overall ecosystem is the overarching goal of mining.3 Bitcoins and transaction fees are the main financial rewards sought by miners.

The phrase is part of the paper’s discussion of the so-called proof-of-work (PoW) algorithm.2 Needless to say, PoW is not the only algorithm used to add records to a blockchain. Others such as proof-of-stake and proof-of-value, for example, have been developed. As a decentralized peer-to-peer network, blockchain allows any CPU to run PoW. In principle, any network node could be a blockchain miner. Attaching a new block of transactions to the existing blockchain to win the financial rewards built into the overall ecosystem is the overarching goal of mining.3 Bitcoins and transaction fees are the main financial rewards sought by miners.

By design, CPUs must thus compete to find the winning solution. Once a solution is found by the winning node, all other CPUs can easily validate it. Having reached consensus on the solution, a new block is added and replicated across all network nodes.

Here we have two distinct stages. First, fierce competition among CPUs to find a solution with one node winning in the end. This is followed by the validation of such a solution undertaken by network nodes. While the former could be time-consuming, the latter can be completed in a few seconds. While mining requires lots of computing power, output verification can be carried out by any CPU, notwithstanding actual computing power.

The One-CPU-one-vote idea applies to both stages, competition and consensus.

The Guess the Number Puzzle

Most kids have played the guess the number puzzle.4 Needless to say, nowadays we can play this game online. At least I did when I was a kid. In this game, one individual among a group of kids asks the others to guess a number between 1 and 10. Maybe the individual wants to give away a piece of candy or a chocolate bar to friends but does not want to openly use nepotism. The guess the number puzzle comes to the rescue here.

While this works in most cases, the fundamental flaw in this puzzle is that participants cannot verify that the winning number is the individual running the game secretly selected. Instead, they must trust the game’s outcome.5 Same goes for the online version of the game, by the way. and the individual running the game. Verification and consensus are thus not feasible. However, In terms of competition, a level playing field exists by default as puzzle participants need no special requirements to join in, other than being part of the circle or network of friends of the individual running the show.

PoW has similarities with the numbers puzzle. But it is significantly more complex.

For starters, PoW requires that CPUs find a “number” with 256 alphanumeric characters.6 To be precise, we are talking about 256 bits here. In CPU speak, one character is equivalent to one byte that comprises 8 bits. The actual length of the number being sought is, therefore, 32 characters. But CPUs can easily manipulate bits. Second, the first 8-9 characters of the number sought must all be zeros. Third, such a number must be below a pre-defined numeric threshold. Finally, CPUs must input the solution found in the previous puzzle-solving competition, alongside a random number7 This number is called a nonce. used to perform the calculations.

No human brain can solve such a computationally complex puzzle.

Blockchain mining competition

By the same token, not all CPUs can solve such a puzzle in a specified time frame, as not all are created equal. In the early days of Bitcoin, solving the puzzle was feasible using an ordinary desktop or laptop computer. Nowadays, miners must use specially designed and optimized microprocessors and hardware to compete and solve the puzzle.8 This graph nicely summarizes the evolution of mining hardware and associated computing power.

Blockchain mining competition has triggered the development of more sophisticated and expensive hardware customized.9 Energy consumption has also dramatically increased over time. That is the subject of a separate post. This has increased entry barriers for nodes participating in the PoW guess the number puzzle. At the same time, it has fostered mining centralization and concentration. Centralization, in turn, raises the probability of a 51% attack on the network.

Mining pools emerged in response to this trend. Such pools allow small miners to be part and parcel of PoW competition by cooperating with others and getting rewards according to the amount of work they contribute to solving the puzzle. Nowadays, most PoW competition is undertaken by mining pools.

Mining pool organizations do not release numbers on the actual number of miners engaged. Some estimates suggest that there might be around 100,000 active miners network.10 See this post for 2015 estimates, which seem to be on the high side. This number is a direct function of Bitcoin’s price that, at the time of this post, is over 1,200 USD: The higher the price, the greater the incentive to become a miner by joining a mining pool.

