I have previously argued that Big Tech companies with unbreakable ties to the real economy are more prone to incessant competition from both incumbents and non-incumbents. Apple and Amazon’s signature products are the best examples here. Take the iPhone. It not only has to deal with the Android caterpillar globally but also faces formidable competition from Samsung and Xiaomi, among others. While Apple has the largest market share in the US (around 60 percent), its lead on a global scale is relatively small. Moreover, in Africa and Latin America, Apple’s devices are minor players at best. I am sure cost and pricing play a key role here.

One way researchers can corroborate digital companies’ ties to the real economy is by checking industrial code classifications available for the US (NAICS & SIC) and the European Union (EU, NACE). Indeed, whereas Google, Meta, and Microsoft are part of the Information sector under NAICS, Apple appears under Manufacturing, while Amazon falls under Retail Trade. Another advantage of consulting such classification schemes is that these companies have multiple industrial codes, which immediately reveal the markets where they are active. Indeed, Apple also has a footing in the Information sector under the rubrics of software publisher, custom computer programming services, computer systems design services, and all other information services. Once again, we see how two-sided markets are positioned to support Apple’s signature analog product.

Amazon has a similar profile. Just like Apple, its core markets are North America and the EU. Entering other regions where income levels are relatively low may not be attractive to the company, as investment costs, which include obligatory brick-and-mortar operations, might not yield average profits. At the same time, local social and political risks may be too high. That opens the door for regional players from the Global South to enter the fray. And that is precisely what has happened. Jumia, Mercado Libre, and Flipkart are great examples, albeit Walmart acquired a majority stake in the latter back in 2018. Here, I will closely examine Mercado Libre (“Free Market” in English).

Established in 1999, Mercado Libre (MeLi) has since grown by leaps and bounds. An overview of its history can be found here. Briefly, an upper-class Argentine male attends Stanford to pursue his MBA during the first Internet boom. eBay and Amazon are already shining, while the dot-com boom is ballooning out of control. His idea is to replicate them in the region. MeLi was then incorporated in Delaware (not Buenos Aires). In 2007, it launched a successful IPO, raising approximately 290 million (or 439 million in 2024 dollars). Compare that to Amazon’s IPO, which took place a decade earlier and raised “only” 50 million (approximately 97 million in 2024 dollars). MeLi’s corporate headquarters are now in the WTC Free Zone of Montevideo. Questions about local taxes should not even be raised.

From a research perspective, the fact that MeLi is incorporated in the US and listed on the NASDAQ means that the company is required to file quarterly and annual SEC reports. Since the company is frequently referred to as the “Amazon of Latin America,” we can use the latest SEC 10-K report to examine such a comparison. So what exactly is MeLi’s core business?

“MercadoLibre, Inc. … is the leading online commerce and fintech ecosystem in Latin America. Our e-commerce platform is the leader in the region based on gross merchandise volume (“GMV”), and our fintech platform is the leader in monthly active users (“MAUs”) among fintech companies in Argentina, Chile and Mexico, and the second largest in Brazil. Mercado Libre’s e-commerce platform is present in 18 countries … and our fintech platform, Mercado Pago, is present in 8 countries… Our ecosystem provides consumers and merchants with a complete portfolio of services to enable buying and selling online and the processing of payments online and offline, as well as offering a wide array of simple day-to-day financial services. We offer our users an ecosystem of integrated e-commerce and digital financial services, which includes: the Mercado Libre Marketplace, the MercadoPago fintech platform, the Mercado Envios logistics service, the Mercado Ads solution and the Mercado Libre Classifieds service.”

Off the bat, we can gather that MeLi has a somewhat different personality from Amazon’s. Indeed, it thrives in two distinct yet interconnected markets: online retail trade and fintech. The former is quite similar to Amazon, as it includes an online store, third-party sellers, logistics (fulfillment centers and shipping), and advertising. MeLi also launched its version of “Amazon Prime” last year, offering similar perks to its members. A key difference is that MeLi relies mainly on third-party sellers to make most of its retail trade profits. Only recently has it begun selling directly to consumers and has opened a distribution center in Texas to facilitate the process.

