TechPlus+ | Technology & Development Redux

-

Brilliant AI Chatbots

Read more: Brilliant AI ChatbotsJust over a decade ago, we could not stop talking about surveillance. Indeed, the 2013 Snowden files revealed a series of spook technologies that most people had only seen in largely mediocre Hollywood films, always with a reference to the Stasi or “communism,” of course. So-called “democracies” will never do that was the implicit, subliminal…

-

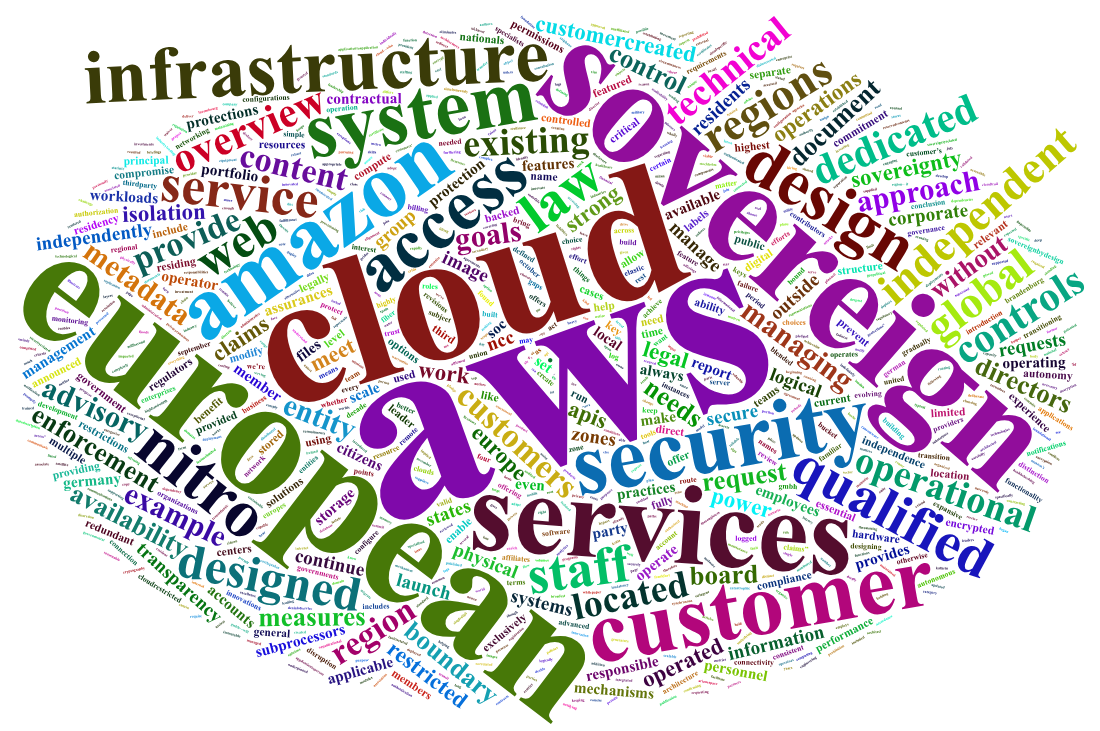

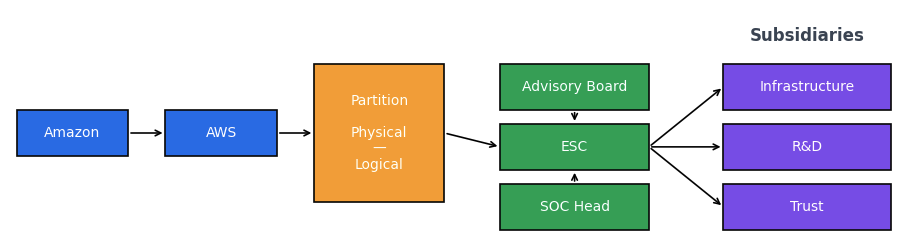

Commoditizing Digital Sovereignty – III

Read more: Commoditizing Digital Sovereignty – IIIUndoubtedly, ESC is a sophisticated proposition—clearly the result of extensive thought, careful planning, and considerable groundwork, both operational and political. It is also important not to overlook the substantial capital and expertise cloud corporations bring to the table. Let me begin with AWS’s corporate strategy. Creating a new “parent” company with Amazon as its own…

