That the EU is well ahead of the rest of the world regarding digital technology regulation is not under dispute . The recent agreement on AI regulation provides further evidence of its leadership . A more interesting question is why the Union has not been able to give birth to digital platforms and companies that can successfully compete with Big Tech and its Chinese counterparts.

While the answer might be complex and vary according to economic ideology, the EU shares with most of the world that external agents primarily develop and host the most widely used digital technologies and platforms. That has both economic and legal implications. In any event, Global South countries can certainly take a page (or more) from the EU’s regulatory efforts, without forgetting to factor in their own local context and specificities, quite different from those in the Union.

Not surprisingly, researchers and pundits have noted that the EU’s recent regulatory push is one of the first steps to change the situation . Indeed, the DSA was a first, albeit timid, step in that direction. However, the heavy lifting is actually being done by the Digital Markets Act (DMA) , which directly targets competition barriers and pitfalls. Before taking a DMA dive, we should quickly revisit competition theory.

Simplifying for the sake of argument, three core competition approaches are at the disposal of policymakers and regulators.

1. Antitrust. Emerged in the 1890s as a response to the market domination by US trusts and cartels at the height of the first Gilded Age. It usually has three components: 1. Supervising firm market power and abuse. 2. Preventing anti-competitive agreements between companies. And 3. Overseeing corporate mergers and acquisitions . The 1890 Sherman Antitrust Act and the 1914 Clayton Antitrust Act are widely known and have served as models for most other countries.

2. Consumer Welfare . Spearheaded by the Chicago School in the 1980s, this approach argues that efficiency and consumer benefits should be the main drivers of competition law, in contrast with the above. In this view, quasi-monopolies might reduce prices and foster innovation while enhancing consumer welfare with its offerings. Benevolent monopolies are thus viable, just as benevolent dictators are. This approach has dominated US regulatory efforts (or lack thereof) since then. But the times they are a-changin’, apparently.

3. Technological Market Power. In this relatively new perspective, digital companies are driven by innovations they have created and thus do not necessarily spread within or between sectors. Owning such innovations gives them a tremendous competitive advantage, enabling them to increase their market power, particularly when patents are issued and complementary technologies are also patented. Entry barriers become almost insurmountable, thus reducing potential competition to a minimum. Regulation is the only way to prevent such developments .

The DMA embraces classical antitrust principles and focuses on the market power and potential abuse by large digital platforms. Its goals are clear: preserving the Union’s market competitiveness and fairness and preventing market fragmentation. Both are considered stepping stones to drive EU innovation and propel the emergence of a resilient tech sector. Large platforms are targeted because they can have the most resounding impact across the EU via information creation, dissemination, and sharing. The DMA calls them “gatekeepers, which are defined as having an annual turnover of 7.5 billion Euros or more and having at least 45 million active users (or 10% of the EU’s population) and ten thousand active users.

Compared to the DSA, the DMA provides a more nuanced view of the types of online platforms that could be classified as gatekeepers. It includes all DSA’s hosting ISPs, but also adds those dealing with video-sharing, operating systems, browsers, interpersonal communications, virtual assistants, and online advertising. As a result, “mere conduit” and “catching” services drop out of contention.

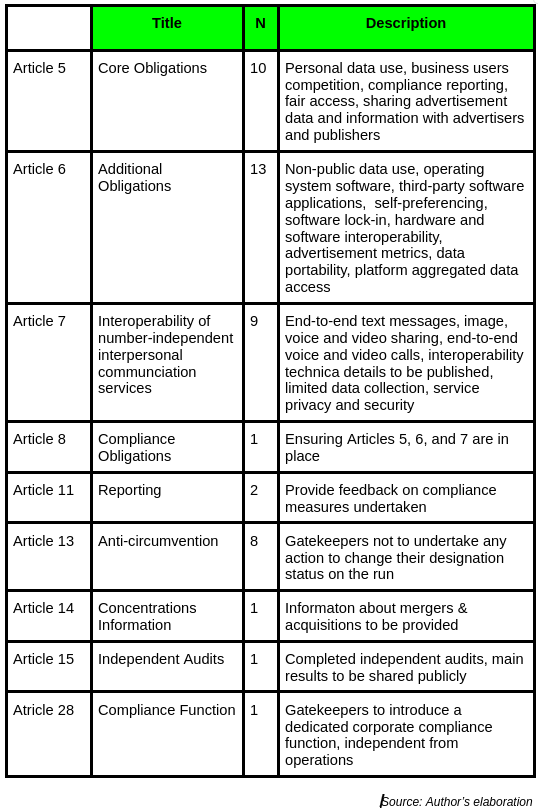

DMA’s core obligations are divided into two categories. The first set comprises self-executing regulations comprising ten overall obligations, including the use, reuse, and cross-use of business users’ nonpublic data; preventing gatekeepers from forcing users and businesses to use a service or sign up for an offering as a condition of platform access; and enhancing transparency rules for advertisers and publishers.

The second group includes 13 obligations that the European Commission, designated to implement the Act, can revisit and revise later, depending on the degree of gatekeepers’ regulatory compliance. Data and software portability, and hardware and platform interoperability, play a prominent role here, allowing users and businesses to avoid lock-in and move freely across platforms. App stores, devices, operating systems and browsers are also part of the package.

Interoperability between interpersonal communication services is subject to its own regulatory requirements, including nine new obligations. Compliance reporting, independent audits and possible market concentration are also stipulated, adding seven more obligations to the list. Eight anti-circumvention measures are also spelled out.

Overall, gatekeepers must comply with 46 DMA obligations. Table 3 provides a bird’s-eye view of these obligations.

The European Commission has already identified the gatekeepers operating within the EU single market. The list includes six companies, eight markets and 22 operators. Recall that large digital platforms simultaneously operate in multiple double-sided markets. The DMA leaves out seven companies that the DSA classified as VLOPs, i.e., Alibaba, Booking.com, Pinterest, Snapchat, Twitter, Wikipedia and Zalando) but adds more markets to its regulatory scalpel. And only Google Search is included, leaving Bing off the hit list.

Expectedly, debate on the DMA’s effectiveness has already started , albeit it is still early days. Some say it goes too far, while others argue the opposite. A common U.S. criticism is the alleged “targeting” of U.S. companies. Indeed, five of the six firms classified as gatekeepers by the EC are from the US. But that seems incoherent, as such a designation shows the success of such firms in a rich market like the EU while implicitly suggesting Europe’s failure to compete at that level. That is precisely why the DMA was enacted!

However, will the DMA trigger an innovation wave in the EU? I do not have a complete answer, but it seems to me that the DMA is just one step. Many more might be needed. Europe should not fall asleep at the wheel now if it wants a digital sector that can compete with the beasts nurtured in other geographies.

Raúl

References