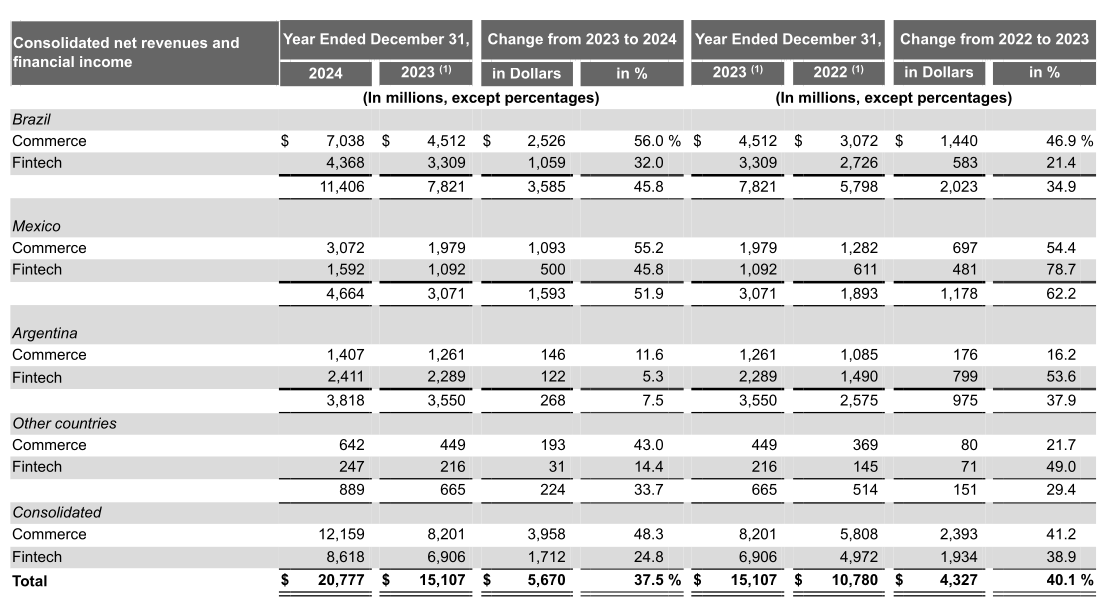

Undoubtedly, Amazon also utilizes fintech to facilitate payments worldwide and has even launched a global remittance service. But that is not part of its core business as such. Indeed, the term “fintech” (or “financial technology”) does not appear in Amazon’s SEC reports, and financial statements do not itemize it. MeLi’s reports are precisely the opposite. Fintech is all over the place in the report. It also contributes a large chunk of the company’s revenues, as shown in the table below (extracted from the 2024 report; click to enlarge).

In 2024, fintech accounted for 42 percent of all revenues, down from 45 percent the previous year. MeLi’s fintech is a comprehensive operation targeting online and offline firms and customers while also facilitating the purchase of crypto assets and coins. It has also launched its own USD-backed stablecoin. I am confident that the company’s fintech arm could survive on its own if the online marketplace were subject to a competitive process that led to a race to the bottom. Bear in mind that fintech competition in the region is also quite dynamic. NuBank, Kavak, and Ualá are worthy competitors that could give Meli Fintech a good run for its money.

The table also displays the actual geographical coverage. While MeLi claims activities in 18 countries for its online retail, we can see that over 95% of its revenues stem from three countries. Brazil is the largest market, accounting for 55 percent of all revenues, and also leads in both retail trade and fintech. Argentina is the only major country where fintech revenues are significantly larger than those of e-commerce. That is probably the result of the country’s economic crisis, characterized by high inflation and exchange rates plummeting at an alarming rate. In any event, here MeLi once again resembles Amazon, whose revenues also come from a few high-income countries.

Any service resembling AWS or cloud computing provided by the company is conspicuously absent from the reports. Instead, we learn that the technological infrastructure now relies on AWS and Google Cloud. The company started using AWS in 2015, but it was only until 2018 that it fully committed to the cloud provider to enhance optimization, according to company staff. In 2020, AWS became its primary cloud provider, according to corporate press releases. MeLi uses Amazon EC2 (computing), Amazon DynamoDB (databases), Amazon S3 (storage), Amazon EMR (big data) and Amazon SageMaker (data analytics), among others. Note that in 2015, MeLi reported it was licensing technologies from Oracle Corp., SAP AG, Salesforce.com Inc., Microstrategy, Radware, Juniper Networks, Cisco Systems Inc., F5 Networks, and NetApp. Centralizing such a diverse group of vendors made a lot of sense from a business perspective. Rather than paying for software licenses (intellectual monopoly), the company decided to pay for cloud services.