-

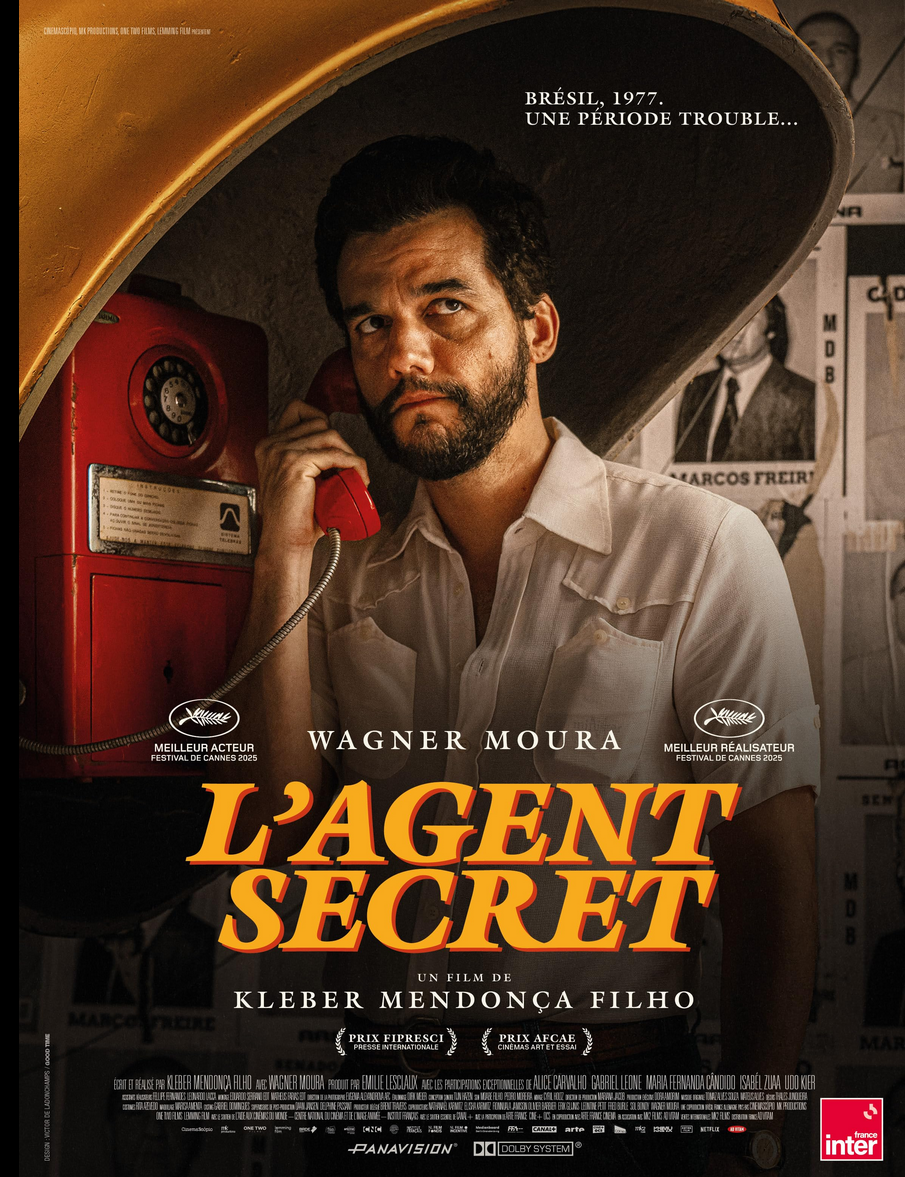

Best Films – 2025

Read more: Best Films – 2025Films such as Resurrection and The Secret Agent, either directly or indirectly, hinted at the end of cinema and the decline of audiences. Indeed, competition from online platforms and social media has impacted the film sector. Recent AI developments demonstrating outstanding video capabilities have further increased the pressure. AI-made films are not far from the…