But does this on its own deter the trend towards mining centralization and concentration?

Examples and Data

In 2014, mining pool GHash was able to muster 51% of the Bitcoin network mining computational power, raising the specter of a possible 51% attack. This immediately raised red flags all over the network. Miners part of GHash pool quickly pulled out while the company issued a statement indicating it would not abuse its power. It also suggested it would take steps to reduce its computational power.11 See the press release here. Two years later, GHash was out of business.

Note that technology was not part of the way the community addressed the issue. Rather, network members took tacitly-agreed collective action to prevent such concentration of computing power and preserve the core character of the ecosystem.

The disappearance of GHash is certainly not uncommon. 5-year data for Bitcoin mining between 2012 and 2016 suggest a continuous change in the top ten Bitcoin miners. For example, only one organization in the top 10 in 2012 was still in the top 10 in 2016. The rest have either moved down in the food chain or disappeared from the scene.12 A chart depicting this in this post.

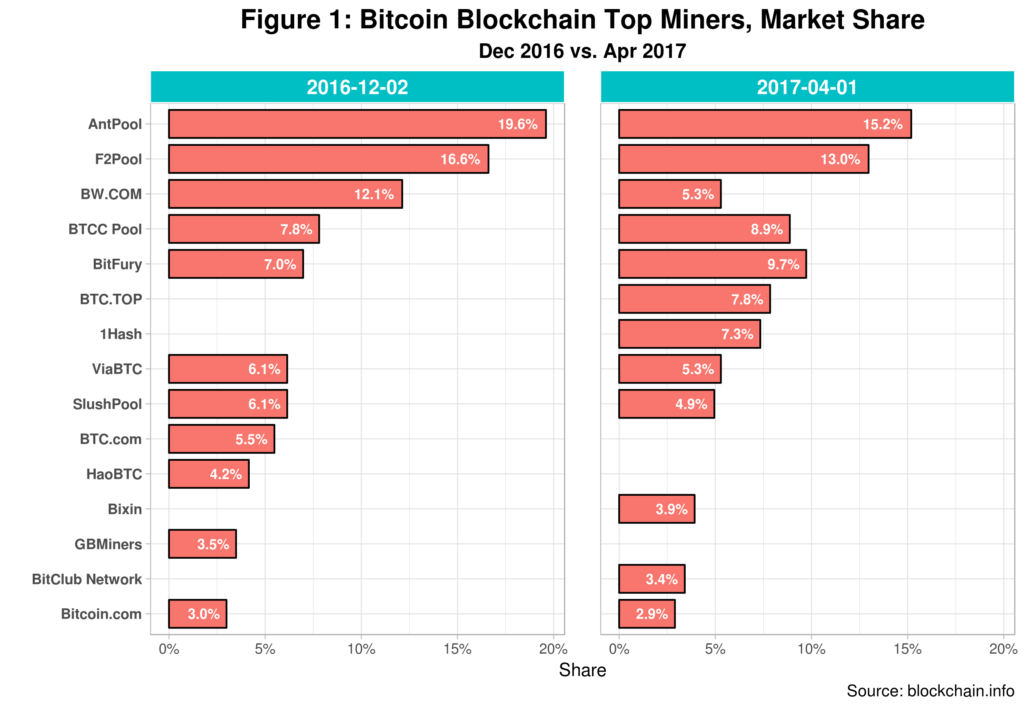

Recent data I compiled for December 2016 and April 2017 suggests a similar pattern.13 So far, I have had no success in compiling reliable historical data for Bitcoin miners but will persist in this endeavor until something clicks. Graph 1 below presents such data.

In effect, we see new players coming into the fray while a few others have disappeared from the top 10. Even more interesting is that the top three mining pools14 A description and comparison of the various mining pools can be found here. that were leading in early December have lost market share by early April, almost 15% altogether. While the top two mining pools are still in the lead, the one ranked third in December has lost more than half of its market share and fallen out of the top five.

