In the early 1980s, when Apple was still an underdog facing stiff competition from larger and well-established tech companies, it masterfully used mass advertising to challenge their dominance. TV and paper news media were the only options available at the time. Perhaps Apple’s most famous ad was 1984, launched in 1983, announcing the upcoming Macintosh computer. It deployed Orwell’s well-known argument to target big tech companies that, in its view, behaved like authoritarian leaders. It surely drew inspiration from the then-ongoing Cold War 1.0 and posited the new computer as a means to liberate oppressed users. Liberation day claims we hear yet again nowadays are thus old-fashioned. Regardless, the ad was undoubtedly disruptive in content and had a substantial impact. Several other successful advertising campaigns soon followed. The irony is that today, we could deploy the 1984 Orwellian ad metaphor to characterize Apple and its Big Tech peers.

I first visited the Apple Cupertino headquarters in early Spring 1996. The previous year, an Indian-American Apple senior manager who worked in the Advanced Technology Group and was interested in development work had contacted UNDP to explore potential partnerships. After many emails and not-so-cheap telephone calls, we got an invitation for a two-day visit. We met with the VP and Chief Scientist, who, at the end of the visit, suggested Apple had a few spare computers and servers that could support our Internet-related project. Steve Cisler informed us that the company had deployed a few Newtons in a poor community in India to help health workers collect much-needed data. One of the core objectives of our project was to utilize Open Source software. Apple informed us that they were porting Linux to Mac and PowerPC-based architectures. Indeed, MkLinux was officially released a couple of months later. Once I returned to New York, I read the news about Apple’s dire financial situation, expecting to lose over 700 million (1.4 billion today) USD. I was floored.

The company quickly shipped a 9150 workgroup server for us to test. However, the server did not come with a monitor or keyboard, so we had to wait a few more days to install it. Another surprise was the server’s proprietary Ethernet port, which refused to accept the regular RJ45 connector. I also received an early version of MkLinux on CD, which we eventually installed without any major headaches. By the end of the year, we were ready to ship the server to one of the project countries. Our China operation had requested an Apple server, so we asked the company for endorsement. It landed there safely in early 1997. A few months later, Jobs became CEO again and changed Apple forever. All the stuff on openness and development was stopped in its tracks, and most of our contacts left the company. By the end of the Millennium, the company had invested millions in China to outsource hardware production, reduce costs and maximize profits.

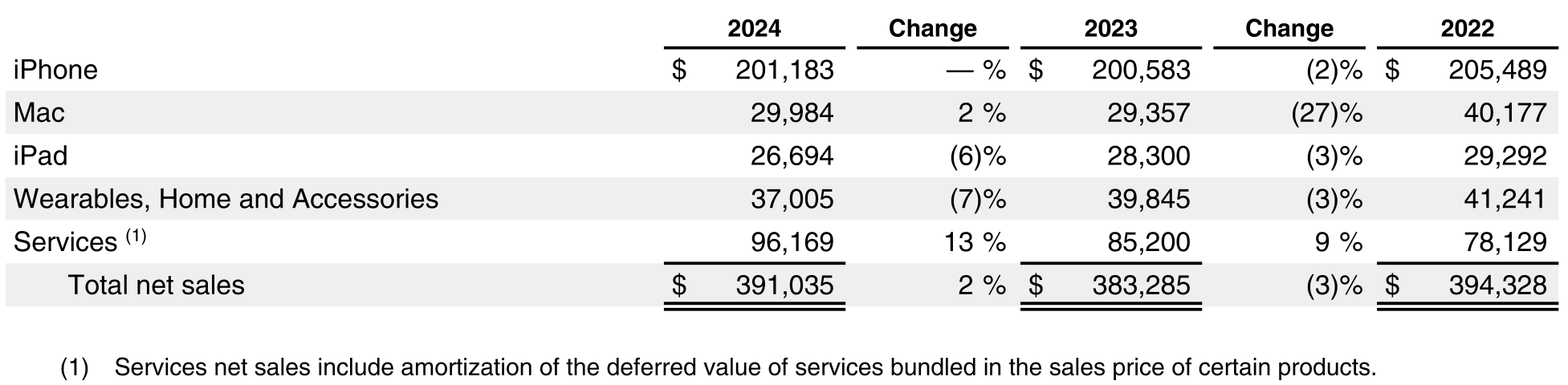

As the story above illustrates, there is no doubt about Apple’s core business model. Apple manufactures hardware and develops matching software and apps, earning money the old-fashioned way. What is different today from the mid-1990s is the type of hardware and software it now produces, as shown in the table below (taken from the SEC 10-K 2024 annual report).