-

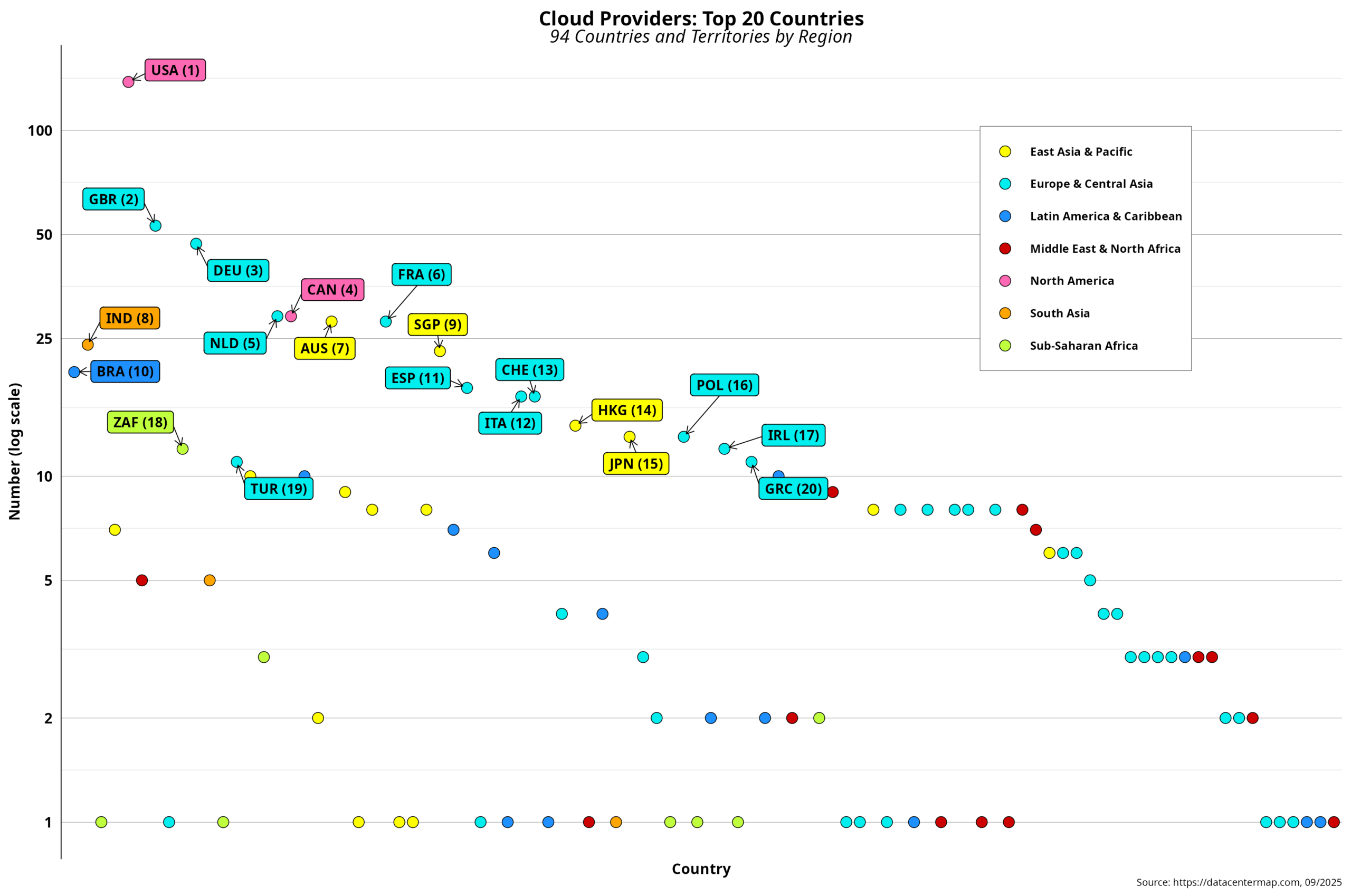

Commoditizing Digital Sovereignty – II

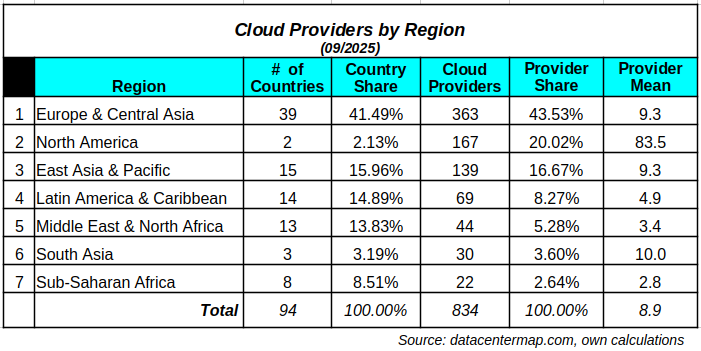

Read more: Commoditizing Digital Sovereignty – IIResearch I recently undertook showed that the cloud sector is large and unequal. Reliable estimates indicate that a few thousand cloud firms operate globally. At the same time, the top three suppliers (Amazon, Microsoft, and Google) together account for over 60 percent of the market. While the latter figure might be overestimated according to some…

-

Commoditizing Digital Sovereignty – I

Read more: Commoditizing Digital Sovereignty – IPerhaps one of the most poignant features of capitalism is its unparalleled capacity to transform almost anything into a commodity. Indeed, everything is for sale, and a price can be tagged on. Included here are tangibles and intangibles. Simplifying, it can be argued that historically, such transformation started with tangible goods in agriculture and manufacturing…

-

Clouds in the Cloud – II

Read more: Clouds in the Cloud – IITalk about an ongoing AI bubble seems to be getting louder by the minute. As previously mentioned, estimates indicate that by 2030, close to 7 trillion USD will be invested in the sector—assuming the bubble will not burst in the interim. Most of this massive investment is expected to go toward digital infrastructure, led by…