In effect, we see new players coming into the fray while a few others have disappeared from the top 10. Even more interesting is that the top three mining pools14 A description and comparison of the various mining pools can be found here. that were leading in early December have lost market share by early April, almost 15% altogether. While the top two mining pools are still in the lead, the one ranked third in December has lost more than half of its market share and fallen out of the top five.

Intense mining competition is thus much alive – and kicking some pools very hard too. Besides, top miners are now sitting farther down farther the ladder vis-à-vis the dreaded 51% market share. This seems to suggest a slowdown in the centralization process. Only a few pools will survive the intense competition process embedded in the PoW blockchain mining process in the long run.

Clustering pools by market share can shed more insights here. In early December of last year, the top five miners had 63.1% of the market. By early April of this year, this figure was down to 54.6%, a 13.4% decrease. Data found in this post shows that in July 2016, the top five pools controlled 61.7 % of the market. This suggests that the top five, regardless of changes at the top, control more than 50% of the mining market.15 More data is needed to further support this assertion. What about all other miners?

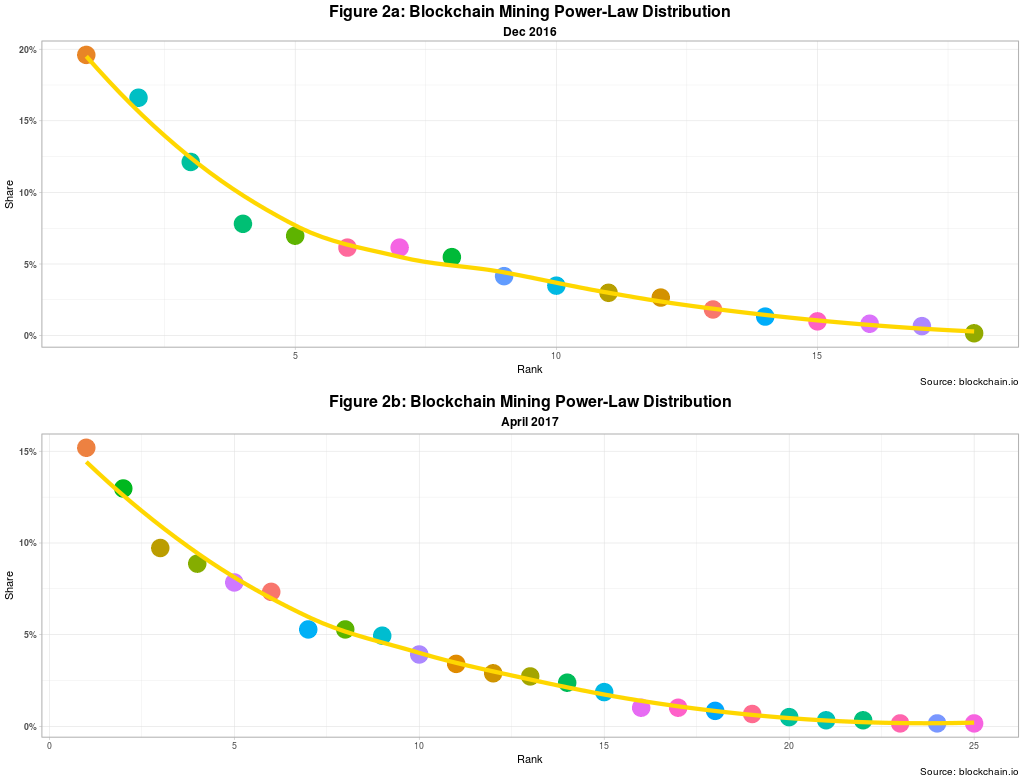

Figures 2a and 2b below depict the overall picture, based on data available that does not include each and every Bitcoin blockchain miner.16 In the graphs, a dot represents one mining pool.

