As the EU Digital Markets Act (DMA) acknowledges, Google operates in various markets, including operating systems, devices, email, browsers, broadcasting, cloud services, mobile apps, advertising, and search. In some cases, such as search engines and mobile operating systems provided for “free,” the company has disproportionate world market shares (90 and 73 percent, respectively), thus attracting regulators’ attention. Regardless, labeling the company under a rubric other than “platform,” which I have previously defined as a multi-sided market company, seems complicated. Google thus resembles a glass octopus with bright yellow arms embracing many markets while showcasing its brain with almost perfect transparency. What is driving the yellowish cephalopod? What is the hunger-trigger mechanism?

The answer can be quickly found in corporate reports, not academic papers. The previous post shows that advertising is by far the company’s core source of revenue and income. Subscriptions, consumption-based cloud fees, and sales of apps, devices, and health and transportation technology comprise the rest—albeit with investments in the latter reported to have resulted in nearly a $ 5 billion loss in 2024. Indeed, over the last 20 years, Google has been trying hard to diversify its business, much like high-income countries that primarily rely on fossil fuels and are now seeing the writing on the wall.

The latest 2024 K-10 SEC Google report directly responds to the question, “How do we make money?”

“We have built world-class advertising technologies for advertisers, agencies, and publishers to power their digital marketing businesses … by serving the right ads at the right time and by building deep partnerships with brands and agencies. AI has been foundational to our advertising business for more than a decade … to help advertisers find untapped and incremental conversion opportunities. Google Services generates revenues primarily by delivering both performance and brand advertising that appears on Google Search & other properties, YouTube, and Google Network partners’ properties (“Google Network properties”). We continue to invest in both performance and brand advertising and seek to improve the measurability of advertising so advertisers understand the effectiveness of their campaigns.”

Advertising-driven technology innovation is what drives the glass octopus. It has two key ingredients: first, state-of-the-art digital advertising technologies that ensure its core services can generate revenue while being used for free. Second, rapid technology innovation that supports the core advertising model. Take the example of “foundational” AI, mentioned in the above quote. AI innovations have been essentially propelled by the drive to improve the advertising model and attract more business and eyeballs, not just for the sake of AI or innovation alone. Perhaps that is why Google fell asleep at the wheel after creating the AI Transformer model in 2017, which was later used and refined by OpenAI to launch its now-famous 2 22 LLM. Recall also the dumbfounding number of products and innovations the company has killed off in the last 15 years or so.

Today, OpenAI and others are seriously challenging Google’s dominance, including its web search, a signature product, for the first time. The company reveals that much in the SEC report without naming names. Moreover, Google’s impact on the advertising market has been astounding. It has essentially created a digital advertisement monopoly while eroding the revenue of traditional content providers that heavily depended on advertising revenues. The disintermediation of analog markets is followed by their centralization under a single entity that can create new intermediaries within its purview. That is how Google (and others) work.

In any case, SEC annual reports are substantially rich and should be carefully studied by Big Tech researchers. Sections on competition and risks offer invaluable insights that could help clarify concepts such as “intellectual monopoly capitalism” or “techno-feudalism,” the latter being the weirdest I have heard so far. Intense competition among a few firms and accelerated super-profits maximization, the core driver of good-old capitalism, permeates these reports. Feudal lords would have none of this.

Meta/Facebook (FB) closely follows the Google advertising model but has significantly improved it. First, it enclosed the digital space by requiring users to authenticate. Indeed, all are welcome if they first knock on the door and provide identification to gain entry at no cost, of course. FB would be part of the private, permissioned team if it were a blockchain. Enclosing the digital realm gave FB a clear competitive advantage over Google by limiting the usability of the latter’s technologies, including web search. Second, the digital enclosure led to the emergence of detailed personal profiles containing a wide range of data, information, and user preferences that advertisers could use to laser-focus ads on a nearly global consumer base. The company claims to have had an average of 3.35 billion daily users by the end of 2024 (SEC 2024 report). That is an unprecedented market size for any business seeking airtime for its services.