-

Clouds in the Cloud – I

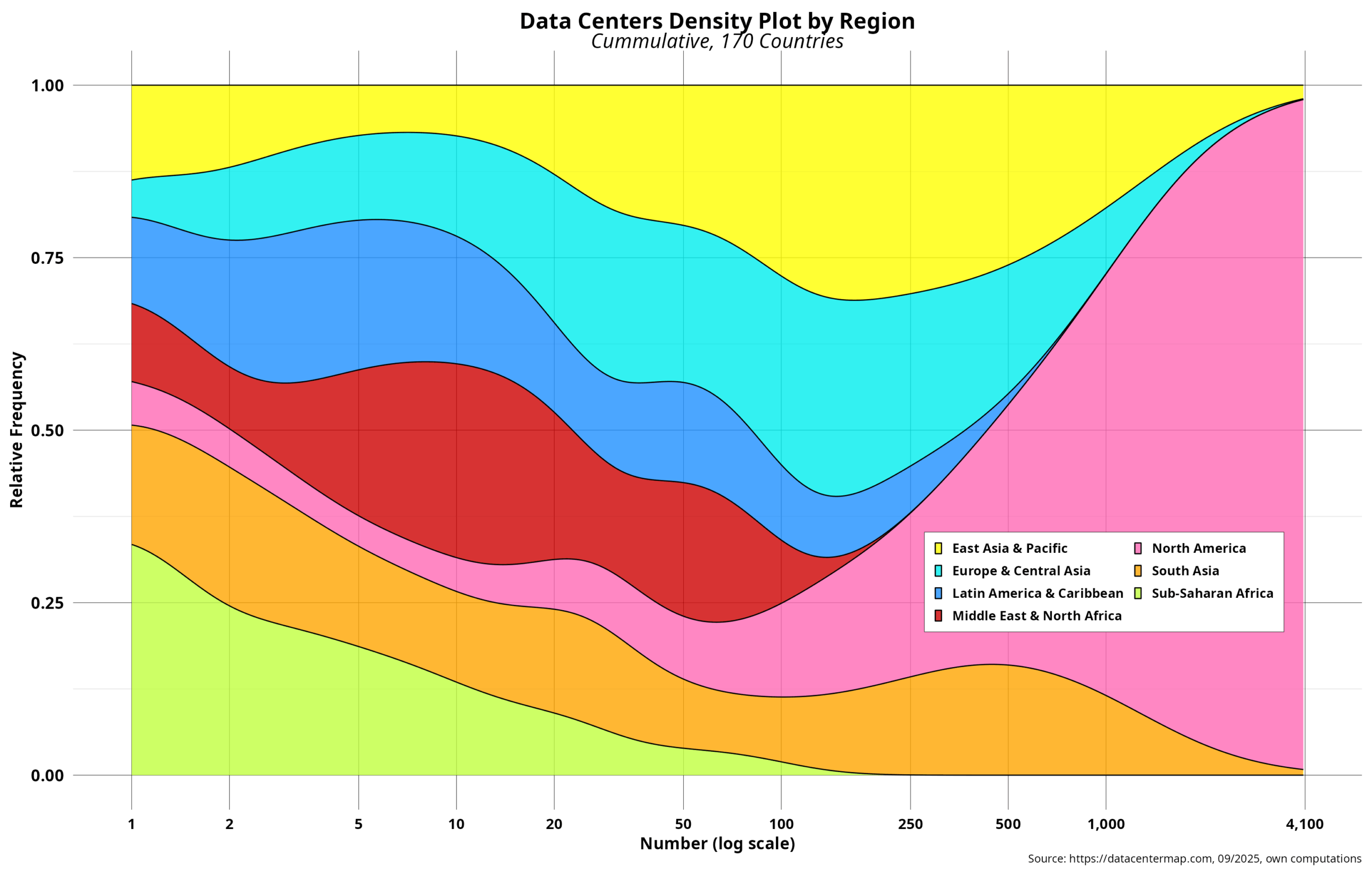

Read more: Clouds in the Cloud – INow that we have a clearer picture of the uneven distribution of data center locations, we can take a closer look at cloud providers. The first step here is to conceptually differentiate between data centers and cloud providers. Recall that the business literature states that cloud providers are one of the five types of data…

-

Data Center Resistance

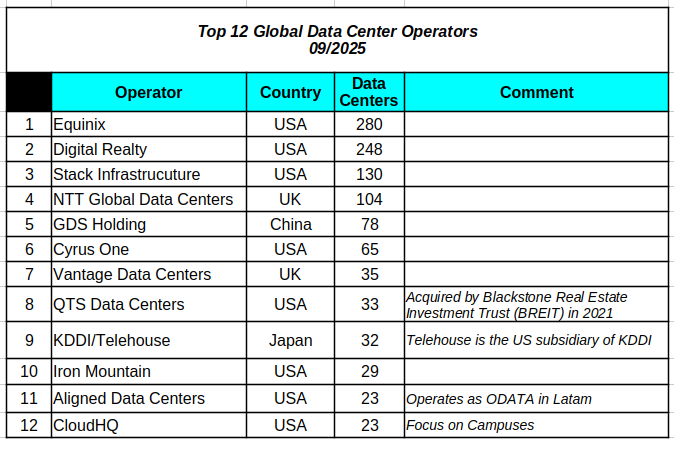

Read more: Data Center ResistanceTwo weeks ago, Mexico announced a 4.8 billion USD data center investment sponsored by CloudHQ, one of the top 12 operators globally by number of sites. The target city is Querétaro, the leading Mexican data center location with 19 facilities. Querétaro is also among the top 15 developing-country towns in the data center race. The…

-

Data Center Centralization – IV

Read more: Data Center Centralization – IVThe last time I visited Eswatini was in late 2019, three months before the COVID-19 pandemic almost brought our collective imagination to a halt. Digital government support was the excuse for the business trip. I had been there a couple of times before and was thus familiar with the territory. Elections held the previous year…

