Connecting to the Internet in 1994, the year Amazon was founded, was certainly not a walk in the park. For starters, the number of access providers could be easily counted. Accessing the emerging network of networks from home required a computer, a modem, an RS-232 compatible cable, supporting software, and an additional phone line, depending on the number of home phone users. For average end users, handling all that could become a long nightmare. Besides, while the Web was poised to explode with the 1993 release of the Mosaic web browser, navigation was still not a common practice.

I loved the screeching noise the modem made while connecting to its peer on the provider’s side. Called a handshake, the device simply converted a digital signal from the computer to analog for transmission, then converted it back to digital at the other end before ceasing. Only on rare occasions did the connection fail. Nowadays, dial-up Internet access is a rarity. The modulation/demodulation (modem) music is a relic of the past. In any case, that was the setup I used to make my first-ever online purchase. Perhaps I should now brag that the now massive Amazon was not its source, as mentioned in a previous post.

Contrary to Google and Facebook, we all know precisely what Amazon sells. Most likely, many have purchased something there at least once, especially in the Global North. In 2004, the company’s 10-K SEC report stated its raison d’être:

“We seek to offer Earth’s Biggest Selection and to be Earth’s most customer-centric company, where customers can find and discover anything they may want to buy. We endeavor to offer our customers the lowest possible prices… we enable businesses and individuals to sell virtually anything to Amazon.com’s millions of customers. We and other sellers offer millions of new, used, refurbished, and collectible items…”

Imperial ambitions aside, actual goals are decidedly unveiled. To create a massive two-sided retail trade digital market that delivers goods and services to customers living in traditional or one-sided markets. This entails the now familiar practice of disintermediating analog markets by creating a centralized digital platform that harvests digital intermediaries, both old and new, now operating under its control. The latter, in turn, are charged a gamut of fees for the services Amazon provides. Visit Amazon Seller Central and click on the pricing tab for details. There are many options available, but please note that there are no freebies. At any rate, such a scenario is strikingly similar to the advertising model employed by Google and Facebook to generate substantial profits. Except here, sellers must ensure that their tangible products are indeed bought, delivered, and consumed (or returned) by clients, with fees accruing all over.

Offering “Earth’s Biggest Selection” required significant investments in digital technologies and infrastructure, where customers could browse an infinite number of online products. In a nutshell, a data center with powerful applications capable of displaying products accurately and successfully handling millions of requests. Back in 2004, AWS was not in the picture. Indeed, it was not even mentioned in the SEC report. But Amazon soon developed technologies that allow it to lease digital infrastructure capacity to interested customers as a value-added service. It is therefore not a coincidence that Amazon was the first Big Tech company to offer cloud services. Google and Microsoft were already behind at that point. Indeed, AWS is a two-sided market connecting developers and companies with service providers. It thus ends up strengthening the company’s core goal of relentlessly enhancing digital retail trade globally.