Obviously, web search is not FB’s signature service. So what does the company produce then? Let us hear it from the horse’s mouth:

“We build technology that helps people connect and share, find and build communities, and grow businesses. Our products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) and mixed reality (MR) headsets, augmented reality (AR), and wearables … Our vision does not center on any single product, but rather an entire ecosystem of experiences, devices, and new technologies … Our AI investments support initiatives across our products and services, helping power the systems that rank content in our apps, our discovery engine that recommends relevant content, the tools advertisers use to reach customers, the development of new generative AI experiences, and the tools that make our product development more efficient and productive.”

In other words, it is a two-sided market that connects individuals who can find, connect with, engage, and share with others, ranging from long-forgotten childhood friends and bullies to new acquaintances and trolls. It is thus a private digital social network. As is well-known, in 2021, the company decided to focus more deeply on the virtual reality business. This entirely different market can undoubtedly benefit from the sheer number of users navigating the enclosed digital space. However, such a new business requires producing new hardware and software, a line of business with its own internal dynamics, with which FB has little experience. Given the intense competition in the digital advertising market, where Google is well ahead of Facebook, the organization is also trying to diversify its investment portfolio. It is not going well, as such investments reported 2024 losses of almost 18 billion dollars, similar to the company’s revenues in China, despite not being officially active in that country!

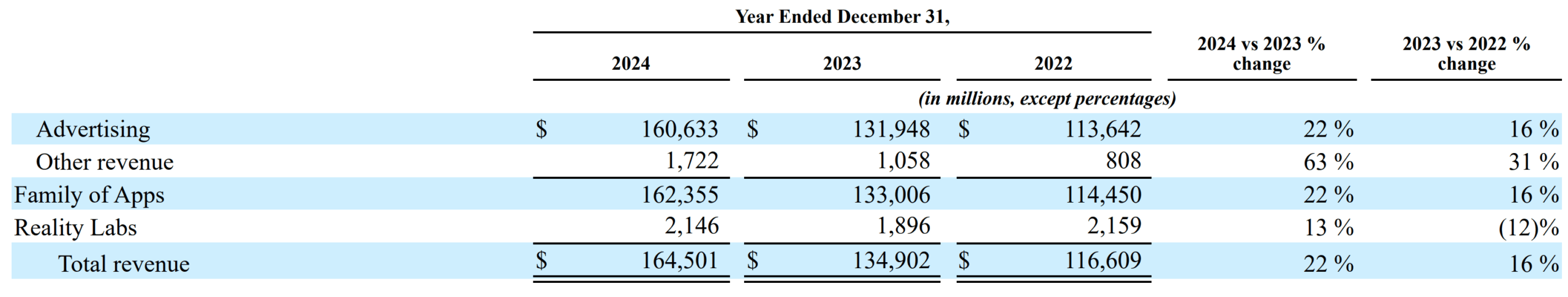

Like Google in its early years, FB makes most of its money from advertisements, as shown in the table below, taken from the latest Annual SEC report.

The so-called Family of Apps (FoA) includes Facebook, Instagram, Messenger, Threads, and WhatsApp. Advertising generated 98 percent of all 2024 revenue. Perhaps more interesting are the geographical sources of such revenues. Last year, 61.6 percent came from Asia Pacific (27.4%), Europe (23.3%, including Turkey and Russia), and the Rest of the World (10.9%; includes Africa, LAC and the Middle East) together. The US and Canada accounted for the rest. Note also that FB China’s revenue is larger than that of the “rest of the world,” comprising 40 percent of the Asia Pacific market, the fastest-growing market in the last few years. FB also reported that the average revenue per person for FoA in 2024 was 49.63 USD, an increase of 15 percent from the previous year. Note that Meta’s revenue is less than half that of Google.

Indeed, Meta’s priorities have been well identified, despite the dismal start of Reality Labs. In the Annual SEC 2024 report, for example, the words “advertising/advertisers” appear over 200 times, while “technology/technologies” appear less than 100 times. Furthermore, while Google indeed operates in different and multiple markets, that does not mean competition with Facebook is not intense. Since both make a living from ads, any disruption to this market can threaten their existence. A good example today is OpenAI and other AI-centered companies that could make that a reality, although they are currently focused on subscription models and consumption-based API revenues. SEC reports from both companies discuss this ad nauseam. They cannot afford to be too complacent.

While Google and Meta share a similar business model running on very different technological platforms, they are not the same. Competition between them is real, albeit not in all markets in which they operate. And yet, they are very different from the other Big Tech members, such as Apple or Microsoft, as we will see next.

Raul