-

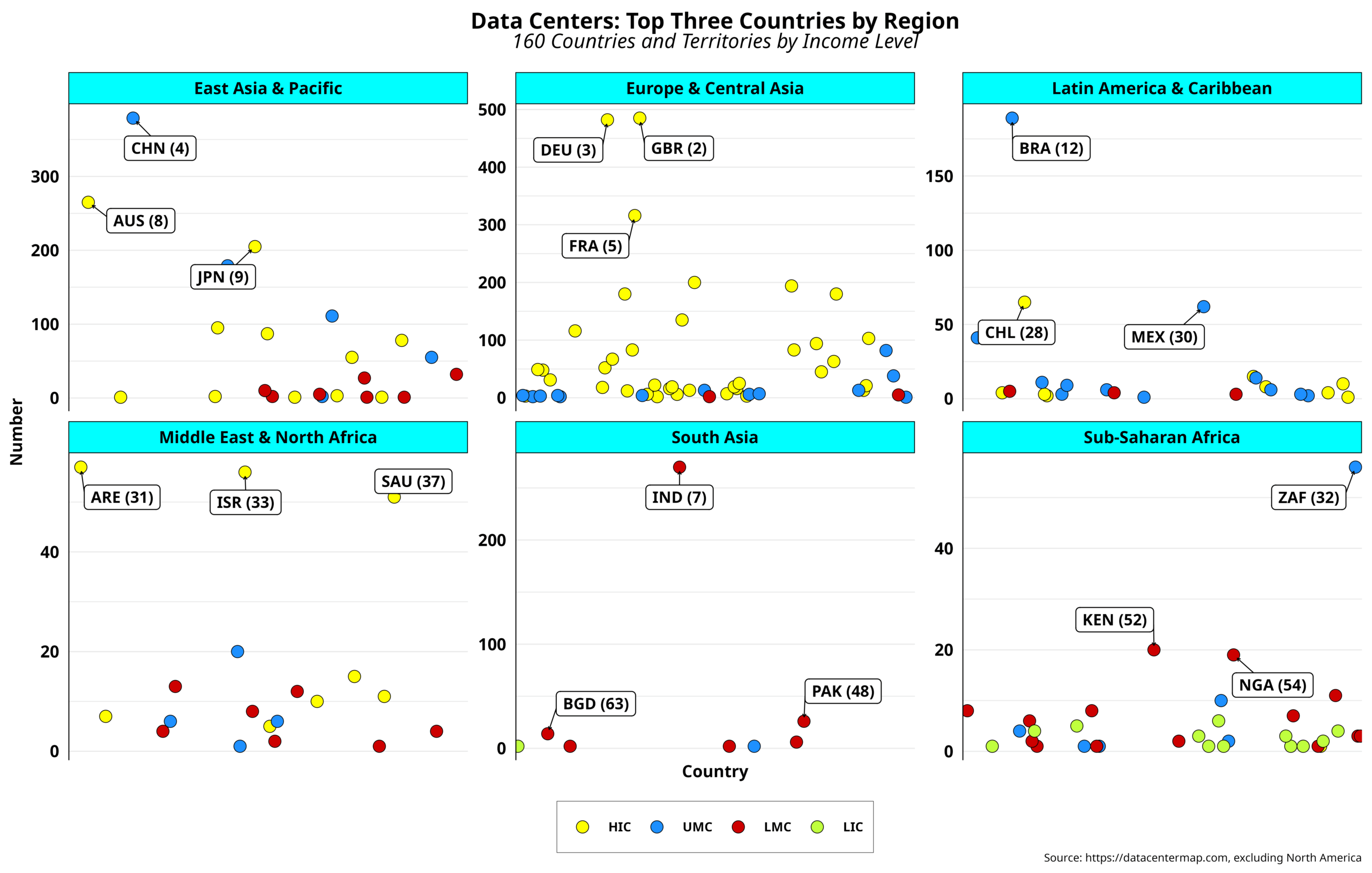

Data Center Centralization – III

Read more: Data Center Centralization – IIICountry data typically provides a comprehensive macro overview of the current status of a particular theme, such as data centers in our case. The same goes for CO2 emissions, for example. On the other hand, countries are geographical abstractions that posit the topic within well-defined boundaries, where a national state exercises its sovereignty to the…