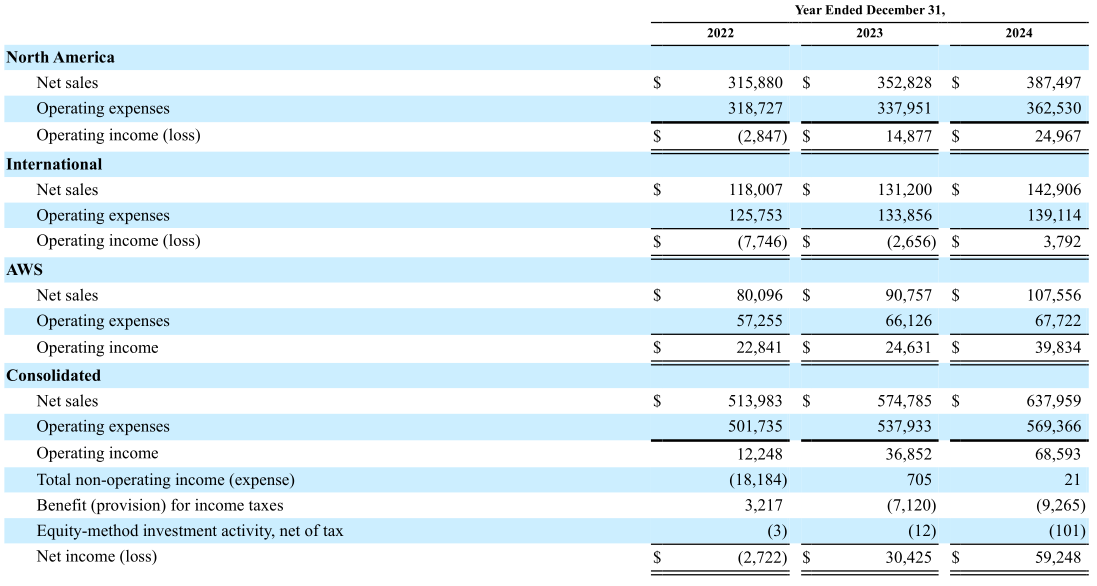

Amazon’s corporate goals have slightly changed, according to the 2024 annual SEC report. While the “most customer-centric company” target has endured, the company now identifies four key principles: 1. Customer obsession. 2. Invention passion. 3. Operational excellence. 4. Long-term thinking. Elucidation of such principles is nowhere to be found, though. Imaginations are welcome to fly high here. The company operates in three segments, as depicted in the table below, which is taken from the report. Numbers are in millions. North America includes the US, Canada, and Mexico.

North America accounts for 61 percent of all sales, followed by the International segment with 22 percent. While AWS is last here, it is the fastest-growing segment, reporting a 19 percent sales increase. Moreover, AWS accounts for almost 68 percent of the company’s 2024 operating income. AWS might be the secret to Amazon’s success, as it serves both internal technology needs, which are not nimble, and external clients leasing computing capacity. Cross-subsidies are a distinct possibility here. Not surprisingly, the company is now planning to invest an additional 100 billion USD to expand cloud capacity and mainstream AI.

AWS continues to lead the cloud market with a 31 percent share, albeit Microsoft Azure seems to be catching up (22%). Google is still a distant third with 12 percent. Data suggests intense competition among players is clearly at work. And disruption is a distinct possibility. The emergence of GenAI and Agentic AI will only accelerate cloud competitive rivalries. The fact that a relatively small number of companies are in such a market does not necessarily mean a cloud cartel is alive and kicking, as proposed by some researchers.

Net sales data show that online stores account for 39 percent of revenues. Third-party seller services come in second with 25 percent, followed by AWS with 17 percent. Note that advertising and subscriptions are minor players, each reporting less than 10 percent of total revenue generation. Even so, each report revenues above 40 billion USD. Estimates indicate Amazon ranks third with a 10 percent share in the global digital advertising market, trailing behind Google and Meta by double digits.

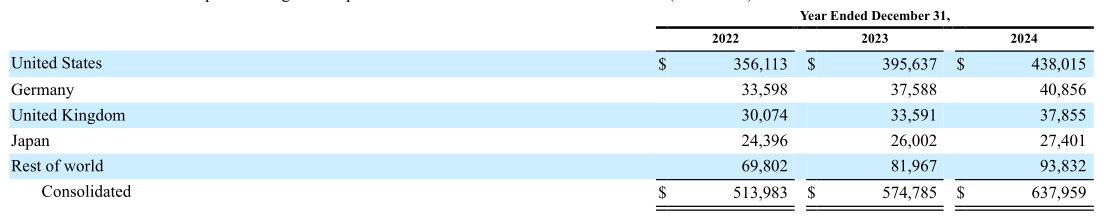

Net sales by country are depicted in the table below.

The US is the top performer, accounting for 69 percent of all net sales. The rest of the world accounts for 15 percent, but the report does not provide details on country sources. Regardless, outfits such as Jumia in Africa and Mercado Libre in Latin America have been able to gain market shares and even thrive in some countries.

Amazon argues that it faces competition in ten markets, namely 1. Retail merchandise. 2. Media, all types. 3. Digital intermediaries. 4. E-commerce providers. 5. Logistics. 6. Cloud et al. 7. Device manufacturers. 8. Groceries, online and off. 9. Advertising. And 10. Healthcare services. If anything, such a list does indeed tell us the markets in which the company is operating. And it has gained access to some of them through mergers and acquisitions without being challenged by competition authorities — a pattern familiar to the other four Big Tech members.

Also note that in many of these ventures, Amazon utilizes two-sided markets to sell products and services to customers in regular markets, that is, the old-fashioned way. It cannot escape the tangible, analog world. Amazon thus has a distinct personality among Big Tech peers. Compared to Google and Facebook, it cannot fully digitize its core business, selling “Earth’s Biggest Selection” to customers, which entails putting products in their hands for final consumption (or rejection). It is essentially a traditional merchant using digital technologies and two-sided markets to expand its selling universe. Amazon employs over 1.5 million people globally, a number that is almost ten times larger than that of most other Big Tech companies. It must also invest heavily in distribution or fulfillment centers to bring merchandise closer to consumers. According to unofficial data, Amazon operates over 1,000 such centers, most of which are located on leased land. That, in addition to the over 100 data centers it manages worldwide.

Raul