That is right. iPhone sales account for 51.4 percent of total revenues, followed by services with 24.6 percent. Services include iCloud, the App Store, AppleCare, Apple Pay, Apple Card, and Apple subscriptions and advertising, which is less disruptive than in the early years. Almost 20 percent of total services revenue comes from what Google pays Apple annually to be the default search engine on its devices. Services have experienced the most significant revenue gains since 2022 (21 percent increase). The company reports a 74 percent gross margin for this rubric, while the corresponding number for products is half that. I am sure the former is overestimated, thanks to Google’s payments, which cost Apple nothing.

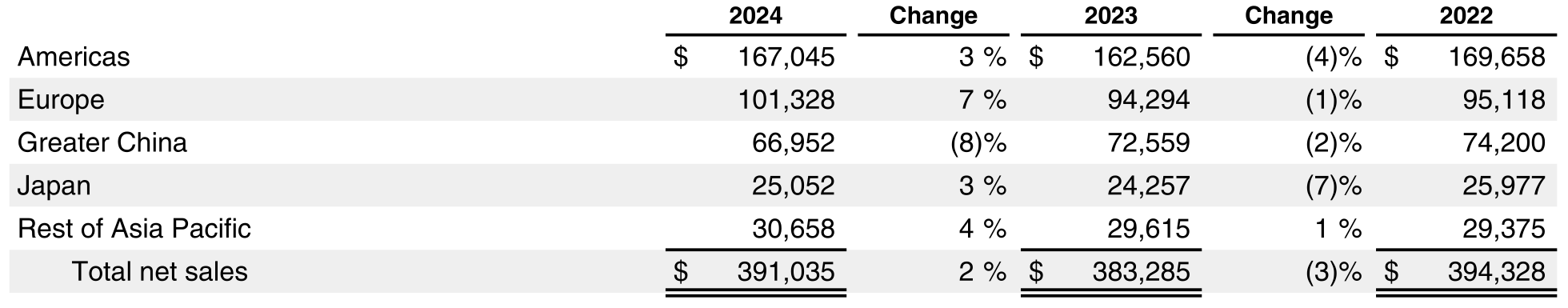

Revenues by region also exhibit a distinct trend, as shown in the table below (from the same source).

While the Americas are the largest market (the US comprising around 85 percent, according to informal estimates), 57.3 percent of all revenues are generated in the other regions. Note that Europe includes Africa, India, and the Middle East. I have no idea where these companies studied geography, if at all. In any case, comparisons with China are unsuitable given the odd worldview. Moreover, revenues from the latter declined 10 percent in nominal terms since 2022. Expect more to come this year.

Unlike Google or Facebook, Apple is more exposed to the roller-coaster of tariff wars. In any case, Apple’s production structure radically differs. It must sell what it produces and cannot rely solely on advertising income, no matter how hard it tries. Indeed, its core products cannot be digitized. They are tangible objects containing a significant amount of digital content. Still, they have real costs per unit that can benefit from further productivity increases and the deployment of AI and robotics. However, they will never be freely available like Google search or Facebook’s social networking.

On the other hand, Apple is not just another hardware/software maker. It has also been capable of creating its own private, enclosed domain by bypassing technical standards and interoperability, refusing to license its hardware and software, and developing proprietary interfaces and accessories. It also offers a range of services exclusively for Apple users. The fact that I could not use the standard Ethernet wire to hook up the old Apple server to the corporate network was no accident. It was part of a corporate strategy. At any rate, such an approach sounds much like the early Facebook, but on an entirely different domain.

The company has also established a strong brand, where users serve as its best salespeople and evangelists. While I have never used or bought an Apple product, I know many who have and are ready to fight tooth and nail to defend the company. I frequently experienced this in the 80s and 90s. Again, in the early 2010s, when UN colleagues were making plans to wake up early and stand in long queues to purchase the latest iPhone about to be released. Go figure. Many, including some of the employees I met, say they agree with the company’s philosophy. I regularly asked them to outline such a philosophy. Endless discussions frequently ensued. I would like to point out that philosophy and ideology are not entirely the same thing. Not even close.

In any event, we are starting to detect degrees of similarity and differences among Big Tech companies. First, Apple’s signature product, the iPhone, cannot be classified as a two-sided market or platform. However, some of its services, such as the App Store and others, perfectly fit the concept. Let us not forget that Apple is over two decades older than Google and Facebook, founded when the Internet was still in the labs. Second, and as mentioned before, production structures differ among them, especially in Apple’s case, as it depends on manufacturing devices. Note that the other two are also in the hardware/software business, but such activities complement or supplement the core business model and products. Third, they all venture into other markets and areas to support and enhance signature products or services, while trying to be ahead of potential competitors and innovators. When they assess that they might fall behind, they regularly neutralize the underlying risks via mergers and acquisitions, where cash does not seem to be a problem.

While Google and Facebook utilize one-sided markets to strengthen their multi-sided market ecosystems and signature products, Apple does the exact opposite to entrench its tangible products in traditional markets. Yet, they all compete against each other, as unexpected innovations could have devastating consequences. LLMs and Agentic AI might be the new Trojan horses. And all are rapidly embracing them. They have no other choice.

Raul