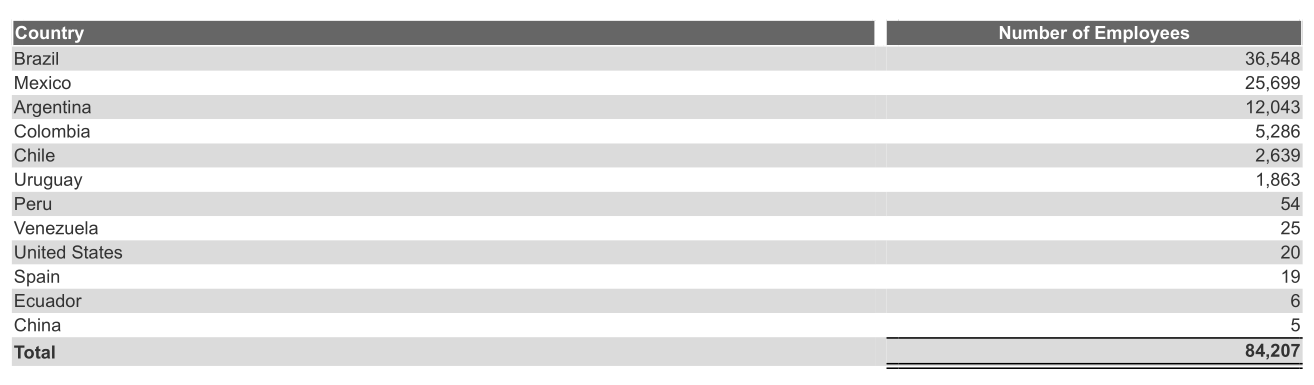

On that basis, MeLi develops its own applications. By the end of 2024, the company had over 18,000 employees working in information technology and product development, reporting a 17 percent increase from the previous year. They work in separate development centers – 17 were cited in the 2021 annual SEC report. MeLi uses open-source software (OSS) but was reluctant to share its code additions with the whole world, as required by many OSS licenses. It has thus become a practitioner of so-called InnerSource, which essentially allows it to adopt OSS but not share new developments with other OSS programmers. MeLi’s new code is thus only available internally. Interestingly, it has also developed a proprietary Platform-as-a-Service (PaaS) product to cater to development teams, supporting application development and Machine Learning models. MeLi is also using GenAI to support such teams via a customized chatbot. The company also built its own data lake running on Amazon S3.

The above tables showcase MeLi’s level of internationalization. While most employees are managed remotely, the company has a presence on three continents, albeit with a limited capacity in some areas. Again, Brazil, Argentina, and Mexico are the primary markets, absorbing almost 90 percent of all workers. Note that 21% of all employees are involved in technology and product development. Interestingly, the company reports that many of its workers are unionized, especially in the three core countries. You will not see that in the SEC reports of Big Tech companies.

In sum, we can conclude that the “Amazon of Latin America” label, frequently used to describe MeLi, does not accurately reflect the company’s true profile. It is only partially correct.

That said, I could argue that what AWS has done for Amazon, fintech is doing for MeLi, noting that the latter has utilized the former as a technology infrastructure provider since 2018. If MeLi decided to do that on its own, its profitability might probably suffer big time, given its cloud hyperscale needs. The firm openly acknowledges substantial cost reduction and increased profitability by using AWS. In that light, I do not expect that to happen any time soon. MeLi’s technology priorities are more focused on application and product development.

Does that mean that MeLi “depends” on AWS and Google Cloud? Not really, as numerous other companies, including many in the Global North, use cloud computing services to run their businesses. They have no other choice, and doing so can help maximize revenues. Is Meli paying “technological rents” to Amazon, as some researchers argue? In my view, the answer is negative, as cloud computing is a business service that most companies must utilize to succeed in the 21st Century. It is a much-needed input into the production process, and AWS is not the only hyperscaler offering such services.

Raul