No doubt economics has come a long way since the times of Adam Smith almost 250 years ago. If we were to summarize its dynamics of change, we could say that economics has moved from a broad political economy approach to a more narrow and now mainstream focus where mathematics seems to play a vital role. While the former also addressed social and political issues, the latter is much more constraint and centers on the economic sphere per se. This does not, however, mean that there are no other theories and schools of thought in between. On the contrary. But nowadays mainstream economics gets most of the coverage and, more importantly, provides the framework and concepts for implementing economic policies at the national and global levels.

That being the case, the evolution of economics has generated a series of ideas or concepts that have survived, in one way or another, the avalanche of time and become pillars of mainstream economic theory. Perhaps the most famous idea or concept is Smith’s “invisible hand” which once again raised to the top of the economic charts in the 1970s.

That being the case, the evolution of economics has generated a series of ideas or concepts that have survived, in one way or another, the avalanche of time and become pillars of mainstream economic theory. Perhaps the most famous idea or concept is Smith’s “invisible hand” which once again raised to the top of the economic charts in the 1970s.

The book by Jeff Madrick, 7 Bad Ideas examines some of these ideas from a critical perspective by showing with both data and examples the adverse outcomes they have triggered in the last few years.

The seven bad ideas detailed by the author are:

- Smith’s Invisible Hand

- Say’s Law of supply and demand

- The (no-)role of governments in economics or what he calls “Friedman’s Folly”

- Inflation is the key macroeconomic concern

- Speculative bubbles do not exist

- Globalization, or (the other) “Friedman’s Folly Writ Large”

- Economics is a science.

I am not sure all these ideas are “bad.” In some cases, one can argue that great ideas have been adopted and adapted by mainstream economics to promote its own singular perspective. Misrepresentation of some good ideas has thus also taken place.

Madrick tackles each of these ideas in detail using both history and empirical evidence to build a robust criticism of each. In this light, the author shows how, for example, Smith’s invisible hand has been distorted by mainstream economists who reduced it to the basic notion of laissez-faire. By the same token, Say’s law (“supply creates its own demand”) is nowadays being misused to justify global austerity policies which are seemingly not working as expected, as can be seen in the case of Europe.

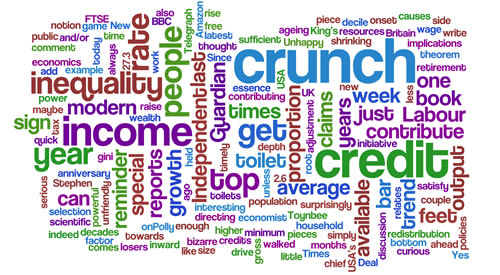

Particularly interesting for me was the chapter on bubbles which shows that orthodox economics is driven by ideological principles, no matter what the historical evidence says. On the conceptual side, it also seems clear that rigorous mathematical and statistical models can and are being misused all over the place. And this raises the issue if current economics is indeed a science: “The basis of much of economics is a set of value judgments, a claim as widely denied as it is generally true” (pg. 191). Looking at the way orthodox economists have reacted to the 2008 global crisis (which they never so coming) or at the sharp rise of inequality seems to support this criticism.

For mainstream economics, inequality in the US is the direct result of the lack of education of its population. They argue that given the ongoing rapid advances in technology and innovation, people need to be re-skilled to be able to capitalize on such developments. This has not yet happened, so it is expected that inequality grows. The evidence used to support this perspective is the historical correlation between income and education: the higher the degree, the higher the income. The assumption here, Madrick tells us, is that “educational attainment is an accurate measure of job skills..”; however, “educational attainment is also… a measure of class.” In effect, “educational attainment may be more a reflection of social and personal characteristics than of job skills” (pg. 206), of social capital as it is called in some quarters,

But inequality is also the result of lower wages, higher unemployment, decreased union power, widespread globalization, ethnicity, etc., factors that do not enter into the equations of orthodox economists. Instead, these factors are usually dismissed quickly. Furthermore, recent and current data seems to disproof the inequality-education-technology argument. Now there is data suggesting that inequality is also growing among college graduates.

So what is the way forward? Madrick calls for more “empirical investigation” (pg. 214) as recommended by John Stuart Mill in 1848, the year of Revolutions in Western Europe.

Maybe, but we also need more alternative approaches. So perhaps a return to “classical political economy” should not be a bad idea after all…

Madrick, Jeff. 2014. Seven Bad ideas: How Mainstream Economists nave Damaged America and the World. New York: Alfred A. Knopf. ISBN: 978-0-307-96118-1.