A recent article by one of its lead developers argues that Bitcoin, defined as an experiment, has utterly failed. While the initial concept was to develop a form of digital money that was completely decentralized and autonomous from any bank or institution, today, Bitcoin is controlled by a few people. Besides, Bitcoin technology has now reached serious limitations that will prevent it from expanding shortly. Is this really the case?

Created in late 2008, right after the bank bailouts by a still anonymous geek that used a Japanese-like name as an alias, Bitcoin has quickly gone from geekdom to stardom. The number of books published on the subject has grown exponentially since 2014. Simultaneously, banks and other financial institutions are now seriously thinking about adopting blockchain, a core Bitcoin technology. We can also find initiatives that suggest using Bitcoin technologies for electoral processes to enhance trust and transparency. I am sure many other applications of Bitcoin technologies will emerge soon. But most of them might be out of the original purview of Bitcoin’s original developers.

Created in late 2008, right after the bank bailouts by a still anonymous geek that used a Japanese-like name as an alias, Bitcoin has quickly gone from geekdom to stardom. The number of books published on the subject has grown exponentially since 2014. Simultaneously, banks and other financial institutions are now seriously thinking about adopting blockchain, a core Bitcoin technology. We can also find initiatives that suggest using Bitcoin technologies for electoral processes to enhance trust and transparency. I am sure many other applications of Bitcoin technologies will emerge soon. But most of them might be out of the original purview of Bitcoin’s original developers.

Bitcoin is a complex technology but can be described as having four inter-related layers: a peer-to-peer network; advanced public cryptography; a distributed public ledger that constitutes the blockchain; and an algorithm (proof of work) that allows users to “mine” (own!) and use bitcoins.

Here, I want to look at the origins and evolution of Bitcoin and thus will not dwell on any of its complex technical details. I must admit that, while I have reviewed quite a few articles on Bitcoin, I have only read a few books at this point in time. One of them is the book by Nathaniel Popper entitled Digital Gold (full reference at the end of this post) who focuses more on the sociological aspects of Bitcoin’s emergence and ongoing development.

Popper’s goal is to recreate the short but not so brief history of Bitcoin by directly talking to the people who have been directly involved in the process, sans its creator, Satoshi Nakamoto. The author interviewed more than 300 people and was provided access to relevant emails and documents. While the technology behind Bitcoin is briefly explained, the book’s main objective is to detail its evolution starting in early 2009. A brief chapter on 1997 traces the idea of creating a cryptocurrency and serves as a useful background to the book’s main content. The story ends on 21 March 2014, while the book was published in May 2015.

Satoshi’s invention’s basic intent was to remove the trust we place in banks, financial institutions, and the state and instead place it on the network itself, a network that by definition is fully decentralized. This view certainly seems to fit the “libertarian” ideology that has arguably served as a lever to promote several other technology innovations. In any event, Satoshi’s initial proposal had very few takers. Only a couple of (unemployed) geeks picked it up and started to use the technology. By July of 2009 things started to change. The first Bitcoin exchange was launched.

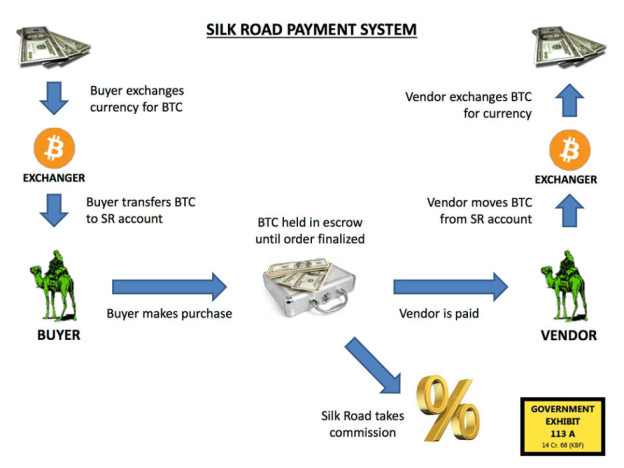

One of the key issues Bitcoin faced in the early years was the ability to use the new cryptocurrency to buy goods and services in the marketplace. As expected, very few serious businesses were willing to accept Bitcoins as a form of payment. At this point, the story of Bitcoin converges with the emergence, evolution and actual demise of Silk Road, the now infamous dark website known for selling illegal drugs online, among other things.

One of the key issues Bitcoin faced in the early years was the ability to use the new cryptocurrency to buy goods and services in the marketplace. As expected, very few serious businesses were willing to accept Bitcoins as a form of payment. At this point, the story of Bitcoin converges with the emergence, evolution and actual demise of Silk Road, the now infamous dark website known for selling illegal drugs online, among other things.

Another big push for the network came from a few selected libertarian millionaires who actively supported it and openly attempted to recruit other individuals with similar wealth or shared similar ideological perspectives. However, wealth proved to be more attractive as Bitcoin value was rapidly increasing over time and many investors saw it as a great opportunity to profit in the short run, including the ex-Facebook Winklevoss twins. And the rest is history, as they say out there.

We can, however, detect the following social components in Bitcoin’s short but complex history:

- A technical innovation based on open-source software created by a geek and initially supported by a very selected geeks group.

- Adopted by other geeks later on who saw it as means to augment their income using advanced technologies to mine the maximum number of Bitcoins possible and try to use them in the actual marketplace.

- Harnessed by tech entrepreneurs who detected an opportunity to create centralized Bitcoin exchanges to facilitate its use and make money as intermediaries.

- Adopted by a few web entrepreneurs that perceived Bitcoin to avoid state oversight to sell their products online. These small set of entrepreneurs had little interest in the actual technology or its libertarian ideology.

- An initial small number of libertarian millionaires saw it as a way of spreading their anti-government ideology while creating new wealth.

- Traditional venture capital and investors saw it as a very profitable business opportunity.

We clearly see a pattern where innovation created in the global network’s fringes is constantly pushed by different social forces towards the mainstream and, in the process, losing most of its initial intent and objectives. In this light, we will have to conclude that Bitcoin has not failed. Rather, it is now transcended its original purpose: Many of its actual applications might go well beyond what its creator originally envisaged. But that, on the other hand, should not surprise us.

The question here is if this pattern is unique to Bitcoin. A quick answer here should be negative if we agree with Tim Wu’s arguments presented in his book, The Master Switch.

Cheers, Raúl

Popper, Nathaniel. 2015. Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money. New York: HarperCollins. ISBN: 978-0062362490.