-

Data Center Centralization – II

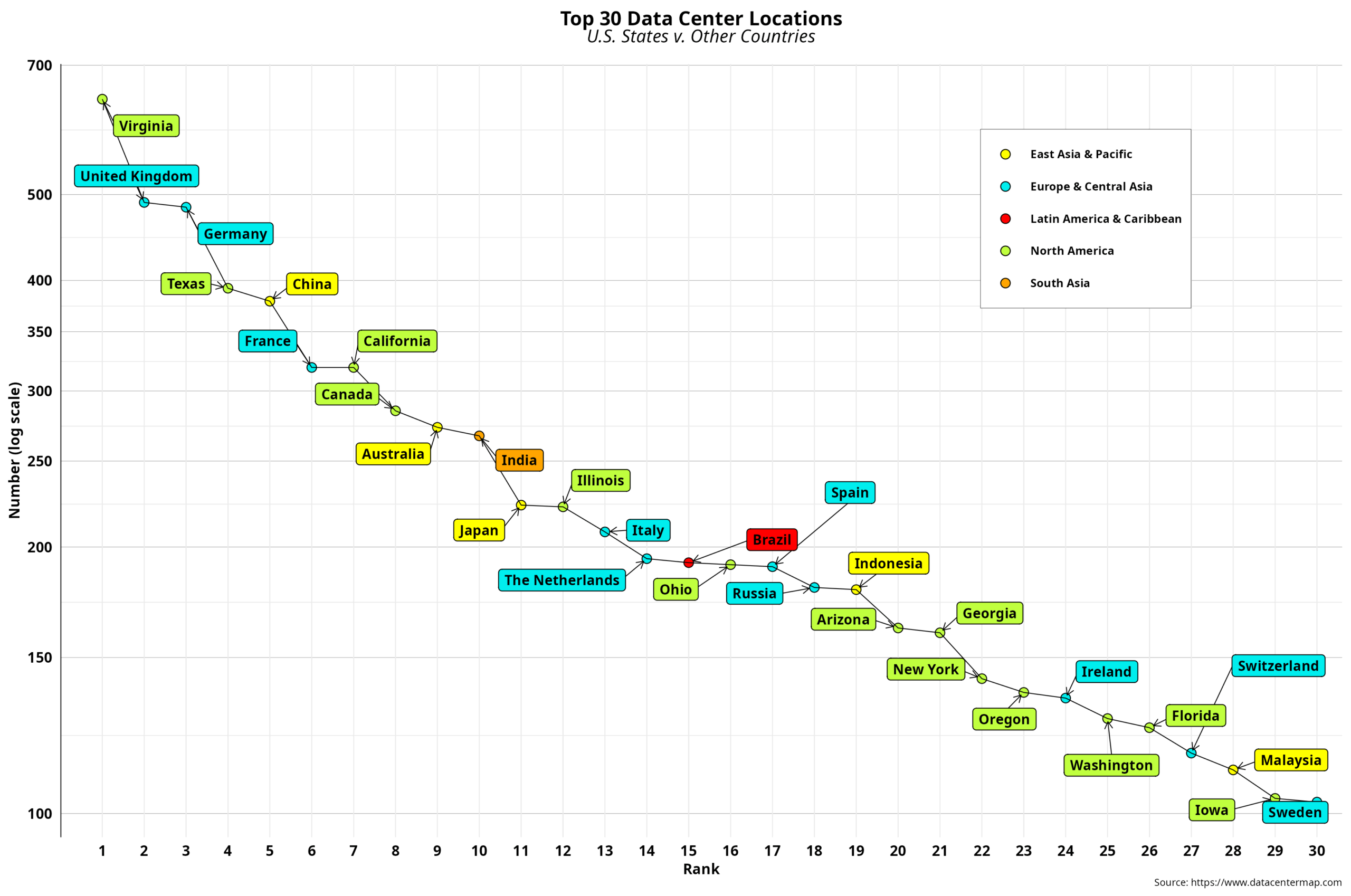

Read more: Data Center Centralization – IIBy now, we are aware that data center deployments have a clear geographical bias. Indeed, one region is significantly ahead of the rest. Those comprised of mostly industrialized countries follow, albeit at a considerable distance. The rest can hardly breathe. In any case, such patterns could serve as the first clue about which areas are…

-

Data Center Centralization – I

Read more: Data Center Centralization – IAs mentioned in the previous post, capital investments in data centers are expected to hit record sums. Predictions for 2030 suggest that nearly 7 trillion dollars will be heading that way, with 25 percent of that amount allocated to energy resources alone. Indeed, Big Tech is not expected to be the only player in this…

-

Data Center Centrality