While we have more data points for April, the trend in both cases is the same. In April this year, for example, 68% of all miners had a market share below 5% with an average of 1.61% share per pool.17 I also did an analysis of Ethereum’s blockchain mining and obtained similar overall results and trends. Bear in mind that Ethereum’s blockchain ecosystem is much smaller than that of Bitcoin. Ethereum also plans to move to proof-of-stake soon to avoid some of these trends.

Market share is directly related to pool income per block successfully mined. So we can use it as a proxy for mining pool revenues and income inequality. A recent study by the University of Cambridge estimates that Bitcoin blockchain miners have earned over 2 billion dollars since its inception.18 The same study has mining market share data for the four quarters of last year. Here, the top 5 miners control over 70% of the market. See page 90 of the report. And the top 5 miners have probably earned 60%, if not more, of that amount.

PoW blockchain mining revenues follow the so-called power-law distribution where a few nodes get most of the income and the rest get the breadcrumbs. Such distribution is common for the overall Internet economy, where centralization and concentration by a few firms have unexpectedly become one of its main traits. 19 See this article for example.

Wrapping Up

Currently, the Bitcoin community is engaged in a heated discussion on how to address the size limitation of the blocks being added to the chain. Data suggests that there is an increasing number of transactions that are not being processed.20 See here for more information on the above.

Two different and irreconcilable proposals are on the table. And at least one of the camps involved in the discussion is trying to use good-old lobbying to get the largest miners to support its proposal. We also saw an example of how the Bitcoin community addressed mining concentration by undertaking concerted collective action.

This says a lot about the one-CPU-one-vote idea. While it sounds attractive, the facts suggest that humans and not CPUs have the final word when it comes to key governance issues. Thus, there is no such thing as smart governance here – to compare with the notion of smart contracts. What we have is a more decentralized form of governance in a proof-of-concept stage, gingerly taking baby steps. And embedded blockchain mining competition (not to mention Bitcoin exchanges) pushing towards centralization will be more a hindrance than a propeller.

Raúl

Endnotes

| ⇧1 | CPU stands for Central Processing Unit, nowadays also known as a microprocessor. |

|---|---|

| ⇧2 | Needless to say, PoW is not the only algorithm used to add records to a blockchain. Others such as proof-of-stake and proof-of-value, for example, have been developed. |

| ⇧3 | Bitcoins and transaction fees are the main financial rewards sought by miners. |

| ⇧4 | Needless to say, nowadays we can play this game online. |

| ⇧5 | Same goes for the online version of the game, by the way. |

| ⇧6 | To be precise, we are talking about 256 bits here. In CPU speak, one character is equivalent to one byte that comprises 8 bits. The actual length of the number being sought is, therefore, 32 characters. But CPUs can easily manipulate bits. |

| ⇧7 | This number is called a nonce. |

| ⇧8 | This graph nicely summarizes the evolution of mining hardware and associated computing power. |

| ⇧9 | Energy consumption has also dramatically increased over time. That is the subject of a separate post. |

| ⇧10 | See this post for 2015 estimates, which seem to be on the high side. |

| ⇧11 | See the press release here. |

| ⇧12 | A chart depicting this in this post. |

| ⇧13 | So far, I have had no success in compiling reliable historical data for Bitcoin miners but will persist in this endeavor until something clicks. |

| ⇧14 | A description and comparison of the various mining pools can be found here. |

| ⇧15 | More data is needed to further support this assertion. |

| ⇧16 | In the graphs, a dot represents one mining pool. |

| ⇧17 | I also did an analysis of Ethereum’s blockchain mining and obtained similar overall results and trends. Bear in mind that Ethereum’s blockchain ecosystem is much smaller than that of Bitcoin. Ethereum also plans to move to proof-of-stake soon to avoid some of these trends. |

| ⇧18 | The same study has mining market share data for the four quarters of last year. Here, the top 5 miners control over 70% of the market. See page 90 of the report. |

| ⇧19 | See this article for example. |

| ⇧20 | See here for more information on the above. |

Comments

One response to “Blockchain Mining: Competition and (de)Centralization”