Read more: Data Center CentralityRecent headlines have put the spotlight on Big Tech’s investment trends in data centers. While the gang of five has already spent $155 billion on data center expansion since January, the total annual amount for this year is expected to reach $365 billion. That is more than the nominal 2023 GDP of over 150 countries,…

-

Laboring AI – II

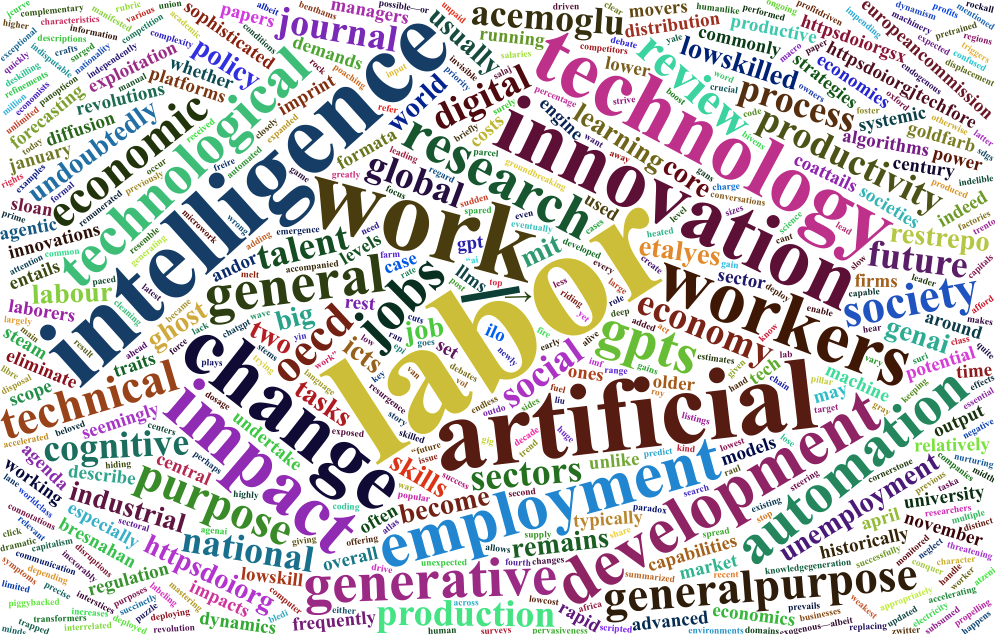

Read more: Laboring AI – IIResearch on the labor impact of GPTs is mainly focused on advanced economies in the West. Implicitly, it is assumed that what thrives in the former should also blossom in all other nations, provided they have reached a certain level of development and have been able to actively integrate into the global economy. The rest…

-

Laboring AI – I

Read more: Laboring AI – IThe sudden resurgence of AI in the early 2010s, riding on the coattails of newly developed and groundbreaking machine learning and deep learning algorithms, was accompanied by the emergence of seemingly endless “future of work” conversations and, eventually, heated debates . By the end of the decade, generating target listings by job and/or sector had…